Menswear Size

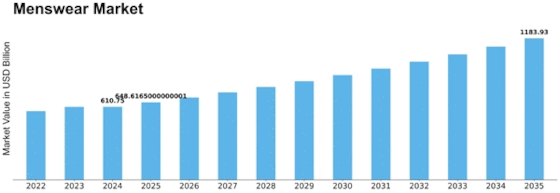

Menswear Market Growth Projections and Opportunities

More than a handful of factors influence the menswear market, affecting both its dynamics and trends in it. The main driving force is changing consumer preferences and the increased emphasis on personal looks. As more men exhibit interest in fashion, the demand for different and stylish menswear items increases. This can be seen among almost all age groups, where the man is looking for clothes that not only fit him but suit his style. The emergence of social sites, media platforms and fashion influencers boost the visibility menswear styling trends which then have an impact on buying decisions hence adding dynamism to this market. The economic situation has a significant impact on the development of Menswear Markets. Demand for menswear is dependent upon the consumer spending patterns, disposable income levels as well as overall economic stability. It was possible that during times of economic boom, consumers could be inclined to purchase more expensive and luxurious menswear products. On the other hand, a recession period can cause changes in consumer spending behavior as consumers shift to cost saving menswear products. The economic factors such as pricing strategies of menswear brands and retailers effect the availability. Regarding the diversity and evolution of the menswear market, cultural and societal factors play important roles. The aesthetics and design of menswear are influenced by cultural factors, such as regional fashion styles, traditions etc. The opening up of styles, body types as well as masculinity expression has led to a variety in the provisioning areas when it comes to menswear. Social changes following the trends of inclusiveness and breaking traditional gender norms further influence men’s fashion market, creating a more inclusive environment. The development of technology also contributes to the Menswear Market, including developments in e-commerce and digital retail experience. This has changed the way a man can source, browse, and order clothes online. Now, thanks to e-commerce platforms and mobile apps that give a lot of choices in menswear styles for consumers who can browse through options from around the world while being at home. Technology is another component of supply chain management which ensures efficient inventory control and timely deliveries – critical functionalities in the rapidly changing fashion world. Regulatory surrounding impact the Menswear Market through a range of standards and guidelines on product safety, labelling as well ethical requirements. Menswear brands must follow regulations as regards sustainable materials, ethical production process and fair labor practice. As consumers become more attuned to the ethical and ecological ramifications of their choices regarding fashion, those brands that reflect these values should receive a positive reaction.

Leave a Comment