-

EXECUTIVE SUMMARY

-

Market Overview

-

Key Findings

-

Market Segmentation

-

Competitive Landscape

-

Challenges and Opportunities

-

Future Outlook

-

MARKET INTRODUCTION

-

Definition

-

Scope of the study

- Research Objective

- Assumption

- Limitations

-

RESEARCH METHODOLOGY

-

Overview

-

Data Mining

-

Secondary Research

-

Primary Research

- Primary Interviews and Information Gathering Process

- Breakdown of Primary Respondents

-

Forecasting Model

-

Market Size Estimation

- Bottom-Up Approach

- Top-Down Approach

-

Data Triangulation

-

Validation

-

MARKET DYNAMICS

-

Overview

-

Drivers

-

Restraints

-

Opportunities

-

MARKET FACTOR ANALYSIS

-

Value chain Analysis

-

Porter's Five Forces Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrants

- Threat of Substitutes

- Intensity of Rivalry

-

COVID-19 Impact Analysis

- Market Impact Analysis

- Regional Impact

- Opportunity and Threat Analysis

-

Medical Device Coatings Market, BY Type (USD Billion)

-

Antimicrobial

-

Drug-Eluting

-

Hydrophilic

-

Anti Therombogenic

-

Medical Device Coatings Market, BY Application (USD Billion)

-

Cardiovascular

-

Orthopedics

-

Neurology

-

Gynecology

-

Others

-

Medical Device Coatings Market, BY Regional (USD Billion)

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Russia

- Italy

- Spain

- Rest of Europe

-

APAC

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Indonesia

- Rest of APAC

-

South America

- Brazil

- Mexico

- Argentina

- Rest of South America

-

MEA

- GCC Countries

- South Africa

- Rest of MEA

-

Competitive Landscape

-

Overview

-

Competitive Analysis

-

Market share Analysis

-

Major Growth Strategy in the Medical Device Coating Market

-

Competitive Benchmarking

-

Leading Players in Terms of Number of Developments in the Medical Device Coating Market

-

Key developments and growth strategies

- New Product Launch/Service Deployment

- Merger & Acquisitions

- Joint Ventures

-

Major Players Financial Matrix

- Sales and Operating Income

- Major Players R&D Expenditure. 2023

-

Company Profiles

-

Surmodics

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Fujifilm

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Thermo Fisher Scientific

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Smith & Nephew

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Heraeus

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Medtronic

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Coatings for Industry

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

St. Jude Medical

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Ascent Healthcare Solutions

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

B. Braun Melsungen

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Biocoat

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Johnson & Johnson

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Abbott Laboratories

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Boston Scientific

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Appendix

-

References

-

Related Reports

-

LIST Of tables

-

LIST OF ASSUMPTIONS

-

North America Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY TYPE, 2019-2035 (USD Billions)

-

North America Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY APPLICATION, 2019-2035 (USD Billions)

-

North America Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY REGIONAL, 2019-2035 (USD Billions)

-

US Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY TYPE, 2019-2035 (USD Billions)

-

US Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY APPLICATION, 2019-2035 (USD Billions)

-

US Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY REGIONAL, 2019-2035 (USD Billions)

-

Canada Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY TYPE, 2019-2035 (USD Billions)

-

Canada Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY APPLICATION, 2019-2035 (USD Billions)

-

Canada Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY REGIONAL, 2019-2035 (USD Billions)

-

Europe Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY TYPE, 2019-2035 (USD Billions)

-

Europe Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY APPLICATION, 2019-2035 (USD Billions)

-

Europe Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY REGIONAL, 2019-2035 (USD Billions)

-

Germany Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY TYPE, 2019-2035 (USD Billions)

-

Germany Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY APPLICATION, 2019-2035 (USD Billions)

-

Germany Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY REGIONAL, 2019-2035 (USD Billions)

-

UK Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY TYPE, 2019-2035 (USD Billions)

-

UK Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY APPLICATION, 2019-2035 (USD Billions)

-

UK Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY REGIONAL, 2019-2035 (USD Billions)

-

France Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY TYPE, 2019-2035 (USD Billions)

-

France Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY APPLICATION, 2019-2035 (USD Billions)

-

France Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY REGIONAL, 2019-2035 (USD Billions)

-

Russia Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY TYPE, 2019-2035 (USD Billions)

-

Russia Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY APPLICATION, 2019-2035 (USD Billions)

-

Russia Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY REGIONAL, 2019-2035 (USD Billions)

-

Italy Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY TYPE, 2019-2035 (USD Billions)

-

Italy Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY APPLICATION, 2019-2035 (USD Billions)

-

Italy Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY REGIONAL, 2019-2035 (USD Billions)

-

Spain Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY TYPE, 2019-2035 (USD Billions)

