Molluscicides Size

Molluscicides Market Growth Projections and Opportunities

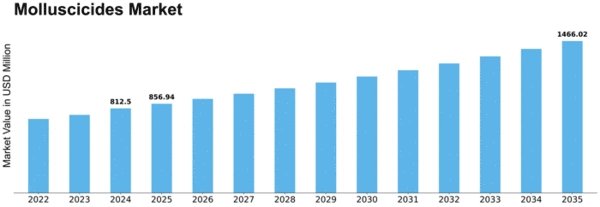

A range of factors that influence supply, demand, pricing, and growth determine the market dynamics of molluscicides. The importance of molluscicides in agriculture is one major driver in this market. Similarly, emphasis on sustainable agriculture and integrated pest management practices has also resulted in molluscicide dynamics in the market. The size of the Molluscidices Market depends on numerous factors that determine what goes on within this specialized industry space collectively known as "molluscicides". One of the most significant factors is the agricultural environment, where mollusks, particularly snails and slugs, pose threats to crops. As global agriculture faces the challenge of increasing pest pressures, farmers seek effective solutions to protect their crops from mollusk damage. Molluscicides are designed to control and manage mollusk populations that pose major threats to agricultural productivity. Thus, the demand for molluscicides depends on the extent and severity of infestations by these creatures on a farm, thereby affecting market size. Market Size of Molluscicides was valued at USD 0.5 Billion in 2022. The Molluscicide Industry is expected to grow from USD 0.54 Billion in 2023 to USD 1.06 Billion by 2032, registering a CAGR of 8.69% during the forecast period (2023 - 2032). Scientific breakthroughs and ongoing research shape the market dynamics of molluscicides. Efforts are continuously being made to develop innovative formulations that are effective against mollusks while environmentally friendly. Regulatory considerations play a significant role in shaping the market dynamics of molluscicides. There are regulations governing pesticide application by industries involved in farming; hence, these laws apply here, too. Allowing for compliance with these regulations is crucial for manufacturers who wish to ensure that their products are safe and effective as far as controlling slugs is concerned. When producers adhere to regulatory standards, it not only ensures product safety but also builds trust between farmers and various regulatory agencies. The overall marketplace dynamics regarding competitors, including malachite manufacturers alongside agrochemical firms and distributors, significantly affect all outcomes from such cases where they depend so much on what exactly happens next throughout them. This competition is intense, leading to constant innovation over products, which comes out of strategy collaborative efforts together with competitive pricing ideas into place within industry players' minds. Molluscides manufacturers have responded by developing products with advanced efficiency, longer persistence duration, and better antagonist profiles, therefore positioning themselves ahead of others within a given area. The global events, economic changes, and weather conditions also affect how this product works. International events like weather influence patterns responding to infestations, or even purchasing can be affected by economic conditions. Industry participants must stay adaptable and responsive to these external factors to navigate challenges and maintain stability in the molluscicides market.

Leave a Comment