Market Trends

Key Emerging Trends in the Malabsorption Syndrome Market

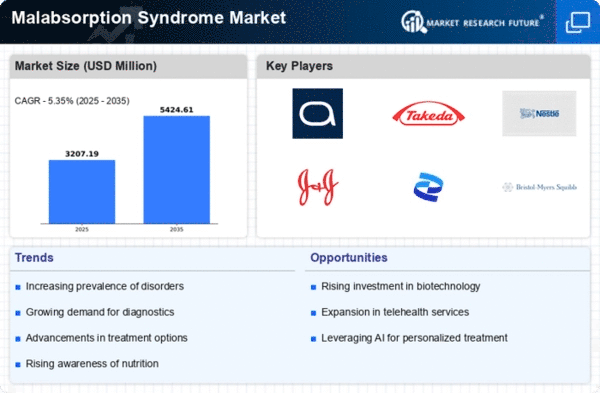

The demand for solutions in the United States Malabsorption Syndrome market has witnessed a significant upswing in recent years, reflecting a growing concern for digestive health. Malabsorption Syndrome, a condition where the small intestine fails to absorb essential nutrients, has become a prevalent issue affecting a considerable portion of the population. This surge in demand can be attributed to several factors, including an increased awareness of digestive disorders, improved diagnostic techniques, and a rising incidence of conditions such as celiac disease, Crohn's disease, and lactose intolerance.

One of the driving forces behind the escalating demand in the US Malabsorption Syndrome market is the heightened awareness among both healthcare professionals and the general public regarding the importance of early detection and management of digestive disorders. As information about the symptoms and consequences of Malabsorption Syndrome becomes more widely available, individuals are seeking medical advice at the earliest signs of digestive distress, thereby fueling the need for diagnostic tools, treatments, and dietary interventions.

In tandem with increased awareness, advancements in diagnostic technologies have played a pivotal role in identifying and understanding Malabsorption Syndrome more effectively. From innovative imaging techniques to precise laboratory tests, healthcare professionals now have a broader array of tools to diagnose and differentiate various forms of malabsorption. This has not only facilitated early detection but has also contributed to the customization of treatment plans, thereby meeting the specific needs of individual patients.

Moreover, the prevalence of conditions associated with Malabsorption Syndrome, such as celiac disease, Crohn's disease, and lactose intolerance, has been on the rise. The growing incidence of these underlying causes has directly translated into an increased demand for therapeutic interventions and management strategies. The pharmaceutical and healthcare industries have responded to this demand by developing and introducing a range of medications, supplements, and specialized diets aimed at alleviating symptoms and improving the overall quality of life for individuals affected by Malabsorption Syndrome.

In addition to conventional pharmaceutical interventions, the market has witnessed a surge in the popularity of alternative and complementary therapies. Patients are increasingly exploring nutritional and lifestyle modifications to manage their symptoms and enhance nutrient absorption. This shift in consumer behavior has given rise to a diverse market landscape, offering a wide range of products and services catering to the multifaceted needs of individuals dealing with Malabsorption Syndrome.

Leave a Comment