Managed Pressure Drilling Size

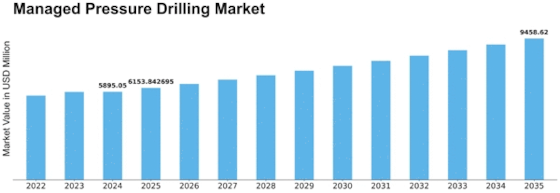

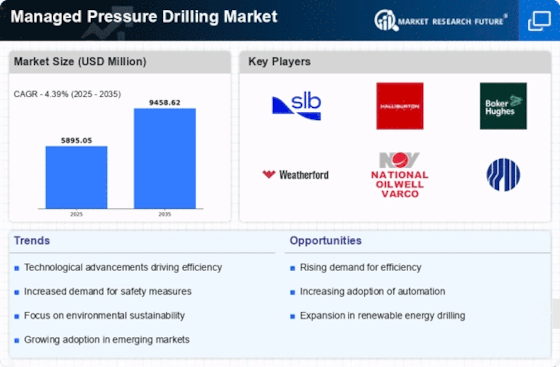

Managed Pressure drilling Market Growth Projections and Opportunities

Many market factors determine the dynamics of the managed pressure drilling (MPD)market. A significant factor is the worldwide need for energy resources, especially oil and gas. With rising global energy demands, more attention has been paid to hydrocarbon production from difficult environments like deepwater reservoirs and unconventional plays. These further fuels the use of state-of-the art drilling techniques such as managed pressure drilling that enables proper recovery from complicated geological settings. Technological innovations have revolutionized the MPD market. Extending to drilling operations, while industrial practices find new ways to address issues around wellbore stability, fluid loss and pressure control. Managed pressure drilling becomes a practical choice, with better well control and improved efficiency in the process. The progressive development of MPD technologies such as automation and real-time monitoring makes it highly attractive to the drilling business. Environmental and regulatory factors that develop with the market are notably important for managed pressure drilling adoption. The industry is prompted to seek ways reducing the effect on environment that are performed with greater environmental regulations and an increasing orientation towards sustainable practices. MPD is consistent with the stated environmental aspirations as it allows to minimize total drilling fluid volume used and prevent formation damage. Moreover, regulatory bodies might even promote or enforce the adoption of innovative drilling methods and thus affect market dynamics. The managed pressure drilling market is sensitive to economic factors including oil and gas prices. Changes in the price of energy can affect drilling operations, and operators may change their methods according to whether exploration or production projects are economically feasible. Since high oil prices cause more investments to be made on complex drilling projects, there is a rise in the demand of advanced technologies such as MPD. On the other hand, when economic crisis or low-energy prices occur, slowdown of such technologies’ market can be seen. The global distribution of oil and gas reserves is another significant factor that affects the MPD market. As exploration and production activities go further into adverse conditions, remote areas requiring technologies that can adapt to complicated drilling situations become necessary. Managed pressure drilling due to its ability that adopts the challenges of geological nature which applies in diverse locations becomes a powerful tool in unlocking hydrocarbon resources.

Leave a Comment