Top Industry Leaders in the Mechanical Energy Storage Market

*Disclaimer: List of key companies in no particular order

Top listed companies in the Mechanical Energy Storage industry are:

Schwungrad Energie Limited, (Ireland)

Voith (Germany)

Powerthru (Canada)

Sulzer Ltd. (Switzerland)

Beacon Power (U.S)

DeWalt, (U.S)

Active Power Inc. (U.S)

Ingersoll Rand (U.S)

Atlas Copco (Sweden)

Hitachi, Ltd. (Japan)

Kirloskar Pneumatic Co Ltd. (India)

Porter-Cable (U.S)

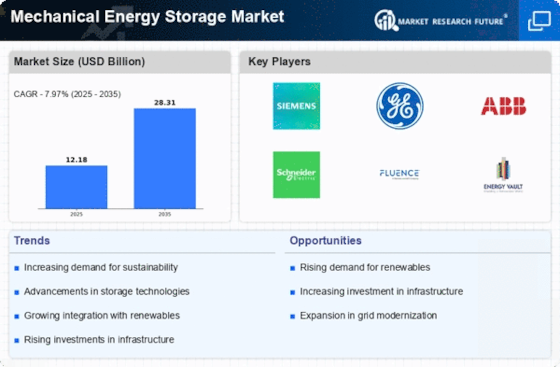

Competitive Landscape of the Mechanical Energy Storage Market: A Dynamic Playfield

The mechanical energy storage (MES) market, encompassing technologies like flywheels, pumped hydro, and compressed air energy storage (CAES), is transforming from a niche player to a crucial piece of the renewable energy puzzle. As the demand for grid stability and clean energy integration surges, the competitive landscape is heating up, with established players jostling for dominance and innovative startups carving their own space.

Key Player Strategies:

Incumbent Giants: Leading industrial players like Voith Hydro, GE Renewable Energy, and Andritz Hydro are leveraging their extensive experience and established customer base to secure large-scale pumped hydro projects. They are also focusing on technological advancements, like modular hydro solutions for smaller grids, to cater to a wider range of applications.

Emerging Challengers: Startups like Energy Vault, Greensmith, and RedT are disrupting the market with innovative MES solutions like high-speed flywheels and advanced CAES systems. These companies are attracting investors with their compact designs, rapid deployment capabilities, and cost-competitive offerings, targeting distributed energy and microgrid applications.

Strategic Partnerships: Collaboration is key in this evolving market. We see partnerships forming between technology providers, energy developers, and utilities to share expertise, accelerate development, and unlock new market opportunities. For example, ABB partnered with Energy Vault to integrate its flywheel technology into microgrids, while Siemens Gamesa is collaborating with Greensmith to develop hybrid wind-CAES systems.

Market Share Analysis Factors:

Technology Maturity: Established technologies like pumped hydro hold a significant market share due to their proven track record and scalability. However, advancements in flywheels and CAES are making them increasingly competitive, especially in regions with space constraints.

Project Financing: The capital-intensive nature of large-scale MES projects necessitates favorable financing options. Players with access to government grants, low-cost loans, and innovative financial models have an edge in securing contracts.

Regional Dynamics: The market growth is unevenly distributed, with Asia Pacific leading the charge due to ambitious renewable energy targets and supportive government policies. Europe and North America are also witnessing significant investments, while emerging markets like Latin America and Africa offer untapped potential.

New and Emerging Trends:

Integration with Renewables: MES is increasingly seen as a critical component for grid integration of variable renewable energy sources like solar and wind. Hybrid systems combining these technologies are gaining traction, offering enhanced grid stability and energy security.

Distributed Energy Solutions: The rise of microgrids and distributed energy resources is opening new avenues for compact and modular MES solutions like flywheels and small-scale CAES systems. These technologies are well-suited for off-grid applications and communities seeking energy independence.

Digitalization and Automation: Integration of advanced controls, sensors, and AI analytics is transforming MES operations. Smart systems are optimizing energy storage cycles, enhancing predictive maintenance, and improving overall grid management efficiency.

Overall Competitive Scenario:

The MES market is characterized by dynamic competition with established players facing pressure from innovative startups. Technological advancements, evolving market needs, and regional variations are shaping the competitive landscape. Success will hinge on adaptability, strategic partnerships, and a focus on cost-effective solutions that cater to specific applications and regional demands. As the renewable energy revolution unfolds, MES is poised to play a vital role, and the race for market dominance is only just beginning.

Latest Company Updates:

Voith (Germany):

- December 5, 2023: Launched Hydrostor, a pumped hydro energy storage technology with modular containers (Source:

Powerthru (Canada):

- December 12, 2023: Partnered with Hydro-Québec to pilot a flywheel energy storage system for grid stabilization (Source: Powerthru website).

Sulzer Ltd. (Switzerland):

- October 26, 2023: Presented its latest Aquilon compressed air energy storage technology at the Energy Storage Europe conference (Source: Sulzer website).

Beacon Power (U.S.):

- November 7, 2023: Achieved grid interconnection for its 20 MW flywheel energy storage project in California (Source: Beacon Power website).

Active Power Inc. (U.S.):

- October 31, 2023: Unveiled its Flywheel Grid Stabilizer for microgrid applications (Source: Active Power website).