Top Industry Leaders in the Mobile DRAM Market

The Competitive Landscape of the Mobile DRAM Market

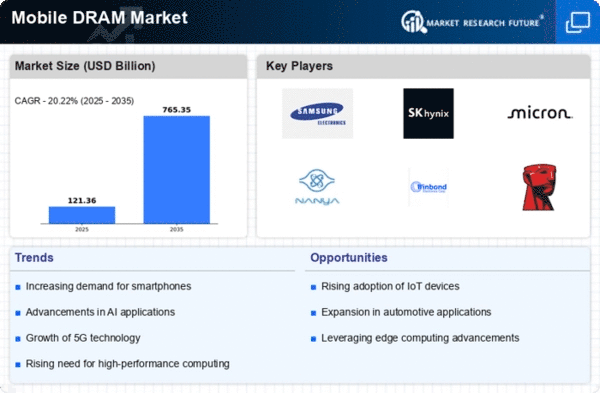

The mobile DRAM market, acts as the invisible powerhouse behind the sleek smartphones and nimble tablets we hold in our palms. These dynamic memory chips store data swiftly and efficiently, enabling smooth app usage, seamless multitasking, and high-resolution visuals, fueling the ever-evolving world of mobile technology. Navigating the dynamic landscape of this market is crucial for players seeking to connect and empower the next generation of mobile devices.

Key Players:

- Samsung

- SK Hynix Inc.

- Micron Technology Inc.

- Nanya Technology Corporation

- Winbond Electronics Corporation

Strategies Adopted by Leaders

- Technological Prowess: Leading players like Samsung, SK Hynix, and Micron Technology invest heavily in R&D, pushing boundaries in process miniaturization, high-speed data transfer, and power efficiency. They pioneer solutions like LPDDR5X and LPDDR6 DRAM modules offering lower power consumption, faster data access, and increased density, catering to the demands of advanced mobile processors and sophisticated applications.

- Customization and Differentiation: Players cater to specific device segments and functionalities. Winbond Electronics Corporation excels in DRAM solutions for budget-friendly smartphones, while Nanya Technology Corporation focuses on high-performance DRAM for gaming phones and flagship devices. This specialization allows for tailored features and deeper understanding of each segment's unique memory requirements.

- Vertical Integration and Supply Chain Management: Controlling key stages of production, from raw materials to chip fabrication, allows for cost optimization and efficient supply chain management. This is crucial in a market where price sensitivity and fluctuations in demand are prevalent.

- Global Footprint: Establishing geographically diverse manufacturing facilities and sales networks is essential for catering to the global nature of smartphone production. Samsung and SK Hynix maintain strong regional presence across continents, ensuring proximity to major device manufacturers and efficient logistics.

- Strategic Partnerships and Collaborations: Collaborations with smartphone manufacturers, chipset designers, and technology providers accelerate innovation and broaden market reach. For instance, partnerships with leading chipset manufacturers enable co-development of optimized DRAM solutions for specific mobile platforms.

Factors for Market Share Analysis:

- DRAM Technology: Analyzing market share by DRAM technology (LPDDR4, LPDDR5, LPDDR6) reveals dominant players in each segment and future growth potential. LPDDR5 and LPDDR6 are expected to see the fastest growth due to their superior performance and increasing adoption in high-end devices.

- Device Segment: Understanding the needs of different smartphone segments (budget, mid-range, premium) is key. Micron Technology caters to budget-friendly devices, while Samsung excels in high-performance DRAM for flagship phones.

- Smartphone Manufacturers: Understanding the dominant smartphone manufacturers and their preferred DRAM suppliers is essential for market share analysis. Samsung and SK Hynix hold significant market share due to their close ties with major device manufacturers like Apple and Samsung Electronics.

New and Emerging Companies:

- Elixir Semiconductor: This Chinese company focuses on high-performance DRAM solutions for AI-powered smartphones and edge computing devices, catering to the growing demand for memory-intensive applications.

- United Microelectronics Corporation (UMC): This Taiwanese company diversifies its portfolio beyond logic chips and enters the mobile DRAM market, offering cost-effective solutions for budget-conscious smartphone manufacturers.

- Rambus: This American company pioneers innovative memory technologies like Xpeed, offering high-bandwidth and low-power solutions for next-generation mobile devices, aiming to disrupt the traditional DRAM landscape.

Industry Developments:

Samsung

- October 2023- Starts production of 16Gb LPDDR5X chips, aiming to solidify market leadership. Announces plans to build new DRAM production facility in the United States.

SK Hynix

- September 2023- Reports record quarterly revenue driven by strong mobile DRAM demand. Collaborates with Google on developing next-generation memory solutions for AI applications.

Micron

- August 2023- Expands mobile DRAM production capacity in Taiwan to meet growing demand. Introduces new low-power DRAM solutions for wearables and IoT devices.