Top Industry Leaders in the Military Antenna Market

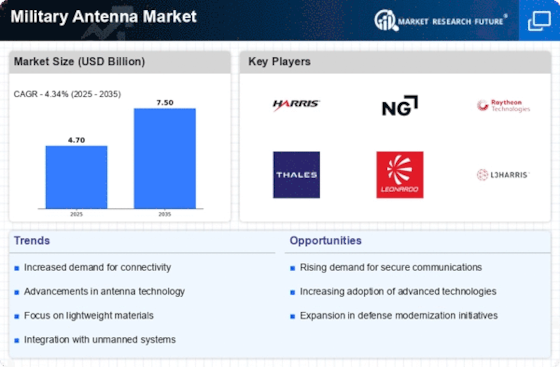

Military Antenna Market

Technological Innovation: Key players invest heavily in research and development to develop advanced antenna systems that offer enhanced performance, bandwidth, and frequency agility to meet the evolving communication and electronic warfare requirements of military forces.

Strategic Partnerships: Collaborations and partnerships with defense contractors, government agencies, and research institutions are pursued to leverage complementary capabilities, share resources, and access new markets, thereby enhancing competitiveness.

Customization and Integration: Offering customized antenna solutions tailored to specific military applications and platforms, as well as integrating antennas into larger defense systems and networks to provide seamless connectivity and interoperability.

Global Expansion: Expansion into emerging markets and regions with growing defense budgets, as well as diversification into adjacent sectors such as homeland security, commercial aerospace, and satellite communications, to capitalize on new opportunities and reduce dependency on military contracts.

Strategies Adopted By Key Players Military Antenna Market

Harris Corporation (U.S.)

Cobham plc (U.K.)

Comrod Communications AS (Norway)

Terma A/S (Denmark)

MTI Wireless Edge (Israel)

Eylex Pty Ltd. (Australia)

Cojot Oy (Finland)

Raytheon Company (U.S.)

Lockheed Martin Corporation (U.S.)

Rohde & Schwarz (Germany)

Barker and Williamson (U.S.)

RAMI (U.S.)

Factors for Market Share Analysis:

Product Portfolio: The breadth and depth of product offerings, including tactical, vehicular, airborne, maritime, and satellite antennas, influence market share. Companies with a comprehensive portfolio catering to diverse military requirements are likely to capture a larger market share.

Technology Leadership: Companies that pioneer innovative antenna technologies, such as phased array antennas, electronically steered antennas, and conformal antennas, gain a competitive edge and command higher market share due to superior performance and reliability.

Contract Wins: Securing major contracts and procurement programs from defense ministries, armed forces, and prime contractors for the supply of military antennas demonstrates market leadership and drives revenue growth.

Customer Relationships: Building strong relationships with defense customers, understanding their unique mission requirements, and providing responsive support services contribute to customer loyalty and repeat business, thereby sustaining market share.

New and Emerging Companies:

Alaris Antennas (South Africa)

Southwest Antennas (US)

Panorama Antennas Ltd (UK)

Cobham Antenna Systems (UK)

Alten Group (France)

Antenna Test Lab Co., Ltd. (Japan)

Rohde & Schwarz (Germany)

ARA Inc. (US)

Kratos Defense & Security Solutions, Inc. (US)

Sierra Wireless (Canada)

Current Company Investment Trends:

Research and Development: Continued investment in R&D to develop next-generation military antenna technologies, including advanced materials, manufacturing processes, and antenna architectures, to meet the evolving requirements of modern warfare and gain a competitive advantage.

Strategic Acquisitions: Acquisition of complementary companies, technologies, and intellectual property rights to expand product portfolios, enhance technical capabilities, and strengthen market position in key defense market segments.

International Expansion: Expansion into new geographic markets and regions with growing defense spending, as well as establishment of local manufacturing facilities and partnerships to comply with offset requirements and improve market access.

Overall Competitive Scenario:

Intense Competition: The military antenna market is characterized by intense competition among established players and new entrants, driven by technological innovation, cost competitiveness, and customer preferences.

Market Consolidation: Consolidation through mergers and acquisitions, as well as partnerships and alliances, is expected to continue as companies seek to achieve economies of scale, broaden product portfolios, and enhance market reach.

Regulatory Environment: Compliance with stringent regulatory requirements and export control regulations, as well as adherence to military standards and specifications, are critical for market success and competitiveness in the global military antenna market.