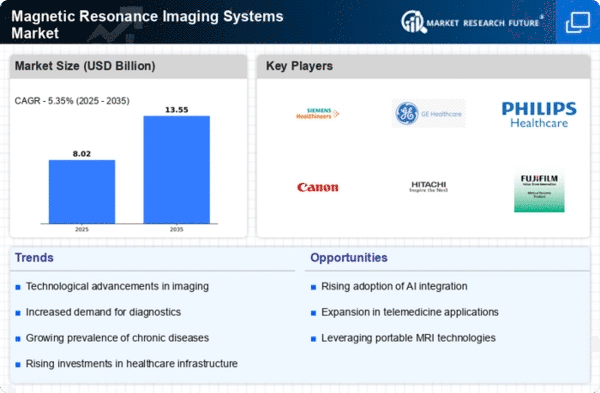

Market Share

Magnetic Resonance Imaging Systems Market Share Analysis

The market for magnetic resonance imaging systems frameworks is a fundamental part of clinical diagnostics and is portrayed by its imperativeness and intensity. In quest for supported market predominance, organizations working in this industry reliably endeavor to execute strong systems because of mechanical progressions. Fathoming Piece of the pie Situating: The idea of piece of the pie situating relates to the assessment of a company's deals income comparable to the total deals income of all organizations working in the magnetic resonance imaging systems market. It shows the strength and intensity of a business compared with its opponents. Item Separation: Item separation is a basic procedure for laying out a piece of the pie position. Creating and presenting novel qualities and innovations that recognize their magnetic resonance imaging systems from those of contenders is a main concern for organizations. This might envelop upgraded imaging abilities, further develop programming functionalities, and expand patient comfort. Cost authority is an extra basic methodology that should be sought after. By endeavoring to produce magnetic resonance imaging systems of predominant quality while decreasing costs, organizations can offer cutthroat evaluating. Subsequently, cost-cognizant medical services establishments and suppliers are drawn in, prompting an extension of piece of the pie. Worldwide Development and Market Entrance: to achieve a bigger portion of the overall industry, organizations much of the time focus on extending their market reach. This involves entering neglected market sections or infiltrating new geographic areas. By understanding the fluctuating requests of various business sectors, associations can tweak their attractive magnetic resonance imaging systems frameworks to satisfy explicit measures, consequently interesting to a greater customer base. Shaping key collusions and coordinated efforts addresses a determined move pointed toward increasing one's market presence. The advancement of cutting-edge magnetic resonance imaging systems frameworks might be achieved through associations with research foundations, medical services suppliers, or innovation organizations. Also, joint endeavors work with the sharing of assets and the extension of market section. Client Relationship The board: For a business to keep up with and grow its piece of the pie, creating strong associations with its customers is fundamental. To ensure shopper fulfillment, organizations put resources into client assistance, preparing projects, and administration arrangements. Consumer loyalty has a positive relationship with magnetic resonance imaging systems dependability and informal, the two of which decidedly affect piece of the pie. Guaranteeing Administrative Consistence and Quality Confirmation: Keeping up with a portion of the overall industry situating is dependent upon the adherence to rigid administrative guidelines and the affirmation of predominant item quality. By putting resources into accreditations and rigid quality affirmation systems, organizations console clients and medical care administrative bodies. This advances validity and trust, which are basic for supporting the development of portion of the overall industry. The advanced methodology includes the incorporation of modern information investigation and man-made brainpower (computer-based intelligence) innovations into magnetic resonance imaging systems frameworks. Associations that distribute assets towards the advancement of man-made intelligence fueled imaging and analytic functionalities lay down a good foundation for themselves as leaders in conveying creative arrangements, subsequently interesting to customer base looking for cutting edge innovation.

Leave a Comment