-

Spain Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY APPLICATION, 2019-2035 (USD Billions)

-

Spain Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY REGIONAL, 2019-2035 (USD Billions)

-

Rest of Europe Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY TYPE, 2019-2035 (USD Billions)

-

Rest of Europe Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY APPLICATION, 2019-2035 (USD Billions)

-

Rest of Europe Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY REGIONAL, 2019-2035 (USD Billions)

-

APAC Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY TYPE, 2019-2035 (USD Billions)

-

APAC Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY APPLICATION, 2019-2035 (USD Billions)

-

APAC Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY REGIONAL, 2019-2035 (USD Billions)

-

China Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY TYPE, 2019-2035 (USD Billions)

-

China Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY APPLICATION, 2019-2035 (USD Billions)

-

China Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY REGIONAL, 2019-2035 (USD Billions)

-

India Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY TYPE, 2019-2035 (USD Billions)

-

India Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY APPLICATION, 2019-2035 (USD Billions)

-

India Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY REGIONAL, 2019-2035 (USD Billions)

-

Japan Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY TYPE, 2019-2035 (USD Billions)

-

Japan Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY APPLICATION, 2019-2035 (USD Billions)

-

Japan Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY REGIONAL, 2019-2035 (USD Billions)

-

South Korea Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY TYPE, 2019-2035 (USD Billions)

-

South Korea Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY APPLICATION, 2019-2035 (USD Billions)

-

South Korea Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY REGIONAL, 2019-2035 (USD Billions)

-

Malaysia Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY TYPE, 2019-2035 (USD Billions)

-

Malaysia Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY APPLICATION, 2019-2035 (USD Billions)

-

Malaysia Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY REGIONAL, 2019-2035 (USD Billions)

-

Thailand Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY TYPE, 2019-2035 (USD Billions)

-

Thailand Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY APPLICATION, 2019-2035 (USD Billions)

-

Thailand Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY REGIONAL, 2019-2035 (USD Billions)

-

Indonesia Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY TYPE, 2019-2035 (USD Billions)

-

Indonesia Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY APPLICATION, 2019-2035 (USD Billions)

-

Indonesia Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY REGIONAL, 2019-2035 (USD Billions)

-

Rest of APAC Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY TYPE, 2019-2035 (USD Billions)

-

Rest of APAC Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY APPLICATION, 2019-2035 (USD Billions)

-

Rest of APAC Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY REGIONAL, 2019-2035 (USD Billions)

-

South America Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY TYPE, 2019-2035 (USD Billions)

-

South America Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY APPLICATION, 2019-2035 (USD Billions)

-

South America Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY REGIONAL, 2019-2035 (USD Billions)

-

Brazil Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY TYPE, 2019-2035 (USD Billions)

-

Brazil Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY APPLICATION, 2019-2035 (USD Billions)

-

Brazil Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY REGIONAL, 2019-2035 (USD Billions)

-

Mexico Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY TYPE, 2019-2035 (USD Billions)

-

Mexico Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY APPLICATION, 2019-2035 (USD Billions)

-

Mexico Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY REGIONAL, 2019-2035 (USD Billions)

-

Argentina Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY TYPE, 2019-2035 (USD Billions)

-

Argentina Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY APPLICATION, 2019-2035 (USD Billions)

-

Argentina Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY REGIONAL, 2019-2035 (USD Billions)

-

Rest of South America Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY TYPE, 2019-2035 (USD Billions)

-

Rest of South America Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY APPLICATION, 2019-2035 (USD Billions)

-

Rest of South America Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY REGIONAL, 2019-2035 (USD Billions)

-

MEA Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY TYPE, 2019-2035 (USD Billions)

-

MEA Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY APPLICATION, 2019-2035 (USD Billions)

-

MEA Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY REGIONAL, 2019-2035 (USD Billions)

-

GCC Countries Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY TYPE, 2019-2035 (USD Billions)

-

GCC Countries Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY APPLICATION, 2019-2035 (USD Billions)

-

GCC Countries Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY REGIONAL, 2019-2035 (USD Billions)

-

South Africa Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY TYPE, 2019-2035 (USD Billions)

-

South Africa Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY APPLICATION, 2019-2035 (USD Billions)

-

South Africa Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY REGIONAL, 2019-2035 (USD Billions)

-

Rest of MEA Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY TYPE, 2019-2035 (USD Billions)

-

Rest of MEA Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY APPLICATION, 2019-2035 (USD Billions)

-

Rest of MEA Medical Device Coating Market SIZE ESTIMATES & Medical Device Coatings Market, BY REGIONAL, 2019-2035 (USD Billions)

