Top Industry Leaders in the Low Rolling Resistance Tire Market

*Disclaimer: List of key companies in no particular order

*Disclaimer: List of key companies in no particular order

Introduction:

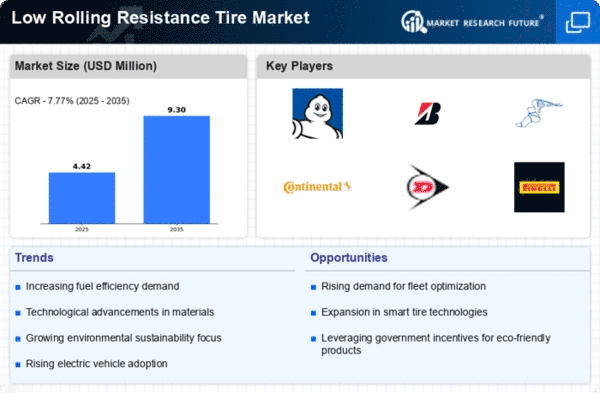

The low rolling resistance (LRR) tire market is currently undergoing a significant transformation, driven by the increasing adoption of electric vehicles (EVs), stringent fuel efficiency regulations, and a growing environmental awareness. This specialized sector within the broader tire industry has become a battleground for both established giants and nimble newcomers, all aiming to secure a substantial market share. This comprehensive exploration delves into the strategies of key players, critical factors influencing market share analysis, and emerging trends shaping the landscape of LRR tires.

Key Player Strategies:

Tire Giants Leveraging Brand Power and R&D Excellence: Leading industry players such as Bridgestone, Michelin, and Goodyear capitalize on their well-established brand reputations and robust research and development capabilities. Cutting-edge LRR tire technologies, such as Michelin's Primacy LRR HP and Bridgestone's Ecopia tires, cater to both traditional passenger cars and the growing EV market. These industry giants heavily invest in new materials, innovative tread designs, and advanced production processes to enhance rolling resistance without compromising safety and performance.

Rising Stars Capitalizing on Niche Expertise: Agile players like Nokian Tyres and GreenX Tyres carve out their market share by focusing on specific segments. Nokian, renowned for its winter tire expertise, introduces the Hakkapeliitta Green—an LRR tire specifically tailored for challenging winter conditions. Meanwhile, GreenX, as a dedicated LRR tire manufacturer, targets eco-conscious consumers through innovative tire designs crafted from renewable materials.

Collaborations and Acquisitions Driving Innovation: Rapid innovation is spurred by strategic partnerships and acquisitions within the industry. Continental's collaboration with Stanford University resulted in a groundbreaking tread pattern that reduces rolling resistance by an impressive 20%. Cooper Tire & Rubber Company's acquisition of Leaper Tires, a specialist in LRR, not only strengthened its LRR portfolio but also expanded its market reach.

Market Share Analysis Factors:

Product Portfolio Breadth and Depth: The ability to offer a diverse range of LRR tires tailored for various vehicle types and applications is pivotal. Players with extensive portfolios covering passenger cars, light trucks, EVs, and commercial vehicles gain a competitive edge.

Technological Prowess and Innovation: Continuous investment in research and development, leading to advancements in materials, tread patterns, and tire compound formulations, distinguishes market leaders. Companies showcasing superior fuel efficiency and performance through innovative LRR technologies secure a competitive advantage.

Geographic Presence and Distribution Network: A robust global presence and efficient distribution networks ensure broader market reach and swift responses to evolving regional demands. Companies like Bridgestone and Michelin, with established networks across continents, inherently possess a competitive advantage.

Brand Recognition and Reputation: Established brands like Michelin and Goodyear benefit from consumer trust and loyalty cultivated over decades. Building brand recognition, particularly for new entrants, is crucial in capturing market share.

New and Emerging Trends:

Sustainability Focus: LRR tires are increasingly viewed as integral to broader sustainability strategies. The utilization of bio-based materials, recycled rubber, and environmentally friendly manufacturing processes is gaining momentum. Companies like Pirelli are actively engaged in sustainable LRR tire production, as evidenced by their EcoPneus concept.

Smart Tires and AI Integration: The integration of sensors and artificial intelligence (AI) into LRR tires is on the horizon. Smart tires capable of monitoring rolling resistance in real-time and adjusting air pressure or tread patterns for optimal performance are anticipated, further enhancing fuel efficiency.

Personalized Tire Recommendations: Leveraging big data and AI, companies are developing algorithms to provide personalized LRR tire recommendations based on individual driving habits, vehicle type, and climatic conditions. This hyper-personalized approach caters to diverse consumer needs and optimizes fuel savings.

Overall Competitive Scenario: The LRR tire market is marked by intense competition, with established players facing challenges from innovative newcomers. While technological advancements continuously drive product improvement, sustainability and personalization emerge as key differentiation factors. Companies that adapt to these evolving trends, invest in research and development, and build strong brand recognition are poised to dominate the ongoing rolling revolution.

Industry Developments and Latest Updates:

Yokohama Rubber Co. Ltd. (Japan): In October 2023, Yokohama announced the launch of its BluEarth AE-02 LRRT for passenger cars, designed to offer both low rolling resistance and high wet grip performance.

Apollo Tyres Ltd. (India): A leading LRRT manufacturer in India, Apollo Tyres' Alpha Bravo Eco Tubeless tire is a popular choice for fuel-efficient passenger cars.

Cheng Shin Rubber Industry Co. (China): Cheng Shin Rubber, also known as Maxxis, is a major global LRRT supplier. Its Bravado H/T tire is widely chosen for pickup trucks and SUVs.

Kumho Tire (South Korea): Another significant LRRT supplier globally, Kumho Tire's Ecowing ES01 tire is a preferred option for passenger cars.

Zhongce Rubber Group Co., Ltd (ZC-Rubber) (Germany): ZC-Rubber, a Chinese tire manufacturer expanding in Europe, has received positive feedback for its LRRT, the Westlake RP18, designed for passenger cars.

Top Companies in the Low Rolling Resistance Tire Industry include Yokohama Rubber Co. Ltd. (Japan), Apollo Tyres Ltd. (India), Cheng Shin Rubber Industry Co. (China), Kumho Tire (South Korea), Zhongce Rubber Group Co., Ltd (ZC-Rubber) (Germany), Nokian Tyres plc (Finland), MRF Tyres (India), Bridgestone Corporation (Japan), The Goodyear Tire & Rubber Company (US), Sumitomo Rubber Industries, Ltd. (Japan), Pirelli & C. S.p.A. (Italy), Hankook Tire (South Korea), Michelin (France), Continental AG (Germany), Firestone Tire and Rubber Company (US), Cooper Tire & Rubber Company (US), and Toyo Tire & Rubber Company (Japan), among others.