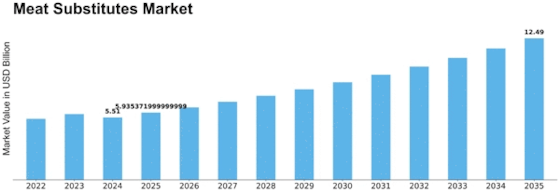

Meat Substitutes Size

Meat Substitutes Market Growth Projections and Opportunities

People's habits and culture are changing, which is good for the business of meat substitutes. People from all over the world are driving this sector because they know that normal meat production causes problems for the earth and people. Plant-based meat substitutes are a long-term answer that uses less space and produces fewer climate gases. This is because more people are choosing to eat foods that are good for the environment and health.

This business also changes because of food and health issuesMore individuals are become vegetarian, vegan, or flexitarian, hence they require plant nutrients. Meat substitutes taste and feel like meat but are better for meat-reducers. Meats with less fat and cholesterol are also beneficial.

Food science and technology have created meat substitutes that taste and feel like genuine flesh. People prefer the flavor of plant-based alternatives made via extrusion, fermentation, and high pressure. Because they improve, meat alternatives are growing more popular among the population. As tastes and the world's people have become more varied, meat substitutes have also changed. When there is an open market, goods that meet the wants and tastes of different racial groups do very well. That's why businesses are making meat goods that fit the tastes and traditions of many different places. Store changes and online shopping have made it easier to find foods that can be used instead of meat. On the internet, people can look at and buy many kinds of meat, which helps the company grow. Also, meat goods are becoming more common and can be bought every day because they can be found in more and more grocery places.

The business of meat substitutes is also affected by politics and money. Two main reasons people choose meat substitutes are price and cost. As more people buy some meat substitutes, their prices go down because of economies of scale and more competition.

Health, food safety, and environmental rules have an effect on the meat substitutes business. There should be rules on labels that make plant-based and alternative protein products stand out on shop shelves. This will help buyers believe the products and the business grow. There may not be as much demand for meat substitutes if there are rules or help for raising regular meat.

How you brand and sell something changes how people feel about it. People are more likely to buy these things if you tell them how good they taste, what they're good for you, and how they work. Celebrities, cooks, and other powerful people in the food world also push meat substitutes, which changes the market.

In the end, the meat products business is affected by what customers want, the economy, government rules, national variety, technical progress, social concerns, store trends, and good marketing. In order to be successful in the long term, people who work in the meat goods business need to be able to adapt to new ideas.

Leave a Comment