Lycopene Size

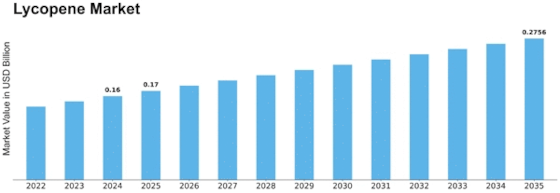

Lycopene Market Growth Projections and Opportunities

The lycopene market is influenced by a multitude of factors that collectively shape its dynamics, growth, and competitiveness. One significant factor driving the market is the increasing consumer awareness and interest in health and wellness. As people become more conscious of the link between diet and health, there is a growing demand for natural antioxidants like lycopene, known for their potential health benefits. Lycopene, a carotenoid pigment found in fruits and vegetables like tomatoes, watermelon, and red peppers, is revered for its antioxidant properties, which are believed to help protect cells from damage caused by free radicals and oxidative stress. This growing consumer interest in health and nutrition is driving demand for lycopene-rich products across various industries, including food and beverage, cosmetics, pharmaceuticals, and dietary supplements.

Moreover, the food and beverage industry plays a significant role in shaping the lycopene market, with manufacturers increasingly incorporating lycopene into a wide range of products. Lycopene's vibrant red color and neutral taste make it a versatile ingredient for enhancing the visual appeal and nutritional profile of foods and beverages. From juices and sauces to snacks and supplements, lycopene is being used to add color, flavor, and health benefits to a variety of products. As consumer demand for natural and functional foods continues to rise, the demand for lycopene-infused products is expected to grow, driving market expansion and innovation in the food and beverage sector.

Furthermore, the cosmetics and personal care industry is driving market growth by incorporating lycopene into skincare and beauty products. Lycopene's antioxidant properties are believed to help protect the skin from environmental damage, UV radiation, and premature aging, making it a sought-after ingredient in anti-aging creams, serums, and sunscreens. As consumers prioritize natural and effective skincare solutions, the demand for lycopene-infused products is expected to rise, driving market growth and product innovation in the cosmetics industry.

Additionally, the pharmaceutical industry is exploring the potential therapeutic applications of lycopene for various health conditions, including cardiovascular diseases, cancer, and inflammation. Preliminary studies suggest that lycopene may have cardioprotective, anticancer, and anti-inflammatory effects, sparking interest in its use as a therapeutic agent in drug development. Pharmaceutical companies are investing in research and clinical trials to evaluate lycopene's efficacy and safety profile, paving the way for potential new drug formulations and nutraceutical products targeting specific health concerns.

Leave a Comment