Top Industry Leaders in the Low GWP Refrigerants Market

In the battle against climate change, low Global Warming Potential (GWP) refrigerants are emerging as the unsung heroes. Cooling our homes, buildings, and industries, they play a crucial role in modern life, but with a significantly reduced environmental footprint than their high-GWP counterparts. Understanding the competitive landscape of this dynamic market is key for players seeking to capitalize on this paradigm shift and contribute to a cooler planet.

In the battle against climate change, low Global Warming Potential (GWP) refrigerants are emerging as the unsung heroes. Cooling our homes, buildings, and industries, they play a crucial role in modern life, but with a significantly reduced environmental footprint than their high-GWP counterparts. Understanding the competitive landscape of this dynamic market is key for players seeking to capitalize on this paradigm shift and contribute to a cooler planet.

Strategic Maneuvers for Market Share:

Leading companies like Honeywell International Inc., Arkema SA, and Chemours Company LLC employ a range of strategies to dominate the low-GWP refrigerants market:

-

Product diversification: Offering a diverse portfolio of low-GWP refrigerants, catering to various applications and equipment types, including natural refrigerants (ammonia, CO2), hydrofluorocarbons (HFCs), and hydrofluoroolefins (HFOs). -

Technological innovation: Investing heavily in R&D to develop next-generation refrigerants with even lower GWP, improved efficiency, and compatibility with existing equipment. This includes exploring blends, cascade systems, and alternative technologies like magnetic refrigeration. -

Regional expansion: Targeting high-growth markets like Asia Pacific and Latin America by establishing local production facilities and tailoring offerings to regional regulations and phase-out timelines for high-GWP refrigerants. -

Vertical integration: Gaining control over the supply chain by acquiring raw material suppliers or expanding into downstream applications like refrigerant blends and equipment manufacturing. -

Strategic partnerships: Collaborating with research institutions, universities, equipment manufacturers, and end-users to accelerate innovation, address technical challenges, and promote market adoption.

Factors Dictating Market Share:

Winning in this competitive market hinges on several key factors:

-

Refrigerant performance: Delivering refrigerants with low GWP, high efficiency, and compatibility with diverse applications and equipment, meeting or exceeding industry standards. -

Cost competitiveness: Balancing high performance with affordability, especially in price-sensitive segments like commercial and residential refrigeration. -

Regulatory compliance: Ensuring adherence to stringent regulations regarding refrigerant safety, environmental impact, and phase-out schedules for high-GWP alternatives. -

Technical expertise and customer support: Building strong relationships with clients through responsive technical support, customized solutions, and efficient after-sales service. -

Sustainability focus: Demonstrating a commitment to environmentally friendly practices throughout the refrigerant life cycle, from production to disposal.

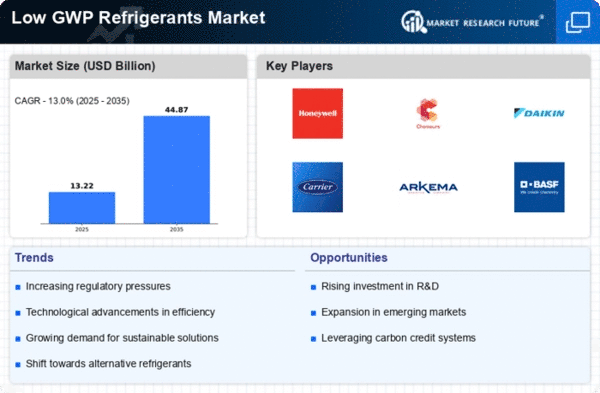

Key Players

Some of the prominent players in the global low GWP refrigerant market are Honeywell International Inc (U.S.),

Daikin industries, Ltd. (Japan),

The Linde Group (Ireland),

Arkema (France),

The Chemours Company (U.S.),

SOL Spa (Italy),

GTS SPA (Italy),

Harp International Ltd (UK),

Mexichem S.A.B de C.V. (Mexico),

HyChill (Australia),

Puyang Zhongwei Fine Chemical Co. Ltd (China),

Tazzetti S.p.A (Italy),

Airgas, Inc (U.S.),

The natural refrigerants company Pty ltd (Australia),

A-Gas International (UK),

Brothers Gas (UAE),

E.F. International (U.S.),

engas Australasia (Australia)

Sinochem Lantian co., Ltd (China)

Recent Developments:

-

October 2023: Advancements in materials science lead to the development of leak-proof refrigerants, addressing a major technical challenge and improving safety and environmental performance. -

November 2023: Growing concerns about refrigerant flammability lead to increased demand for training programs and safety protocols for handling and servicing low-GWP refrigerants. -

December 2023: The increasing focus on energy efficiency fuels interest in natural refrigerants like CO2, despite their higher complexity and infrastructure requirements.