-

PRODUCT LAUNCH/PRODUCT DEVELOPMENT/APPROVAL

-

ACQUISITION/PARTNERSHIP

-

LIST Of figures

-

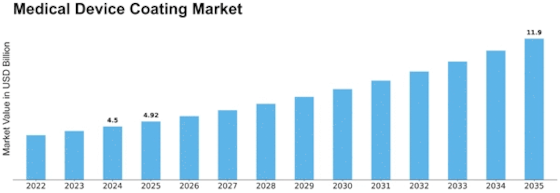

MARKET SYNOPSIS

-

NORTH AMERICA MEDICAL DEVICE COATING MARKET ANALYSIS

-

US MEDICAL DEVICE COATING MARKET ANALYSIS BY TYPE

-

US MEDICAL DEVICE COATING MARKET ANALYSIS BY APPLICATION

-

US MEDICAL DEVICE COATING MARKET ANALYSIS BY REGIONAL

-

CANADA MEDICAL DEVICE COATING MARKET ANALYSIS BY TYPE

-

CANADA MEDICAL DEVICE COATING MARKET ANALYSIS BY APPLICATION

-

CANADA MEDICAL DEVICE COATING MARKET ANALYSIS BY REGIONAL

-

EUROPE MEDICAL DEVICE COATING MARKET ANALYSIS

-

GERMANY MEDICAL DEVICE COATING MARKET ANALYSIS BY TYPE

-

GERMANY MEDICAL DEVICE COATING MARKET ANALYSIS BY APPLICATION

-

GERMANY MEDICAL DEVICE COATING MARKET ANALYSIS BY REGIONAL

-

UK MEDICAL DEVICE COATING MARKET ANALYSIS BY TYPE

-

UK MEDICAL DEVICE COATING MARKET ANALYSIS BY APPLICATION

-

UK MEDICAL DEVICE COATING MARKET ANALYSIS BY REGIONAL

-

FRANCE MEDICAL DEVICE COATING MARKET ANALYSIS BY TYPE

-

FRANCE MEDICAL DEVICE COATING MARKET ANALYSIS BY APPLICATION

-

FRANCE MEDICAL DEVICE COATING MARKET ANALYSIS BY REGIONAL

-

RUSSIA MEDICAL DEVICE COATING MARKET ANALYSIS BY TYPE

-

RUSSIA MEDICAL DEVICE COATING MARKET ANALYSIS BY APPLICATION

-

RUSSIA MEDICAL DEVICE COATING MARKET ANALYSIS BY REGIONAL

-

ITALY MEDICAL DEVICE COATING MARKET ANALYSIS BY TYPE

-

ITALY MEDICAL DEVICE COATING MARKET ANALYSIS BY APPLICATION

-

ITALY MEDICAL DEVICE COATING MARKET ANALYSIS BY REGIONAL

-

SPAIN MEDICAL DEVICE COATING MARKET ANALYSIS BY TYPE

-

SPAIN MEDICAL DEVICE COATING MARKET ANALYSIS BY APPLICATION

-

SPAIN MEDICAL DEVICE COATING MARKET ANALYSIS BY REGIONAL

-

REST OF EUROPE MEDICAL DEVICE COATING MARKET ANALYSIS BY TYPE

-

REST OF EUROPE MEDICAL DEVICE COATING MARKET ANALYSIS BY APPLICATION

-

REST OF EUROPE MEDICAL DEVICE COATING MARKET ANALYSIS BY REGIONAL

-

APAC MEDICAL DEVICE COATING MARKET ANALYSIS

-

CHINA MEDICAL DEVICE COATING MARKET ANALYSIS BY TYPE

-

CHINA MEDICAL DEVICE COATING MARKET ANALYSIS BY APPLICATION

-

CHINA MEDICAL DEVICE COATING MARKET ANALYSIS BY REGIONAL

-

INDIA MEDICAL DEVICE COATING MARKET ANALYSIS BY TYPE

-

INDIA MEDICAL DEVICE COATING MARKET ANALYSIS BY APPLICATION

-

INDIA MEDICAL DEVICE COATING MARKET ANALYSIS BY REGIONAL

-

JAPAN MEDICAL DEVICE COATING MARKET ANALYSIS BY TYPE

-

JAPAN MEDICAL DEVICE COATING MARKET ANALYSIS BY APPLICATION

-

JAPAN MEDICAL DEVICE COATING MARKET ANALYSIS BY REGIONAL

-

SOUTH KOREA MEDICAL DEVICE COATING MARKET ANALYSIS BY TYPE

-

SOUTH KOREA MEDICAL DEVICE COATING MARKET ANALYSIS BY APPLICATION

-

SOUTH KOREA MEDICAL DEVICE COATING MARKET ANALYSIS BY REGIONAL

-

MALAYSIA MEDICAL DEVICE COATING MARKET ANALYSIS BY TYPE

-

MALAYSIA MEDICAL DEVICE COATING MARKET ANALYSIS BY APPLICATION

-

MALAYSIA MEDICAL DEVICE COATING MARKET ANALYSIS BY REGIONAL

