Micro Display Size

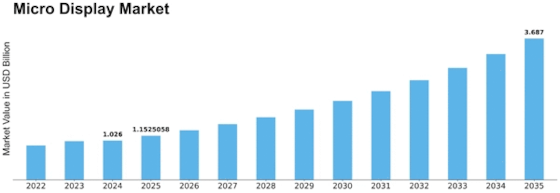

Micro Display Market Growth Projections and Opportunities

The popularity of small, conservative electronic devices across several industries is one important factor. Micro screens are becoming standard components of smartphones, and other portable electronics as consumers gravitate toward smaller, more portable devices. The primary driver of the market's expansion is this spike in popularity, which encourages manufacturers to create and distribute mini displays that provide excellent visual clarity and high goals within constrained structural parameters. The market sees a continuous pursuit of improvements in brightness, contrast ratios, and power efficiency. To stay ahead of the curve, manufacturers integrate the newest advancements in display technology, such as microLED and natural light-discharging diode (OLED), into their products. These mechanical headways improve microdisplay exhibitions and address the growing demand for more dynamic and energy-efficient visual arrangements. The need for immersive experiences in gaming, entertainment, education, and business is propelling the use of tiny screens in AR and VR headsets. The micro display industry benefits from the growing need for high-quality, low-dormancy screens that provide a realistic and useful user experience as these developments receive widespread recognition. The automotive industry makes a significant contribution to the micro display market, particularly when it comes to the integration of revolutionary display innovations in automobiles. Expanded reality displays (VRDs) and head-up displays (HUDs) in cars provide drivers with critical information directly on the windshield, enhancing safety and reducing distractions. The need for tiny displays that can withstand the harsh conditions of the automotive environment while providing accurate and clear visual data is driven by the auto industry's responsibility to integrate smart displays in automobiles. The rising spotlight on energy proficiency is another market factor impacting the micro display market. With a developing accentuation on supportability, makers are creating energy-effective micro display arrangements that lessen power utilization without compromising execution. This lines up with the more extensive industry pattern towards eco-accommodating innovations and reverberates with customers and organizations looking for ecological display choices.

Leave a Comment