Growth in Industrial Activities

The MEA Lubricants Market is significantly influenced by the growth in industrial activities across various sectors, including manufacturing, construction, and mining. The region's industrial output has been on an upward trajectory, with a reported increase of 4.5% in 2025. This growth necessitates the use of specialized lubricants to ensure machinery operates efficiently and reliably. Industries are increasingly recognizing the importance of maintaining equipment through proper lubrication, which can lead to reduced downtime and maintenance costs. As industrial activities expand, the demand for high-performance lubricants tailored to specific applications is expected to rise, further propelling the MEA Lubricants Market.

Increasing Automotive Production

The MEA Lubricants Market is experiencing growth driven by the rising automotive production in the region. Countries such as Saudi Arabia and the United Arab Emirates are investing heavily in their automotive sectors, leading to an increased demand for lubricants. In 2025, the automotive production in the MEA region was projected to reach approximately 2 million units, which directly correlates with the need for high-quality lubricants to ensure optimal vehicle performance. This trend is likely to continue, as the automotive industry expands, thereby creating a robust market for lubricants. The MEA Lubricants Market must adapt to the evolving needs of automotive manufacturers, focusing on innovative lubricant solutions that enhance engine efficiency and longevity.

Rising Demand for Energy Efficiency

The MEA Lubricants Market is increasingly influenced by the rising demand for energy efficiency across various sectors. As energy costs continue to rise, businesses are seeking ways to reduce consumption and improve operational efficiency. High-quality lubricants play a crucial role in minimizing friction and wear in machinery, thereby enhancing energy efficiency. In 2025, it was estimated that energy-efficient lubricants could reduce energy consumption by up to 10% in industrial applications. This growing awareness of energy efficiency is likely to drive demand for advanced lubricants that not only meet performance standards but also contribute to cost savings. The MEA Lubricants Market must respond to this trend by offering products that align with the energy efficiency goals of its customers.

Regulatory Support for Sustainable Practices

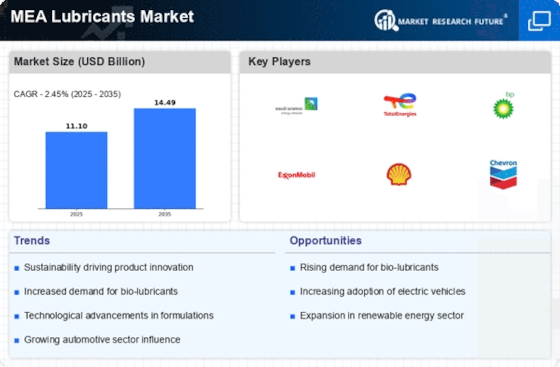

The MEA Lubricants Market is witnessing a shift towards sustainability, driven by regulatory support for environmentally friendly practices. Governments in the region are implementing policies that encourage the use of eco-friendly lubricants, which are less harmful to the environment. For instance, the UAE has introduced regulations aimed at reducing carbon emissions, which has led to an increased demand for biodegradable lubricants. This regulatory landscape is likely to foster innovation within the MEA Lubricants Market, as companies strive to develop products that meet these new standards while maintaining performance. The emphasis on sustainability is expected to reshape product offerings and market dynamics in the coming years.

Technological Innovations in Lubricant Production

The MEA Lubricants Market is benefiting from technological innovations in lubricant production processes. Advances in formulation technologies are enabling manufacturers to create high-performance lubricants that offer superior protection and efficiency. For example, the introduction of nanotechnology in lubricant formulations has shown promising results in enhancing lubrication properties. As the demand for advanced lubricants grows, manufacturers in the MEA region are likely to invest in research and development to stay competitive. This focus on innovation is expected to drive the MEA Lubricants Market forward, as companies seek to meet the evolving needs of consumers and industries alike.