-

EXECUTIVE SUMMARY

-

Market Attractiveness Analysis

- Global Mid-Wave Infrared (MWIR) Sensors Market, by Type

- Global Mid-Wave Infrared (MWIR) Sensors Market, by Application

- Global Mid-Wave Infrared (MWIR) Sensors Market, by Region

-

MARKET INTRODUCTION

-

Definition

-

Scope of the Study

-

Market Structure

-

Key Buying Criteria

-

Macro Factor Indicator Analysis

-

RESEARCH METHODOLOGY

-

Research Process

-

Primary Research

-

Secondary Research

-

Market Size Estimation

-

Forecast Model

-

List of Assumptions

-

MARKET DYNAMICS

-

Introduction

-

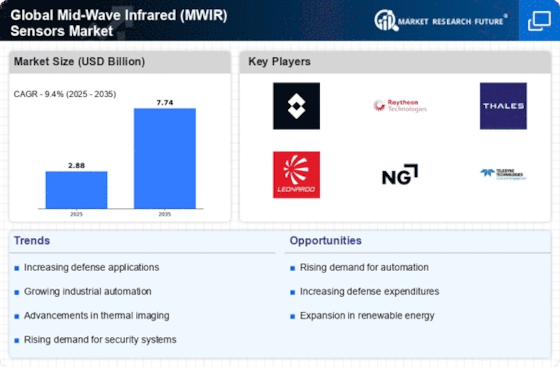

Drivers

- MWIR (Mid-Wave Infrared) Cooled Thermal Imaging Surveillance Longer Range Than LWIR (Long-Wave Infrared)

- Advancement In Technology Such As Turbulence Mitigation, And Artificial Intelligence (AI)

- Growing Demand For High-Efficiency MWIR Sensors For Gas Monitoring Applications

- Drivers Impact Analysis

-

Restraints

- High Costs Associated With MWIR Cooled Thermal Cameras Than Uncooled LWIR Cameras

- Restraints Impact Analysis

-

Opportunities

- High performance MWIR for deployment on unmanned aerial vehicles (UAV)

- Optical filters benefits for MWIR

- Cryocooled Infrared Systems

-

Impact of COVID-19

- Impact On Semiconductor Component Manufacturers

- Impact On MWIR Sensors

- Covid-19 Impact Product Manufacturers

- Impact on Supply Chain Delay

-

MARKET FACTOR ANALYSIS

-

Value Chain Analysis/Supply Chain Analysis

-

Porter’s Five Forces Model

-

Bargaining Power of Suppliers

-

Bargaining Power of Buyers

-

Threat of New Entrants

-

Threat of Substitutes

-

Intensity of Rivalry

-

GLOBAL MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY TYPE

-

Introduction

-

Cooled Mid-Wave Infrared (MWIR) Sensors

-

High Operating Temperature (HOT) Mid-Wave Infrared (MWIR) Sensors

- XBn (InAsSb)

- nBn

- SLS (Strained-Layer Superlattice)

- Lead Selenice (PbSe)

-

GLOBAL MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY APPLICATION

-

Introduction

-

Aerospace & Defense

- Miniature Payloads

- Surveillance Cameras

- Enhanced Flight Vision Systems (EFVS)

- Unmanned Aerial Vehicle (UAV)

- Missile Warning Systems (MWS)

