Market Trends

Key Emerging Trends in the Mechatronics Robotics Courses Market

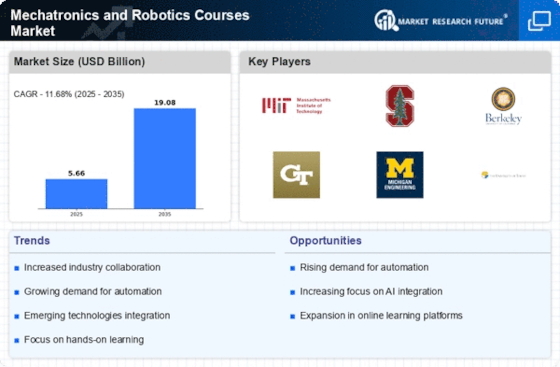

Recent years have seen a notable increase in the market trends for mechatronics and robotics courses, which is indicative of the rising need for workers with expertise in these cutting-edge sectors. The multidisciplinary combination of control engineering, electronics, computer science, and mechanical engineering known as mechatronics has emerged as a hub for innovation in a variety of sectors. Similarly, robotics is changing how people interact with technology; its uses span from production to healthcare. The demand for people with expertise in robotics and mechatronics is growing as technology progresses, propelling the demand for courses in these fields.

The growing integration of robotics and mechatronics across sectors is one notable development in the industry. Efficiency now depends heavily on automation, which has led companies to invest in technology that, fostering a lucrative market for related courses. Because of this, experts in the complex fields of mechatronics and robotics are highly sought for.

Businesses in sectors like manufacturing, healthcare, logistics, and even entertainment are actively looking for people with these types of skills to improve their operations and maintain their competitiveness in a market that is changing quickly. Furthermore, the need for mechatronics and robotics courses has increased with the introduction of Industry 4.0. Industry 4.0, which combines digital technology, artificial intelligence, and the Internet of Things (IoT), is the term used to describe the fourth industrial revolution.

This revolution is mostly driven by mechatronics and robotics, which are responsible for the creation of autonomous systems and smart factories. The need for qualified individuals with the ability to develop, install, and manage robotic and mechatronic systems is growing as more organizations adopt Industry 4.0 principles. The emphasis on practical, hands-on learning experiences in robotics and mechatronics courses is another noteworthy trend. Acknowledging the significance of practical applications, academic institutions and training providers are integrating industrial partnerships, labs, and hands-on projects into their courses.

This method guarantees that students are competent in using their knowledge of theory to solve real-world situations in addition to providing them with theoretical information. Because of this, graduates of mechatronics and robotics courses are more equipped to handle the demands of the workforce, which increases the appeal of these programs to both students and employers.

Leave a Comment