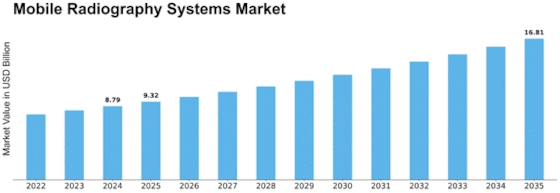

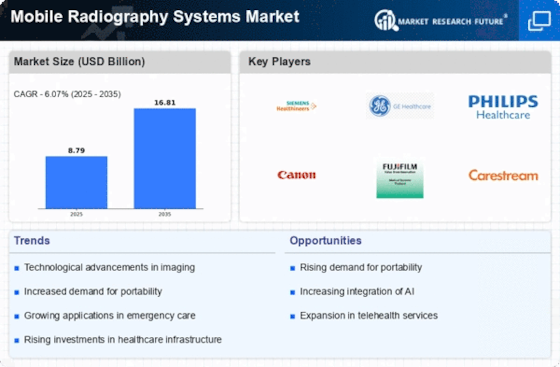

Mobile Radiography Systems Size

Mobile Radiography Systems Market Growth Projections and Opportunities

The market is similarly formed by the development of healthcare foundation universally. The rising number of emergency clinics, facilities, and logical spotlights, especially in arising economies, drives the demand for mobile radiography systems. These systems offer adaptability in continual care, making them fundamental in different healthcare settings. The segment shift towards a maturing populace is an essential factor. With a higher pervasiveness of continuous diseases and age-related conditions, there is a developing requirement for indicative imaging, including mobile radiography. As the old population rises, so does the demand for portable and efficient radiography arrangements. The deluge in continuous ailments, like cardiovascular diseases and cancer, requires continuous symptomatic imaging. Mobile radiography systems give a helpful and fast method for performing X-beams at the patient's bedside or in different healthcare settings, supporting the early location and management of persistent circumstances. With the globalization of healthcare administrations, there is a rising demand for mobile radiography systems that can be effortlessly transported and used in various geological areas. This is especially significant in remote or underserved regions where access to cutting edge symptomatic gear is restricted. Cost contemplations and effectiveness are critical factors impacting the market. Mobile radiography systems offer a practical answer for healthcare offices, dispensing with the requirement for devoted radiology rooms and diminishing functional expenses. The effectiveness of these systems in giving fast and precise imaging further adds to their unlimited reception. The coordination of mobile radiography systems with electronic health records is turning out to be progressively important. Consistent information moves and incorporation with existing healthcare information systems improve workflow proficiency, reduce errors, and add to the general adequacy of patient care.

Leave a Comment