- Missile Seekers

- Others

-

Commercial

- Semiconductor Inspections

- Industrial Inspections

- Non-Destructive Testing

- Gas Leak Detections

- Others

-

GLOBAL MID-WAVE INFRARED (MWIR) SENSORS MARKET SIZE ESTIMATION & FORECAST, BY REGION

-

Introduction

-

North America

- Market Estimates & Forecast, by Country, 2018-2032

- Market Estimates & Forecast, by Type, 2018-2032

- Market Estimates & Forecast, by Application, 2018-2032

- US

- Market Estimates & Forecast, by Type, 2018-2032

- Market Estimates & Forecast, by Application, 2018-2032

- Canada

- Market Estimates & Forecast, by Type, 2018-2032

- Market Estimates & Forecast, by Application, 2018-2032

- Mexico

- Market Estimates & Forecast, by Type, 2018-2032

- Market Estimates & Forecast, by Application, 2018-2032

-

Europe

- Market Estimates & Forecast, by Country, 2018-2032

- Market Estimates & Forecast, by Type, 2018-2032

- Market Estimates & Forecast, by Application, 2018-2032

- UK

- Germany

- France

- Rest of Europe

-

Asia-Pacific

- Market Estimates & Forecast, by Country, 2018-2032

- Market Estimates & Forecast, by Type, 2018-2032

- Market Estimates & Forecast, by Application, 2018-2032

- China

- Japan

- India

- Rest of Asia-Pacific

-

Middle East & Africa

- Market Estimates & Forecast, by Type, 2018-2032

- Market Estimates & Forecast, by Application, 2018-2032

-

South America

- Market Estimates & Forecast, by Type, 2018-2032

- Market Estimates & Forecast, by Application, 2018-2032

-

COMPETITIVE LANDSCAPE

-

Introduction

-

Key Developments & Growth Strategies

-

Competitor Benchmarking

-

Vendor Share Analysis, 2021(% Share)

-

COMPANY PROFILES

-

SemiConductor Devices

- Company Overview

- Financial Overview

- Solution/Services Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Teledyne FLIR LLC

-

Lynred

-

Leonardo S.p.A.

-

GSTIR

-

Silent Sentinel

-

Ascendent Technology Group

-

Excelitas Technologies Corp.

-

Opto Engineering

-

New Infrared Technologies (NIT)

-

L3Harris Technologies, Inc.

-

Sierra-Olympia Tech.

-

InfraTec GmbH

-

Xenics NV

-

Tech Imaging Services.

-

NOTE:

-

This table of content is tentative and subject to change as the research progresses.

-

In section 12, only the top 10 companies will be profiled. Each company will be profiled based on the Market Overview, Financials, Service Portfolio, Business Strategies, and Recent Developments parameters.

-

The companies are selected based on two broad criteria¬– strength of Type portfolio and excellence in business strategies.

-

Key parameters considered for evaluating strength of the vendor’s Type portfolio are industry experience, Type capabilities/features, innovations/R&D investment, flexibility to customize the Type, ability to integrate with other systems, pre- and post-sale services, and customer ratings/feedback.

-

Key parameters considered for evaluating a vendor’s excellence in business strategy are its market share, global presence, customer base, partner ecosystem (Provider alliances/resellers/distributors), acquisitions, and marketing strategies/investments.

-

The financial details of the company cannot be provided if the information is not available in the public domain and or from reliable sources.

-

LIST OF TABLES

-

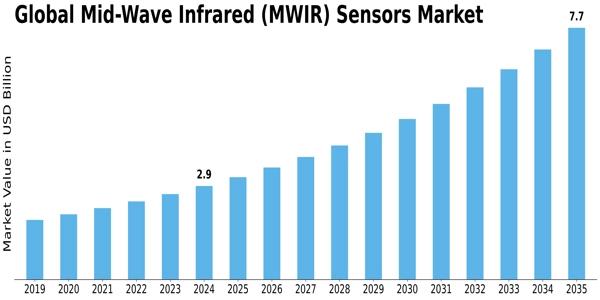

MARKET SYNOPSIS 22

-

GLOBAL MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY TYPE, 2025-2034 (USD MILLION) 43

-

GLOBAL MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY HIGH OPERATING TEMPERATURE (HOT) MID-WAVE INFRARED (MWIR) SENSORS, 2025-2034 (USD MILLION) 44

-

GLOBAL MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY APPLICATION, 2025-2034 (USD MILLION) 47

-

GLOBAL MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY AEROSPACE & DEFENSE APPLICATION, 2025-2034 (USD MILLION) 48

-

GLOBAL MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY COMMERCIAL APPLICATION, 2025-2034 (USD MILLION) 50

-

GLOBAL MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY REGION, 2025-2034 (USD MILLION) 53

-

NORTH AMERICA MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY COUNTRY, 2025-2034 (USD MILLION) 56

-

NORTH AMERICA MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY TYPE, 2025-2034 (USD MILLION) 56

-

NORTH AMERICA MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY HIGH OPERATING TEMPERATURE (HOT) MID-WAVE INFRARED (MWIR) SENSORS, 2025-2034 (USD MILLION) 57

-

NORTH AMERICA MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY APPLICATION, 2025-2034 (USD MILLION) 58

-

NORTH AMERICA MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY AEROSPACE & DEFENSE APPLICATION, 2025-2034 (USD MILLION) 58

