Top Industry Leaders in the Mesh App Service Architecture Market

Competitive Landscape of Mesh App and Service Architecture Market: A Detailed Analysis

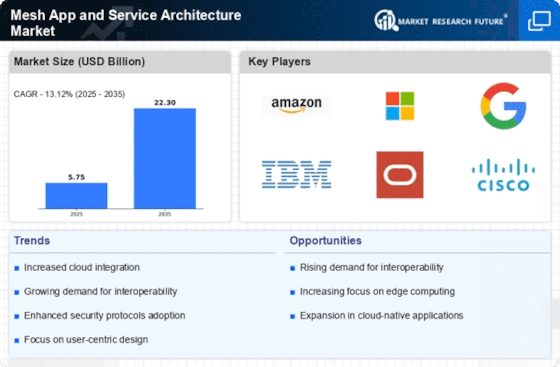

The Mesh App and Service Architecture (MASA) market is experiencing a surge in growth, fueled by the rising demand for seamless connectivity and interaction between devices and applications. This decentralized approach to app and service delivery, with its inherent scalability, redundancy, and resilience, is increasingly favored in the age of the Internet of Things (IoT) and cloud-based computing. To navigate this dynamic market, understanding the key players, their strategies, and emerging trends is crucial.

Key players:

- Docker, Inc. (U.S.)

- Microsoft Corporation (U.S.)

- ASI Solutions, Inc (U.S.)

- Axway Software (France)

- Apple Inc. (U.S.)

- IBM Corporation (U.S.)

- Google LLC (U.S.)

- AnAr Solutions Pvt. Ltd. (India)

Market Share Analysis Factors:

- Product Portfolio and Feature Set: The breadth and depth of offerings, encompassing APIs, analytics, omni-channel capabilities, and cloud/on-premise deployment options, significantly influence market share.

- Customer Base and Industry Focus: Catering to specific verticals like e-commerce, banking, and mobile wallets through tailored solutions and partnerships can create a competitive edge.

- Pricing Strategy and Value Proposition: Cost-effective solutions coupled with clear value propositions that address pain points and demonstrate ROI can attract a wider audience.

- Innovation and Technological Advancements: Continuous investment in R&D, open-source contributions, and adoption of cutting-edge technologies like AI and machine learning can fuel market leadership.

New and Emerging Companies:

- Cloud-Native Platform Providers: Platform-as-a-service (PaaS) and serverless computing players like Pivotal, Cloud Foundry, and Platform9 are integrating MASA capabilities into their offerings, targeting application developers seeking a unified development and deployment environment.

- Cybersecurity Specialists: With growing concerns around service mesh security vulnerabilities, companies like Apigee (acquired by Google) and Sysdig are offering specialized security solutions for MASA deployments, ensuring data protection and compliance.

- Open-Source Project Leaders: Communities around projects like Istio and Linkerd are fostering innovation and attracting talent, making open-source MASA solutions a viable alternative for cost-conscious organizations.

Current Company Investment Trends:

- Strategic Partnerships and Acquisitions: Established players like Microsoft and Google are actively acquiring and partnering with ISVs and start-ups to expand their MASA portfolios and access new markets.

- Focus on Open Source and Developer Relations: Open-source projects and developer communities are being nurtured by companies like Tyk and Solo.io, fostering collaboration and driving adoption.

- Cloud-Native Integration and Automation: Integrating MASA with cloud-native platforms and automating service mesh management are key priorities for companies like Pivotal and Cloud Foundry.

- Security and Compliance Enhancements: Investment in security features, vulnerability scanning, and compliance tools is increasing to address concerns around data privacy and regulatory requirements.

Recent News and Developments:

- October 26, 2023: Amazon Web Services (AWS) announced the launch of AWS Outposts Serverless, a new service that enables developers to run serverless applications on edge locations using mesh architectures.

- October 19, 2023: Microsoft announced the general availability of Azure Arc for Kubernetes, a service that allows users to manage Kubernetes clusters across cloud and edge environments.

- September 27, 2023: The Linux Foundation announced the launch of Open Mesh Group, an industry consortium focused on developing open-source standards for mesh networking and applications.