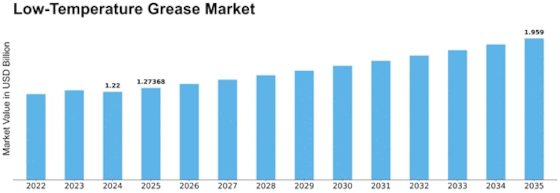

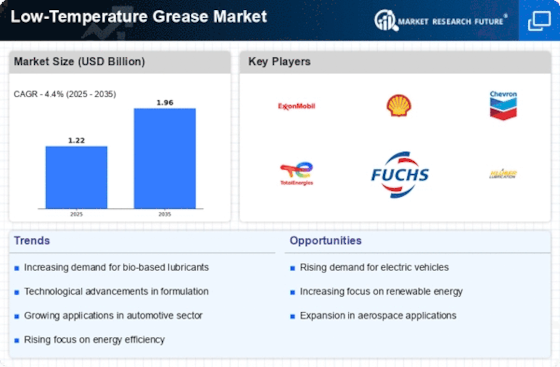

Low Temperature Grease Size

Low-Temperature Grease Market Growth Projections and Opportunities

The Low-Temperature Grease Market is influenced by various factors contributing to its growth and dynamics. A primary driver is the demand arising from industries and applications that operate in cold environments or encounter low temperatures. Low-temperature greases are specially formulated lubricants designed to maintain their performance and fluidity under extreme cold conditions. Industries such as automotive, aerospace, food processing, and energy exploration rely on low-temperature greases to ensure smooth and efficient operations in frigid environments. The critical need for equipment reliability, reduced friction, and enhanced wear protection in cold climates fuels the demand for these specialized lubricants.

Technological advancements in lubricant formulations and additives significantly contribute to market dynamics. Continuous research and development efforts focus on improving the low-temperature performance of greases, ensuring better cold-flow properties, and maintaining stability at sub-zero temperatures. Innovations in additive technologies address challenges related to viscosity changes, oil thickening, and mechanical stability in cold environments, enhancing the overall functionality of low-temperature greases. Technological advancements drive the adaptation of these greases in diverse applications where temperature extremes are a constant operational concern.

The automotive industry's growth and advancements in energy exploration contribute to the expansion of the Low-Temperature Grease Market. In the automotive sector, low-temperature greases are essential for components like wheel bearings, chassis parts, and universal joints, particularly in regions with harsh winter climates. Additionally, the exploration and production of oil and gas in cold environments demand reliable lubrication solutions, making low-temperature greases crucial for equipment such as drilling rigs, pumps, and valves. The increased use of specialized lubricants in these sectors propels the growth of the low-temperature grease market.

Global economic conditions and trade dynamics impact the Low-Temperature Grease Market. As a globally traded commodity, factors such as international trade agreements, tariffs, and geopolitical events can influence the supply chain and market conditions for low-temperature greases. Economic stability, manufacturing trends, and trade policies play a role in determining the accessibility and cost competitiveness of these lubricants in the market.

Environmental considerations and regulatory standards also play a role in shaping the low-temperature grease market. The industry's commitment to environmentally responsible lubricant solutions aligns with stringent regulations governing the use of lubricants in sensitive environments. Compliance with environmental standards ensures that low-temperature greases adhere to eco-friendly practices, making them suitable for use in applications where environmental impact is a concern.

Market competition and industry collaborations are notable factors shaping the Low-Temperature Grease Market. The market features a mix of established lubricant manufacturers, specialty grease producers, and end-users, fostering a competitive landscape. Collaboration between low-temperature grease producers, equipment manufacturers, and research institutions facilitates the development of new formulations, applications, and industry standards. Partnerships within the industry supply chain contribute to the overall growth and advancement of low-temperature grease solutions.

Challenges related to cost considerations, compatibility with materials, and diverse application requirements are factors that the low-temperature grease industry addresses. The cost of producing specialized lubricants can be higher compared to conventional greases, posing challenges in maintaining cost-effectiveness for end-users. Additionally, the compatibility of low-temperature greases with various materials and components is crucial, requiring ongoing research and testing. The industry's focus on addressing these challenges ensures the reliability and performance of low-temperature greases in diverse and demanding applications.

Leave a Comment