Focus on Automotive Electronics

The automotive sector in Mexico is undergoing a transformation, with a growing emphasis on electronic components and systems. The system on-chip market is benefiting from this shift as vehicles become increasingly equipped with advanced driver-assistance systems (ADAS) and infotainment solutions. The demand for chips that can support these technologies is rising, with projections indicating a growth rate of approximately 10% in the automotive segment. Manufacturers are investing in the development of specialized chips that enhance vehicle safety and connectivity, thereby positioning themselves favorably in a competitive market. This focus on automotive electronics is likely to drive innovation and growth within the system on-chip market.

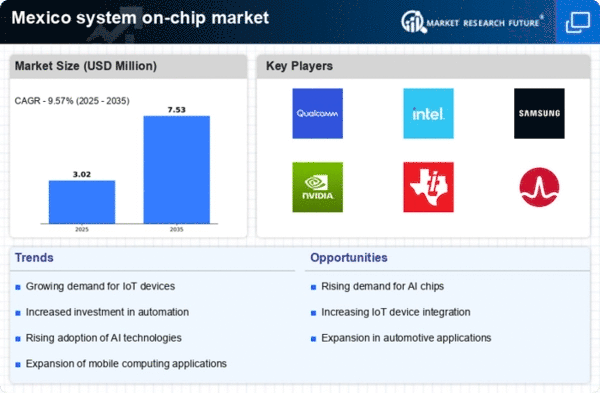

Increasing Adoption of AI Technologies

The integration of artificial intelligence (AI) technologies into various sectors is driving the system on-chip market in Mexico. As industries increasingly rely on AI for data processing and automation, the demand for efficient and compact solutions is rising. The system on-chip market is witnessing a surge in the development of AI-enabled chips, which are designed to handle complex algorithms and large datasets. This trend is expected to contribute to a projected growth rate of approximately 15% annually in the coming years. Companies are investing heavily in research and development to create specialized chips that can support AI applications, thereby enhancing their competitive edge in the market.

Rising Demand for Consumer Electronics

The burgeoning consumer electronics sector in Mexico is a key driver for the system on-chip market. As consumers increasingly seek advanced features in devices such as televisions, wearables, and home appliances, manufacturers are compelled to innovate. The system on-chip market is responding by producing chips that offer enhanced processing power and energy efficiency. This trend is reflected in the anticipated growth of the market, which is expected to reach a valuation of $2 billion by 2027. The integration of smart technologies into everyday products is likely to further fuel demand, as consumers prioritize connectivity and functionality in their electronic devices.

Expansion of Mobile and Wireless Communication

The rapid expansion of mobile and wireless communication technologies is significantly impacting the system on-chip market in Mexico. With the increasing penetration of smartphones and IoT devices, there is a growing need for advanced chip solutions that can support high-speed connectivity and data transfer. The system on-chip market is adapting to these demands by developing chips that integrate multiple functionalities, such as processing, connectivity, and power management, into a single unit. This integration not only reduces the size of devices but also enhances their performance. The market is projected to grow by around 12% as manufacturers focus on creating more efficient and versatile solutions to meet consumer expectations.

Government Initiatives for Technology Development

The Mexican government is actively promoting technology development, which is positively influencing the system on-chip market. Initiatives aimed at fostering innovation and supporting local semiconductor manufacturing are emerging. The system on-chip market stands to benefit from these policies, as they encourage investment in research and development. The government has allocated funding to support startups and established companies in the tech sector, which is expected to lead to advancements in chip technology. This supportive environment may result in a projected market growth of around 8% over the next few years, as local firms capitalize on government incentives to enhance their product offerings.