Luxury Jewelry Size

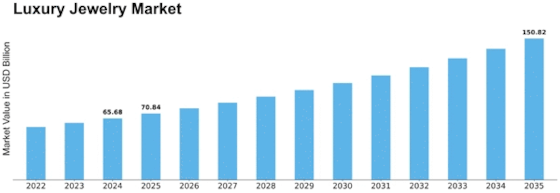

Luxury Jewelry Market Growth Projections and Opportunities

Rhodium is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 6.6% from 2023 to 2030. In 2022, its value was USD 29,269.26 million, and it's predicted to reach USD 48,189.58 million by 2030. Rhodium is a member of the platinum group of metals, displaying a silvery-white color, high reflectivity, and resistance to corrosion. The Rhodium market is poised for significant growth, primarily due to its increasing demand in the automotive sector, where it's utilized in catalytic converters to reduce harmful emissions from vehicles. Additionally, rhodium serves as a catalyst in various chemical reactions and plays a crucial role in nitric acid production—an essential component in the manufacturing of fertilizers and various chemicals. However, high prices could potentially have a negative impact on the market growth of rhodium. On a positive note, the rising demand for luxury jewelry is expected to support the rhodium market in the upcoming years.

In terms of source, the global rhodium market is divided into mining and recycling. In 2022, the mining segment dominated the market, holding a substantial share with a value of USD 19,468.94 million, and it's projected to grow at a rate of 6.1%. Advancements in mining technologies and extraction techniques have contributed to making it more feasible to extract rhodium directly, rather than solely as a by-product of platinum and palladium mining.

The global rhodium market is segmented based on application into Catalyst, Alloying Agent, and Others. In 2022, the Catalyst segment led the market with a significant share, valued at USD 14,734.34 million, and is projected to grow at a rate of 7.7%. The increasing use of rhodium as a catalyst in the chemical industry is expected to significantly impact its market growth in the coming years. Rhodium catalysts are employed in the production of vinyl acetate, a crucial monomer used in manufacturing polyvinyl acetate and various other polymers.

Concerning end-use, the global rhodium market is segmented into Automotive, Chemical, Glass, Jewelry, Electrical & Electronics, and Others. In 2022, the Automotive segment took a substantial share, valued at USD 24,464.04 million, and is expected to grow at a rate of 6.9%. Rhodium is a vital component used in catalytic converters installed in the exhaust systems of vehicles. The increasing use of rhodium to enhance the efficiency of the catalytic conversion process is anticipated to boost its market demand.

Leave a Comment