Top Industry Leaders in the Military Robots Market

Strategies Adopted: In the fiercely competitive Military Robots market, key players adopt strategic approaches to maintain a competitive edge. A significant focus is on continuous investment in research and development (R&D) to enhance robotic capabilities, from autonomous ground vehicles to unmanned aerial systems. Strategic collaborations with military agencies, research institutions, and technology partners facilitate the development of specialized applications, including reconnaissance, surveillance, and explosive ordnance disposal. Additionally, global expansion through international sales, partnerships with local defense contractors, and participation in defense contracts ensures a broader market reach, allowing companies to cater to the diverse needs of defense forces worldwide.

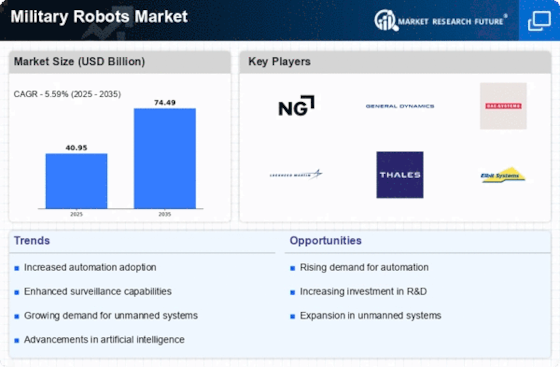

Competitive Landscape of Military Robots Market

- FLIR Systems, Inc. (US)

- General Dynamics Corporation (US)

- BAE Systems (UK)

- Lockheed Martin Corporation (US)

- Saab AB (Sweden)

Factors for Market Share Analysis: Market share analysis in the Military Robots market considers various factors essential to a company's competitive standing. Technical capabilities, such as the ability to offer a comprehensive suite of robotic solutions for different military domains, play a pivotal role. Companies providing adaptable and modular robotic systems capable of performing a wide range of tasks are better positioned to capture a larger market share. Compliance with stringent military standards, interoperability with existing defense systems, and adaptability to emerging threats contribute significantly to market share dynamics. Additionally, factors like robotic endurance, mission success rates, and the ability to operate in diverse environments impact a company's market share.

New and Emerging Companies: While established players dominate the market, new and emerging companies contribute to the innovation and evolution of military robotic solutions. Companies like FLIR Systems and Roboteam are gaining recognition for their specialized robotic systems, often focusing on modular designs, multi-mission capabilities, and advanced sensory technologies. Emerging companies often bring agility and a fresh perspective to the Military Robots market, introducing novel approaches and technologies that address the evolving needs of modern warfare.

Industry News: Recent industry news in the Military Robots market highlights ongoing developments and trends shaping the sector. Innovations in robotic swarm technologies, artificial intelligence-driven mission planning, and enhanced communication and connectivity features are gaining prominence. News often covers advancements in robotic exoskeletons for enhancing soldier capabilities, expanding the operational scope for military forces. Additionally, developments in counter-robotics technologies and anti-drone systems underscore the dynamic nature of the market, with continuous efforts to address emerging threats and challenges. Industry news reflects the evolution of military robotic capabilities and the industry's response to changing security landscapes.

Current Company Investment Trends: Investment trends in the Military Robots market underscore a commitment to technological innovation, autonomy, and adaptability. Companies are allocating substantial resources to R&D initiatives focused on robotic swarm technologies, artificial intelligence for mission planning, and advanced materials for lightweight and durable robotic systems. Investments in counter-robotics technologies, including electronic warfare and anti-drone solutions, are gaining traction. Strategic acquisitions of technology startups, partnerships with research institutions, and collaborations with military agencies contribute to a holistic approach, ensuring a continuous stream of cutting-edge solutions and maintaining a competitive stance in the market.

Overall Competitive Scenario: The overall competitive scenario in the Military Robots market reflects a balance between established industry leaders and emerging companies that bring innovation and flexibility to the sector. Established defense contractors and robotics manufacturers leverage their extensive experience, global reach, and comprehensive robotic portfolios to set industry standards. Simultaneously, emerging companies contribute to the diversification of Military Robot solutions, often focusing on specific applications or introducing disruptive technologies. The industry's response to evolving military requirements, technological advancements, and emerging threats highlights the adaptability and resilience of Military Robots providers. As defense forces globally seek more advanced and versatile robotic systems, the Military Robots market is poised for continued evolution. The emphasis on technological advancements, strategic collaborations, and meeting the dynamic needs of modern warfare positions this market as a critical enabler for military capabilities in reconnaissance, surveillance, and tactical operations.

Recent Development:Top of Form

January 2022, China unveiled what it asserts to be the globe's most extensive electrically powered quadruped robot, designed to support the military in logistics and reconnaissance missions. The four-legged robot boasts a payload capacity of up to 352 pounds and can achieve a speed of 10 kilometers per hour.

July 2022, Teledyne FLIR Defense secured a contract valued at USD 62.1 million with the US Armed Services for the acquisition of 500 Centaur multi-mission robots.