Top Industry Leaders in the Mining Chemicals Market

Beneath the earth's surface lies a hidden realm where colossal machines and potent chemicals dance a complex pirouette to extract riches from the ground. This is the domain of the mining chemical market, a dynamic space pulsing with innovation and competitive fire. Understanding the players, their strategies, and the forces shaping this subterranean battleground is crucial for anyone navigating its depths.

Market Titans and their Playbooks:

-

Global Dominance: Industry giants like BASF SE, Solvay Chemicals, and Ashland Chemicals leverage their extensive product portfolios, established relationships with mining giants, and global distribution networks to maintain leadership. BASF's acquisition of Chemours' mining chemicals division in 2023 exemplifies this focus on consolidation and market share expansion. -

Regional Champions: Companies like China Coal Technology & Engineering Group Corporation (CCTEG) and Lanxess AG hold strong positions in their respective regions, capitalizing on local supply chain access and regulatory knowledge. Lanxess' expansion into the Australian mining market in 2023 showcases this regional focus. -

Specialty Solutions: Players like Cytec Industries and Arkema S.A. focus on developing novel, high-performance mining chemicals like flotation reagents and flocculants, catering to specific mineral extraction challenges and commanding premium prices. Cytec's development of a temperature-resistant frother for extracting metals at higher depths exemplifies this strategy. -

Sustainable Solutions: Environmental concerns are influencing strategies, with companies like Orica Ltd. and AkzoNobel investing in eco-friendly alternatives like biodegradable flocculants and reducing water consumption in processing. Orica's partnership with a biotech startup to develop bio-based frothers showcases this green commitment.

Factors Determining Market Share:

-

Product Portfolio Breadth: Offering a diverse range of mining chemicals for different mineral types and extraction processes provides a significant advantage. Solvay Chemicals' extensive portfolio catering to various aspects of mineral processing exemplifies this strategy. -

Technological Prowess: Developing innovative, efficient, and environmentally friendly mining chemicals offers a competitive edge. Arkema's development of smart flocculants that optimize water usage and mineral recovery showcases this focus on innovation. -

Regional Presence: Strong presence in high-growth mining regions like Latin America and Africa, where mineral exploration and extraction are booming, is crucial for market share dominance. CCTEG's expansion into the Chilean copper mining sector illustrates this regional importance. -

Sustainability Credentials: Green solutions are gaining traction, with companies highlighting reduced environmental impact, lower water consumption, and bio-based alternatives resonating with eco-conscious miners and regulators. AkzoNobel's development of low-VOC mining chemicals exemplifies this sustainable approach.

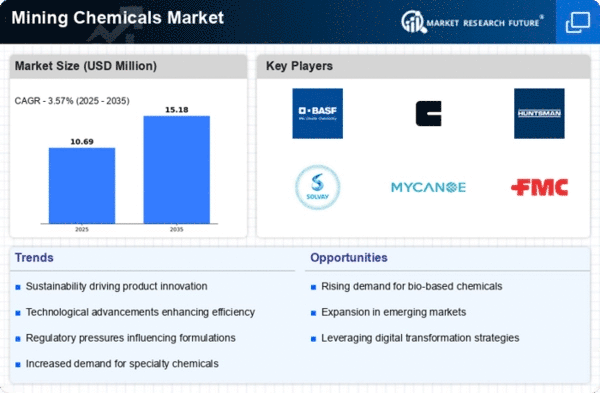

Key Players:

- BASF SE

- Solvay S.A.

- Dow Chemical Company

- SNF Group

- AkzoNobel N.V.

- Clariant AG

- Chevron Phillips Chemical Company

- Kemira Oyj

- Orica Limited

- National Aluminium Company

Recent Developments:

August 2023: Lanxess expands its operations in Australia, aiming to capitalize on the region's booming gold mining industry.

September 2023: Cytec Industries unveils a new, temperature-resistant frother for deep-sea mineral extraction, targeting a niche market with high-performance solutions.

October 2023: Orica partners with a biotech startup to develop bio-based frothers, aligning with its sustainability commitments and seeking eco-friendly alternatives.

December 2023: CCTEG secures a major contract with a Chilean copper mining company, solidifying its regional presence and market share in Latin America.