-

NORTH AMERICA MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY COMMERCIAL APPLICATION, 2025-2034 (USD MILLION) 59

-

US MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY TYPE, 2025-2034 (USD MILLION) 60

-

US MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY HIGH OPERATING TEMPERATURE (HOT) MID-WAVE INFRARED (MWIR) SENSORS, 2025-2034 (USD MILLION) 60

-

US MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY APPLICATION, 2025-2034 (USD MILLION) 60

-

US MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY AEROSPACE & DEFENSE APPLICATION, 2025-2034 (USD MILLION) 61

-

US MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY COMMERCIAL APPLICATION, 2025-2034 (USD MILLION) 61

-

CANADA MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY TYPE, 2025-2034 (USD MILLION) 63

-

CANADA MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY HIGH OPERATING TEMPERATURE (HOT) MID-WAVE INFRARED (MWIR) SENSORS, 2025-2034 (USD MILLION) 63

-

CANADA MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY APPLICATION, 2025-2034 (USD MILLION) 64

-

CANADA MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY AEROSPACE & DEFENSE APPLICATION, 2025-2034 (USD MILLION) 64

-

CANADA MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY COMMERCIAL APPLICATION, 2025-2034 (USD MILLION) 65

-

MEXICO MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY TYPE, 2025-2034 (USD MILLION) 66

-

MEXICO MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY HIGH OPERATING TEMPERATURE (HOT) MID-WAVE INFRARED (MWIR) SENSORS, 2025-2034 (USD MILLION) 66

-

MEXICO MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY APPLICATION, 2025-2034 (USD MILLION) 67

-

MEXICO MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY AEROSPACE & DEFENSE APPLICATION, 2025-2034 (USD MILLION) 67

-

MEXICO MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY COMMERCIAL APPLICATION, 2025-2034 (USD MILLION) 68

-

EUROPE MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY COUNTRY, 2025-2034 (USD MILLION) 70

-

EUROPE MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY TYPE, 2025-2034 (USD MILLION) 71

-

3.2.3 EUROPE MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY HIGH OPERATING TEMPERATURE (HOT) MID-WAVE INFRARED (MWIR) SENSORS, 2025-2034 (USD MILLION) 72

-

EUROPE MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY APPLICATION, 2025-2034 (USD MILLION) 73

-

EUROPE MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY AEROSPACE & DEFENSE APPLICATION, 2025-2034 (USD MILLION) 73

-

EUROPE MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY COMMERCIAL APPLICATION, 2025-2034 (USD MILLION) 74

-

GERMANY MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY TYPE, 2025-2034 (USD MILLION) 74

-

GERMANY MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY HIGH OPERATING TEMPERATURE (HOT) MID-WAVE INFRARED (MWIR) SENSORS, 2025-2034 (USD MILLION) 75

-

GERMANY MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY APPLICATION, 2025-2034 (USD MILLION) 75

-

GERMANY MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY AEROSPACE & DEFENSE APPLICATION, 2025-2034 (USD MILLION) 76

-

GERMANY MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY COMMERCIAL APPLICATION, 2025-2034 (USD MILLION) 76

-

UK MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY TYPE, 2025-2034 (USD MILLION) 77

-

UK MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY HIGH OPERATING TEMPERATURE (HOT) MID-WAVE INFRARED (MWIR) SENSORS, 2025-2034 (USD MILLION) 77

-

UK MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY APPLICATION, 2025-2034 (USD MILLION) 78

-

UK MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY AEROSPACE & DEFENSE APPLICATION, 2025-2034 (USD MILLION) 78

-

UK MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY COMMERCIAL APPLICATION, 2025-2034 (USD MILLION) 79

-

FRANCE MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY TYPE, 2025-2034 (USD MILLION) 80

-

FRANCE MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY HIGH OPERATING TEMPERATURE (HOT) MID-WAVE INFRARED (MWIR) SENSORS, 2025-2034 (USD MILLION) 80

-

FRANCE MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY APPLICATION, 2025-2034 (USD MILLION) 81

-

FRANCE MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY AEROSPACE & DEFENSE APPLICATION, 2025-2034 (USD MILLION) 81

-

FRANCE MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY COMMERCIAL APPLICATION, 2025-2034 (USD MILLION) 82

-

ITALY MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY TYPE, 2025-2034 (USD MILLION) 83

