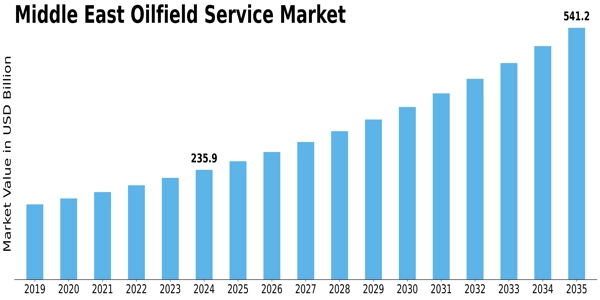

Middle East Oilfield Service Size

Middle East Oilfield Service Market Growth Projections and Opportunities

The Middle East oilfield service market is influenced by various market factors that shape its dynamics and growth. These factors play a significant role in determining the demand for oilfield services in the region, affecting both suppliers and consumers alike.

One crucial market factor is the global oil demand and price fluctuations. The Middle East is a major contributor to the world's oil supply, and any changes in global demand or oil prices directly impact the region's oilfield service market. When oil prices are high, there's typically an increase in drilling activities and oilfield development projects, leading to higher demand for services such as drilling, well completion, and production enhancement. Conversely, during periods of low oil prices, companies may reduce their capital expenditures, resulting in a slowdown in the oilfield service market.

Another significant factor is government policies and regulations. The Middle East governments often play a central role in the oil and gas sector, implementing policies that can either stimulate or hinder market growth. Regulatory changes, such as taxation policies, licensing requirements, and environmental regulations, can influence investment decisions and project timelines in the oilfield service sector. Moreover, geopolitical tensions and regional conflicts in the Middle East can also disrupt oilfield operations and impact market stability.

Technological advancements are also driving forces in the Middle East oilfield service market. Innovations in drilling techniques, reservoir characterization, and digitalization have transformed the way oil and gas companies operate. These advancements improve efficiency, reduce costs, and enable the exploitation of previously inaccessible reserves. As a result, oilfield service providers must continually invest in research and development to remain competitive and meet the evolving needs of their clients in the Middle East.

Market competition is another factor that shapes the Middle East oilfield service market. The region is home to numerous international and local service providers competing for contracts and market share. Competition can drive innovation, improve service quality, and lower costs for oil and gas operators. However, intense competition can also squeeze profit margins and lead to consolidation within the industry as companies seek to gain a competitive edge through mergers and acquisitions.

Furthermore, macroeconomic factors such as economic growth, inflation rates, and currency exchange rates influence the Middle East oilfield service market. Strong economic growth in the region typically correlates with increased oil and gas activities, driving demand for oilfield services. Conversely, economic downturns can lead to reduced investment in the oil and gas sector, impacting service providers' revenue and profitability. Additionally, fluctuations in currency exchange rates can affect the cost of imported equipment and services, potentially impacting project economics for oil and gas operators.

Lastly, environmental and sustainability considerations are becoming increasingly important factors in the Middle East oilfield service market. As global awareness of climate change grows, there is a growing pressure on oil and gas companies to reduce their environmental footprint and adopt sustainable practices. This shift towards cleaner energy sources and carbon emission reduction initiatives can influence investment decisions and project priorities in the region's oilfield service sector.

The Middle East oilfield service market is influenced by a combination of market factors ranging from global oil demand and price fluctuations to technological advancements and environmental considerations. Understanding and adapting to these factors are essential for oilfield service providers to navigate the dynamic market landscape and capitalize on emerging opportunities in the region.

Leave a Comment