Top Industry Leaders in the Low Profile Additives Market

The low profile additives (LPA) market is experiencing a steady rise. These thermoplastics, added to unsaturated polyester resins, enhance the surface finish and reduce shrinkage in fiberglass and composite materials. This translates to improved aesthetics, durability, and processability, driving demand across industries like automotive, construction, and marine.

The low profile additives (LPA) market is experiencing a steady rise. These thermoplastics, added to unsaturated polyester resins, enhance the surface finish and reduce shrinkage in fiberglass and composite materials. This translates to improved aesthetics, durability, and processability, driving demand across industries like automotive, construction, and marine.

Strategies for Market Share:

-

Product Innovation: Leading players are constantly developing new LPAs with improved functionalities, targeting specific end-use applications. For instance, Ashland's recently launched low-VOC LPAs cater to the growing demand for sustainable products. -

Regional Expansion: Established players are expanding their global footprint through acquisitions, partnerships, and greenfield investments. Wacker Chemie AG's recent joint venture in China is a prime example. -

Vertical Integration: Some players are integrating forward or backward to gain control over the supply chain and increase cost-efficiency. Polynt's acquisition of a raw material supplier exemplifies this strategy. -

Focus on Sustainability: Environmental regulations and consumer preferences are pushing sustainability to the forefront. Companies are developing bio-based or readily recyclable LPAs to capitalize on this trend. -

Digitalization: Utilizing digital tools for R&D, production optimization, and customer service is gaining traction. Ashland's online technical resource platform illustrates this trend.

Factors Affecting Market Share:

-

Technology Leadership: Companies possessing expertise in polymer chemistry and innovation capabilities often hold an edge. -

Brand Reputation: Established players with a strong brand reputation have an advantage in attracting customers. -

Pricing Strategy: Balancing cost-effectiveness with product quality is crucial for market penetration. -

Distribution Network: Having a robust and efficient distribution network ensures wider market reach. -

Regulatory Compliance: Navigating the evolving regulatory landscape around raw materials and sustainability is essential.

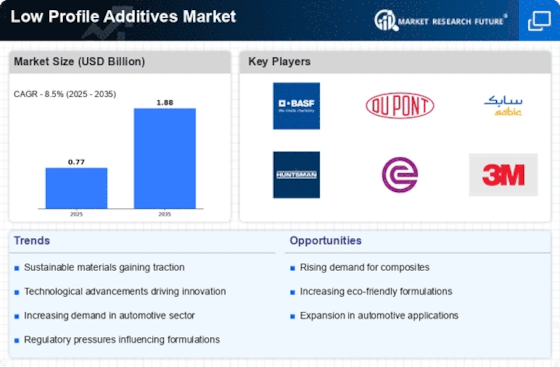

Key Players

-

PolyOne Corporation (U.S.)

-

Ashland (U.S.)

-

CCP Composites (U.S.)

-

Wacker Chemie AG (Germany)

-

LyondellBasell Industries Holdings B.V. (Netherlands)

-

Momentive (U.S.)

-

FRP Services & Company (Japan)

-

Reichhold LLC 2 (U.S.)

-

Command Chemical Corporation, Inc. (U.S.)

-

Changzhou Huarun Composite Materials Co., Ltd. (China)

-

Arkema (France)

-

Swancor Ind. Co., Ltd. (Taiwan)

Recent Developments :

September 2023: Swancor Manufacturing Inc. expands its production capacity by 20% to meet growing demand.

October 2023: A new study finds that LPAs can significantly reduce greenhouse gas emissions in the automotive industry.

November 2023: The China Composites Industry Association establishes new quality standards for LPAs, boosting confidence in the market.

December 2023: A major fire at a major LPA manufacturing facility disrupts supply chains and leads to price volatility.