-

ITALY MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY HIGH OPERATING TEMPERATURE (HOT) MID-WAVE INFRARED (MWIR) SENSORS, 2025-2034 (USD MILLION) 83

-

ITALY MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY APPLICATION, 2025-2034 (USD MILLION) 84

-

ITALY MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY AEROSPACE & DEFENSE APPLICATION, 2025-2034 (USD MILLION) 84

-

ITALY MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY COMMERCIAL APPLICATION, 2025-2034 (USD MILLION) 85

-

REST OF EUROPE MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY TYPE, 2025-2034 (USD MILLION) 86

-

REST OF EUROPE MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY HIGH OPERATING TEMPERATURE (HOT) MID-WAVE INFRARED (MWIR) SENSORS, 2025-2034 (USD MILLION) 86

-

REST OF EUROPE MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY APPLICATION, 2025-2034 (USD MILLION) 87

-

REST OF EUROPE MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY AEROSPACE & DEFENSE APPLICATION, 2025-2034 (USD MILLION) 87

-

REST OF EUROPE MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY COMMERCIAL APPLICATION, 2025-2034 (USD MILLION) 88

-

ASIA-PACIFIC MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY COUNTRY, 2025-2034 (USD MILLION) 91

-

ASIA-PACIFIC MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY TYPE, 2025-2034 (USD MILLION) 92

-

3.2.3 ASIA-PACIFIC MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY HIGH OPERATING TEMPERATURE (HOT) MID-WAVE INFRARED (MWIR) SENSORS, 2025-2034 (USD MILLION) 92

-

ASIA-PACIFIC MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY APPLICATION, 2025-2034 (USD MILLION) 93

-

ASIA-PACIFIC MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY AEROSPACE & DEFENSE APPLICATION, 2025-2034 (USD MILLION) 94

-

ASIA-PACIFIC MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY COMMERCIAL APPLICATION, 2025-2034 (USD MILLION) 94

-

CHINA MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY TYPE, 2025-2034 (USD MILLION) 95

-

CHINA MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY HIGH OPERATING TEMPERATURE (HOT) MID-WAVE INFRARED (MWIR) SENSORS, 2025-2034 (USD MILLION) 95

-

CHINA MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY APPLICATION, 2025-2034 (USD MILLION) 96

-

CHINA MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY AEROSPACE & DEFENSE APPLICATION, 2025-2034 (USD MILLION) 96

-

CHINA MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY COMMERCIAL APPLICATION, 2025-2034 (USD MILLION) 97

-

INDIA MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY TYPE, 2025-2034 (USD MILLION) 98

-

INDIA MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY HIGH OPERATING TEMPERATURE (HOT) MID-WAVE INFRARED (MWIR) SENSORS, 2025-2034 (USD MILLION) 98

-

INDIA MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY APPLICATION, 2025-2034 (USD MILLION) 99

-

INDIA MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY AEROSPACE & DEFENSE APPLICATION, 2025-2034 (USD MILLION) 99

-

INDIA MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY COMMERCIAL APPLICATION, 2025-2034 (USD MILLION) 100

-

JAPAN MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY TYPE, 2025-2034 (USD MILLION) 101

-

JAPAN MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY HIGH OPERATING TEMPERATURE (HOT) MID-WAVE INFRARED (MWIR) SENSORS, 2025-2034 (USD MILLION) 101

-

JAPAN MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY APPLICATION, 2025-2034 (USD MILLION) 102

-

JAPAN MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY AEROSPACE & DEFENSE APPLICATION, 2025-2034 (USD MILLION) 102

-

JAPAN MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY COMMERCIAL APPLICATION, 2025-2034 (USD MILLION) 103

-

SOUTH KOREA MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY TYPE, 2025-2034 (USD MILLION) 104

-

SOUTH KOREA MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY HIGH OPERATING TEMPERATURE (HOT) MID-WAVE INFRARED (MWIR) SENSORS, 2025-2034 (USD MILLION) 104

-

SOUTH KOREA MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY APPLICATION, 2025-2034 (USD MILLION) 105

-

SOUTH KOREA MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY AEROSPACE & DEFENSE APPLICATION, 2025-2034 (USD MILLION) 105

-

SOUTH KOREA MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY COMMERCIAL APPLICATION, 2025-2034 (USD MILLION) 106

-

REST OF ASIA-PACIFIC MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY TYPE, 2025-2034 (USD MILLION) 107

