Micro Pump Size

Micro pump Market Growth Projections and Opportunities

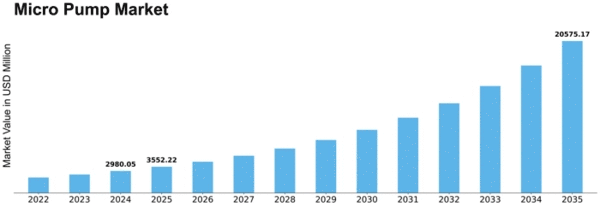

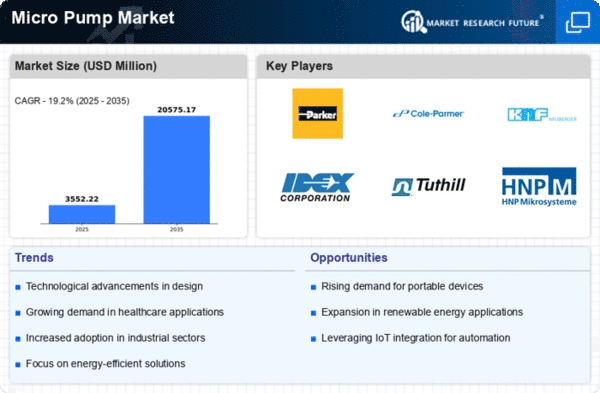

The global market for microfluidic pumps is experiencing significant growth, driven by increased investment in research and development within the life sciences and pharmaceutical sectors, coupled with a rising demand for point-of-care testing. Projections indicate that the global micropump market is poised to reach a valuation of USD 3.18 billion by the year 2023. The surge in point-of-care testing, recognized for its efficacy in drug and medication delivery, has amplified the need for precision and efficiency in drug administration, thereby fostering an increased demand for micropumps on a global scale.

A key contributor to the expansion of the micropump market is the escalating utilization of these devices in pharmaceutical, medical, and diagnostic applications. This trend underscores the versatile applications of micropumps in diverse sectors, further enhancing their market presence. Among the various types of micropumps, mechanical micropumps currently dominate the market, holding the largest share. The mechanical micropump segment is anticipated to exhibit a robust Compound Annual Growth Rate (CAGR) of 19.17% from 2017 to 2023.

However, as the micropump market continues to thrive, it faces certain challenges that warrant attention. One such challenge is the adherence to stringent regulatory requirements, which may act as a decelerating factor for market growth. Meeting and complying with regulatory standards can be a complex undertaking, influencing the pace at which the micropump market expands. Additionally, the market contends with challenges related to geometrical and surface chemistry issues, which can impact the overall efficacy and performance of micropumps.

Despite these challenges, the micropump market remains buoyant, primarily fueled by the relentless advancements in life sciences and pharmaceuticals. The demand for precise and efficient drug delivery mechanisms, coupled with the expanding applications of micropumps in various sectors, contributes to the market's resilience. The continued focus on research and development activities, coupled with technological innovations, is expected to address existing challenges and propel the micropump market towards sustained growth in the coming years.

In conclusion, the global micropump market is witnessing robust growth driven by factors such as increased R&D investment, a rising demand for point-of-care testing, and the versatile applications of micropumps in pharmaceutical, medical, and diagnostic domains. While challenges exist, the market's ability to navigate and overcome these hurdles underscores its potential for long-term expansion and development.

Leave a Comment