-

THAILAND MEDICAL DEVICE COATING MARKET ANALYSIS BY TYPE

-

THAILAND MEDICAL DEVICE COATING MARKET ANALYSIS BY APPLICATION

-

THAILAND MEDICAL DEVICE COATING MARKET ANALYSIS BY REGIONAL

-

INDONESIA MEDICAL DEVICE COATING MARKET ANALYSIS BY TYPE

-

INDONESIA MEDICAL DEVICE COATING MARKET ANALYSIS BY APPLICATION

-

INDONESIA MEDICAL DEVICE COATING MARKET ANALYSIS BY REGIONAL

-

REST OF APAC MEDICAL DEVICE COATING MARKET ANALYSIS BY TYPE

-

REST OF APAC MEDICAL DEVICE COATING MARKET ANALYSIS BY APPLICATION

-

REST OF APAC MEDICAL DEVICE COATING MARKET ANALYSIS BY REGIONAL

-

SOUTH AMERICA MEDICAL DEVICE COATING MARKET ANALYSIS

-

BRAZIL MEDICAL DEVICE COATING MARKET ANALYSIS BY TYPE

-

BRAZIL MEDICAL DEVICE COATING MARKET ANALYSIS BY APPLICATION

-

BRAZIL MEDICAL DEVICE COATING MARKET ANALYSIS BY REGIONAL

-

MEXICO MEDICAL DEVICE COATING MARKET ANALYSIS BY TYPE

-

MEXICO MEDICAL DEVICE COATING MARKET ANALYSIS BY APPLICATION

-

MEXICO MEDICAL DEVICE COATING MARKET ANALYSIS BY REGIONAL

-

ARGENTINA MEDICAL DEVICE COATING MARKET ANALYSIS BY TYPE

-

ARGENTINA MEDICAL DEVICE COATING MARKET ANALYSIS BY APPLICATION

-

ARGENTINA MEDICAL DEVICE COATING MARKET ANALYSIS BY REGIONAL

-

REST OF SOUTH AMERICA MEDICAL DEVICE COATING MARKET ANALYSIS BY TYPE

-

REST OF SOUTH AMERICA MEDICAL DEVICE COATING MARKET ANALYSIS BY APPLICATION

-

REST OF SOUTH AMERICA MEDICAL DEVICE COATING MARKET ANALYSIS BY REGIONAL

-

MEA MEDICAL DEVICE COATING MARKET ANALYSIS

-

GCC COUNTRIES MEDICAL DEVICE COATING MARKET ANALYSIS BY TYPE

-

GCC COUNTRIES MEDICAL DEVICE COATING MARKET ANALYSIS BY APPLICATION

-

GCC COUNTRIES MEDICAL DEVICE COATING MARKET ANALYSIS BY REGIONAL

-

SOUTH AFRICA MEDICAL DEVICE COATING MARKET ANALYSIS BY TYPE

-

SOUTH AFRICA MEDICAL DEVICE COATING MARKET ANALYSIS BY APPLICATION

-

SOUTH AFRICA MEDICAL DEVICE COATING MARKET ANALYSIS BY REGIONAL

-

REST OF MEA MEDICAL DEVICE COATING MARKET ANALYSIS BY TYPE

-

REST OF MEA MEDICAL DEVICE COATING MARKET ANALYSIS BY APPLICATION

-

REST OF MEA MEDICAL DEVICE COATING MARKET ANALYSIS BY REGIONAL

-

KEY BUYING CRITERIA OF MEDICAL DEVICE COATING MARKET

-

RESEARCH PROCESS OF MRFR

-

DRO ANALYSIS OF MEDICAL DEVICE COATING MARKET

-

DRIVERS IMPACT ANALYSIS: MEDICAL DEVICE COATING MARKET

-

RESTRAINTS IMPACT ANALYSIS: MEDICAL DEVICE COATING MARKET

-

SUPPLY / VALUE CHAIN: MEDICAL DEVICE COATING MARKET

-

Medical Device Coatings Market, BY TYPE, 2025 (% SHARE)

-

Medical Device Coatings Market, BY TYPE, 2019 TO 2035 (USD Billions)

-

Medical Device Coatings Market, BY APPLICATION, 2025 (% SHARE)

-

Medical Device Coatings Market, BY APPLICATION, 2019 TO 2035 (USD Billions)

-

Medical Device Coatings Market, BY REGIONAL, 2025 (% SHARE)

-

Medical Device Coatings Market, BY REGIONAL, 2019 TO 2035 (USD Billions)

-

BENCHMARKING OF MAJOR COMPETITORS

Leave a Comment