Market Trends

Key Emerging Trends in the Methane Sulfonic Acid Market

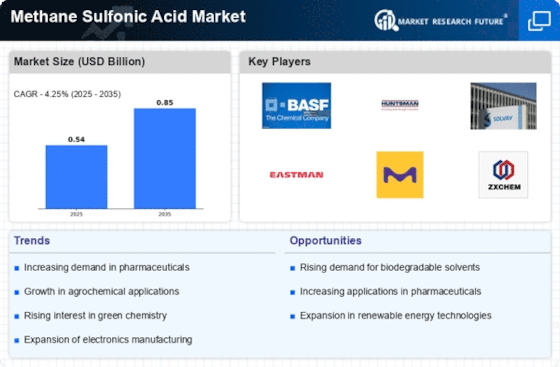

The Methane Sulfonic Acid (MSA) Market is currently experiencing notable trends that are influencing the industry across various applications. One significant trend is the increasing demand for MSA as a versatile and environmentally friendly acid catalyst in chemical processes. With a growing emphasis on sustainable and green chemistry, MSA has gained popularity as a substitute for traditional mineral acids in various reactions, including esterifications and alkylations. This trend is driven by the desire of industries to reduce their environmental impact, enhance process efficiency, and comply with stringent regulations regarding hazardous chemicals.

Environmental sustainability is a key driver influencing market trends in the Methane Sulfonic Acid Market. MSA is known for its low volatility, non-corrosive nature, and biodegradability, making it an attractive choice for environmentally conscious industries. Manufacturers are responding to the demand for eco-friendly alternatives by promoting MSA as a safer and more sustainable option compared to traditional mineral acids like sulfuric acid. This trend aligns with the global push towards greener and more sustainable chemical processes.

Technological advancements play a pivotal role in shaping market trends in the Methane Sulfonic Acid Market. Ongoing research and development efforts focus on optimizing the production processes and applications of MSA. Innovations in synthesis methods, purification techniques, and formulation approaches contribute to enhancing the purity and effectiveness of MSA in various applications. These technological trends address the industry's need for high-quality and efficient acid catalysts that can be utilized in a wide range of chemical reactions.

The pharmaceutical and agrochemical sectors are significant influencers of market trends in the Methane Sulfonic Acid Market. MSA is widely used as a catalyst and intermediate in the synthesis of active pharmaceutical ingredients (APIs) and agrochemicals. Its compatibility with sensitive compounds and its ability to facilitate specific reactions contribute to its increased adoption in these industries. This trend is driven by the stringent quality requirements and regulatory standards governing the production of pharmaceuticals and agrochemicals.

Supply chain dynamics and raw material costs are critical factors impacting market trends in the Methane Sulfonic Acid Market. The availability and pricing of raw materials, such as methane and sulfur trioxide, can influence the overall cost of MSA production. Fluctuations in raw material prices, geopolitical factors affecting the supply chain, and global economic conditions can pose challenges for manufacturers. Companies in the Methane Sulfonic Acid Market are actively managing their supply chains and exploring strategies to ensure a stable and cost-effective production process.

Moreover, there is a growing trend towards the use of MSA in emerging applications such as electroplating and electrochemical processes. MSA's unique properties, including its stability and conductivity, make it suitable for use in various electrochemical applications. Manufacturers are exploring the potential of MSA as an electrolyte additive, corrosion inhibitor, and electroplating bath component, expanding its scope beyond traditional catalytic applications. This trend reflects the versatility of MSA and its potential to address evolving needs in diverse industrial sectors.

Leave a Comment