-

REST OF ASIA-PACIFIC MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY HIGH OPERATING TEMPERATURE (HOT) MID-WAVE INFRARED (MWIR) SENSORS, 2025-2034 (USD MILLION) 107

-

REST OF ASIA-PACIFIC MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY APPLICATION, 2025-2034 (USD MILLION) 108

-

REST OF ASIA-PACIFIC MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY AEROSPACE & DEFENSE APPLICATION, 2025-2034 (USD MILLION) 108

-

REST OF ASIA-PACIFIC MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY COMMERCIAL APPLICATION, 2025-2034 (USD MILLION) 109

-

REST OF THE WORLD MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY REGION, 2025-2034 (USD MILLION) 111

-

REST OF THE WORLD MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY TYPE, 2025-2034 (USD MILLION) 112

-

3.2.3 REST OF THE WORLD MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY HIGH OPERATING TEMPERATURE (HOT) MID-WAVE INFRARED (MWIR) SENSORS, 2025-2034 (USD MILLION) 113

-

REST OF THE WORLD MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY APPLICATION, 2025-2034 (USD MILLION) 114

-

REST OF THE WORLD MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY AEROSPACE & DEFENSE APPLICATION, 2025-2034 (USD MILLION) 114

-

REST OF THE WORLD MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY COMMERCIAL APPLICATION, 2025-2034 (USD MILLION) 115

-

MIDDLE EAST & AFRICA MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY TYPE, 2025-2034 (USD MILLION) 115

-

MIDDLE EAST & AFRICA MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY HIGH OPERATING TEMPERATURE (HOT) MID-WAVE INFRARED (MWIR) SENSORS, 2025-2034 (USD MILLION) 116

-

MIDDLE EAST & AFRICA MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY APPLICATION, 2025-2034 (USD MILLION) 116

-

MIDDLE EAST & AFRICA MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY AEROSPACE & DEFENSE APPLICATION, 2025-2034 (USD MILLION) 117

-

MIDDLE EAST & AFRICA MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY COMMERCIAL APPLICATION, 2025-2034 (USD MILLION) 117

-

SOUTH AMERICA MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY TYPE, 2025-2034 (USD MILLION) 118

-

SOUTH AMERICA MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY HIGH OPERATING TEMPERATURE (HOT) MID-WAVE INFRARED (MWIR) SENSORS, 2025-2034 (USD MILLION) 118

-

SOUTH AMERICA MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY APPLICATION, 2025-2034 (USD MILLION) 119

-

SOUTH AMERICA MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY AEROSPACE & DEFENSE APPLICATION, 2025-2034 (USD MILLION) 119

-

SOUTH AMERICA MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY COMMERCIAL APPLICATION, 2025-2034 (USD MILLION) 120

-

PARTNERSHIPS/AGREEMENTS/CONTRACTS/COLLABORATIONS 124

-

BUSINESS EXPANSIONS/ACQUISITIONS 125

-

PRODUCT LAUNCHES/DEVELOPMENTS 125

-

SEMICONDUCTOR DEVICES: PRODUCTS/SOLUTIONS/SERVICES OFFERED 127

-

TELEDYNE FLIR LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED 131

-

TELEDYNE FLIR LLC: KEY DEVELOPMENTS 132

-

LYNRED: PRODUCTS/SOLUTIONS/SERVICES OFFERED 134

-

LYNRED: KEY DEVELOPMENTS 135

-

LEONARDO S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 139

-

GSTIR: PRODUCTS/SOLUTIONS/SERVICES OFFERED 141

-

SILENT SENTINEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED 142

-

SILENT SENTINEL: KEY DEVELOPMENTS 143

-

ASCENDENT TECHNOLOGY GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED 144

-

EXCELITAS TECHNOLOGIES CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 147

