Market Growth Projections

The Global Luxury Hotels Market Industry is poised for substantial growth, with projections indicating a market value of 97.1 USD Billion in 2024 and an anticipated rise to 214.5 USD Billion by 2035. This represents a compound annual growth rate of 7.47% from 2025 to 2035. Such growth is indicative of the increasing demand for luxury accommodations worldwide, driven by factors such as rising disposable incomes, technological advancements, and changing consumer preferences. The market's expansion reflects broader trends in global travel and tourism, positioning luxury hotels as a key player in the hospitality sector.

Rising Disposable Incomes

The Global Luxury Hotels Market Industry is experiencing growth driven by rising disposable incomes among consumers, particularly in emerging economies. As individuals gain more financial freedom, they are increasingly willing to spend on luxury travel experiences. For instance, countries like China and India have seen significant increases in middle-class populations, leading to a surge in luxury hotel bookings. This trend is expected to contribute to the market's valuation of 97.1 USD Billion in 2024, with projections indicating a potential rise to 214.5 USD Billion by 2035. Such economic shifts suggest a robust demand for high-end accommodations.

Technological Advancements

Technological advancements play a pivotal role in shaping the Global Luxury Hotels Market Industry. Innovations such as mobile check-ins, personalized guest experiences through AI, and enhanced online booking systems are becoming standard in luxury hotels. These technologies not only streamline operations but also elevate the guest experience, making stays more enjoyable and efficient. As luxury hotels adopt these advancements, they attract a tech-savvy clientele that values convenience and personalization. This trend is likely to bolster the market's growth, as hotels that embrace technology can differentiate themselves in a competitive landscape.

Increased Travel and Tourism

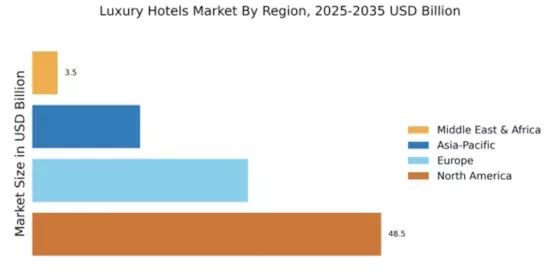

The Global Luxury Hotels Market Industry benefits from the ongoing increase in global travel and tourism. With more people traveling for leisure and business, the demand for luxury accommodations continues to rise. According to recent statistics, international tourist arrivals are projected to reach unprecedented levels, particularly in regions such as Europe and Asia-Pacific. This influx of travelers is likely to drive revenue growth in the luxury hotel sector, contributing to a compound annual growth rate of 7.47% from 2025 to 2035. The expansion of travel networks and improved accessibility further supports this trend.

Changing Consumer Preferences

The Global Luxury Hotels Market Industry is also influenced by changing consumer preferences, particularly among younger generations. Millennials and Gen Z travelers are seeking unique, experiential stays that go beyond traditional luxury offerings. This demographic values authenticity, local culture, and personalized services, prompting luxury hotels to adapt their offerings accordingly. As these preferences evolve, hotels that can provide tailored experiences are likely to thrive. This shift in consumer behavior is expected to contribute to the market's growth trajectory, aligning with the projected increase in market value to 214.5 USD Billion by 2035.

Sustainability and Eco-Friendly Practices

Sustainability has emerged as a crucial driver in the Global Luxury Hotels Market Industry. Increasingly, consumers are prioritizing eco-friendly practices when selecting accommodations. Luxury hotels are responding by implementing sustainable initiatives, such as reducing energy consumption, sourcing local products, and minimizing waste. This shift not only appeals to environmentally conscious travelers but also enhances brand reputation. As a result, hotels that adopt sustainable practices may see increased occupancy rates and customer loyalty. The growing importance of sustainability is expected to influence market dynamics significantly in the coming years.