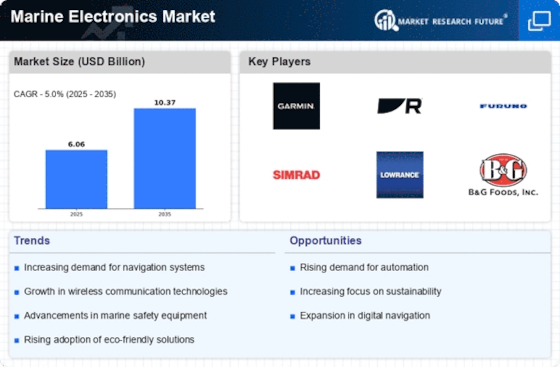

Top Industry Leaders in the Marine Electronics Market

Strategies Adopted:

Product Innovation: Key players invest in research and development to introduce innovative marine electronic solutions, including advanced navigation systems, fishfinders, sonars, and communication equipment, to meet the evolving needs of maritime industries.

Strategic Partnerships: Collaborations and partnerships with shipbuilders, naval forces, and maritime authorities are pursued to integrate marine electronics into vessel designs, enhance interoperability, and expand market reach.

Focus on Integration: Offering integrated marine electronics suites that combine navigation, communication, and safety systems to provide seamless operation and enhanced situational awareness for ship operators.

Aftermarket Services: Providing comprehensive aftermarket support, including installation, maintenance, and repair services, to ensure the reliability and performance of marine electronic systems throughout their lifecycle.

Key Players:

FLIR Systems Inc.

Garmin Ltd.

Transas

Icom Inc.

Furuno Electric Co.Ltd.

Kongsberg Maritime

SRT Marine Systems plc

Navico

Northrop Grumman Sperry Marine B.V.

Japan Radio Co.Ltd.

Factors for Market Share Analysis:

Product Portfolio: The breadth and depth of product offerings, including chartplotters, radar systems, autopilots, and AIS transponders, influence market share. Companies with a comprehensive portfolio catering to diverse maritime applications are likely to capture a larger market share.

Brand Reputation: Established brands with a reputation for quality, reliability, and customer service have a competitive advantage in the market. Positive brand perception influences purchase decisions and customer loyalty.

Geographic Presence: Companies with a global presence and distribution network, catering to both commercial and recreational maritime sectors across multiple regions, are better positioned to capture market share and exploit emerging opportunities.

Regulatory Compliance: Compliance with international maritime regulations and standards, such as IMO SOLAS requirements and IEC certification, is crucial for market acceptance and customer trust.

New and Emerging Companies:

Humminbird (a brand of Johnson Outdoors Inc.)

SI-TEX Marine Electronics

B&G (a brand of Navico)

Airmar Technology Corporation

C-MAP (a brand of Navico)

Digital Yacht Ltd.

Nobeltec (a brand of MaxSea International)

MarineTraffic

OpenSeaMap

Current Company Investment Trends:

Research and Development: Continued investment in R&D to develop next-generation marine electronic solutions with enhanced performance, reliability, and user experience, addressing emerging market demands and technological advancements.

Market Expansion: Expansion into new geographic markets and market segments, including emerging economies and niche maritime sectors, to capitalize on growing demand for marine electronics and diversify revenue streams.

Digital Transformation: Adoption of digital technologies, such as cloud computing, big data analytics, and IoT connectivity, to offer innovative marine data services, predictive maintenance solutions, and fleet management platforms.

Overall Competitive Scenario:

Intense Competition: The marine electronics market is highly competitive, with numerous players vying for market share through product differentiation, technological innovation, and strategic partnerships.

Market Dynamics: Factors such as maritime safety regulations, fleet modernization initiatives, environmental sustainability goals, and digital transformation trends influence market dynamics and competitive strategies.

Customer Focus: Companies that prioritize customer needs, offer tailored solutions, and provide responsive support services are better positioned to succeed in the competitive marine electronics market by building strong customer relationships and fostering brand loyalty.

Marine Electronics Industry Developments

For instance, July 2019

KPM-Maritime collaborated with marine electronics and safety equipment distributor Pinpoint Electronics to expand the global audience for its product range by using Pinpoint’s varied client base and expertise in delivering items to shipyards, boat builders, and military and commercial fleets.

For instance, March 2018

Speedcast International Limited, a provider of remote communication and IT solutions, partnered with SRH Marine to offer Navigation as a Service (NaaS), a simplified electronic distribution of electronic navigational charts and updates, to Maritime vessels. The SIGMA Gateway technology powers Speedcast NaaS from Speedcast and the Pilot from SRH Marine.