-

EXCELITAS TECHNOLOGIES CORP.: KEY DEVELOPMENTS 148

-

OPTO ENGINEERING: PRODUCTS/SOLUTIONS/SERVICES OFFERED 150

-

NEW INFRARED TECHNOLOGIES (NIT): PRODUCTS/SOLUTIONS/SERVICES OFFERED 152

-

L3HARRIS TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 155

-

SIERRA-OLYMPIA TECH.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 157

-

SIERRA-OLYMPIA TECH.: KEY DEVELOPMENTS 158

-

INFRATEC GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED 160

-

XENICS NV: PRODUCTS/SOLUTIONS/SERVICES OFFERED 161

-

XENICS NV: KEY DEVELOPMENTS 162

-

TECH IMAGING SERVICES: PRODUCTS/SOLUTIONS/SERVICES OFFERED 164

-

LIST OF FIGURES

-

MARKET ATTRACTIVENESS ANALYSIS: GLOBAL MID-WAVE INFRARED (MWIR) SENSORS MARKET 22

-

GLOBAL MID-WAVE INFRARED (MWIR) SENSORS MARKET: STRUCTURE 23

-

BOTTOM-UP AND TOP-DOWN APPROACHES 28

-

MARKET DYNAMIC ANALYSIS OF THE GLOBAL MID-WAVE INFRARED SENSOR MARKET 31

-

DRIVERS IMPACT ANALYSIS: GLOBAL MID-WAVE INFRARED SENSOR MARKET 33

-

RESTRAINTS IMPACT ANALYSIS: GLOBAL MID-WAVE INFRARED SENSOR MARKET 34

-

GLOBAL MID-WAVE INFRARED SENSOR MARKET: VALUE CHAIN ANALYSIS 39

-

PORTER’S FIVE FORCES ANALYSIS 40

-

GLOBAL MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY TYPE, 2021 (% SHARE) 42

-

GLOBAL MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY TYPE, 2021 VS 2032 (USD MILLION) 42

-

GLOBAL MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY APPLICATION, 2021 (% SHARE) 46

-

GLOBAL MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY APPLICATION, 2021 VS 2032 (USD MILLION) 46

-

GLOBAL MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY REGION, 2021 (% SHARE) 52

-

GLOBAL MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY REGION, 2021 VS 2032 (USD MILLION) 52

-

NORTH AMERICA MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY COUNTRY, 2021 (% SHARE) 55

-

NORTH AMERICA MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY COUNTRY, 2021 VS 2032 (USD MILLION) 55

-

NORTH AMERICA MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION) 56

-

NORTH AMERICA MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION) 57

-

EUROPE MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY COUNTRY, 2021 (% SHARE) 70

-

EUROPE MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY COUNTRY, 2021 VS 2032 (USD MILLION) 70

-

EUROPE MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION) 71

-

EUROPE MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION) 72

-

ASIA-PACIFIC MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY COUNTRY, 2021 (% SHARE) 90

-

ASIA-PACIFIC MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY COUNTRY, 2021 VS 2032 (USD MILLION) 90

-

ASIA-PACIFIC MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION) 91

-

ASIA-PACIFIC MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION) 93

-

REST OF THE WORLD MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY REGION, 2021 (% SHARE) 110

-

REST OF THE WORLD MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY REGION, 2021 VS 2032 (USD MILLION) 111

-

REST OF THE WORLD MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY TYPE, 2018-2032 (USD MILLION) 112

-

REST OF THE WORLD MID-WAVE INFRARED (MWIR) SENSORS MARKET, BY APPLICATION, 2018-2032 (USD MILLION) 113

-

GLOBAL MID-WAVE INFRARED (MWIR) SENSORS MARKET: COMPETITIVE BENCHMARKING 123

-

VENDOR SHARE ANALYSIS, 2021 (%) 124

-

TELEDYNE FLIR LLC: FINANCIAL OVERVIEW SNAPSHOT 130

-

TELEDYNE FLIR LLC: SWOT ANALYSIS 133

-

LYNRED: SWOT ANALYSIS 135

-

LEONARDO S.P.A.: FINANCIAL OVERVIEW SNAPSHOT 138

-

LEONARDO S.P.A.: SWOT ANALYSIS 140

-

SILENT SENTINEL: SWOT ANALYSIS 143

-

EXCELITAS TECHNOLOGIES CORP.: SWOT ANALYSIS 149

-

L3HARRIS TECHNOLOGIES, INC.: FINANCIAL OVERVIEW SNAPSHOT 154

-

L3HARRIS TECHNOLOGIES, INC.: SWOT ANALYSIS 155

-

SIERRA-OLYMPIA TECH.: SWOT ANALYSIS 158

-

XENICS NV: SWOT ANALYSIS 163'

Source Secondary Research, Primary Research, MRFR Database and Analyst Review

Source Secondary Research, Primary Research, MRFR Database and Analyst Review

Leave a Comment