Top Industry Leaders in the LoRa LoRaWAN IoT Market

Competitive Landscape of LoRa and LoRaWAN IoT Market:

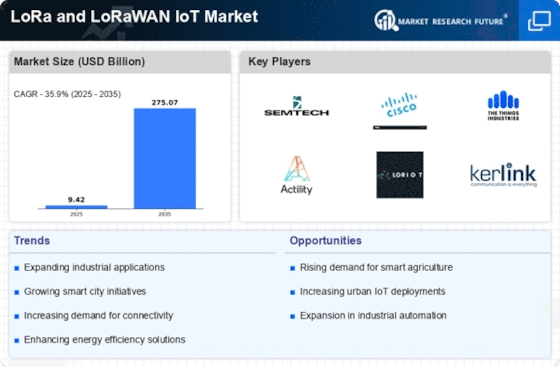

The LoRa and LoRaWAN technologies are experiencing explosive growth within the Internet of Things (IoT) market, driven by their exceptional long-range communication, low power consumption, and cost-effectiveness. This has ignited a dynamic competitive landscape with established players battling new entrants and niche specialists vying for market share.

Key Players:

- Cisco

- NEC Corporation

- Tata Communications

- Semtech

- Orange SA

- Advantech

- Comcast

- AWS

- Bosch

- Murata

Strategies Adopted:

- Vertical Specialization: Targeting specific IoT applications like smart cities, agriculture, or industrial automation with tailored solutions and partnerships.

- Ecosystem Expansion: Building comprehensive portfolios offering hardware, software platforms, network services, and application development tools.

- Technology Advancements: Investing in R&D for next-generation LoRa chipsets, enhanced network security, and integration with other IoT protocols.

- Regional Focus: Adapting to diverse regulatory environments and developing solutions addressing specific regional needs.

Factors for Market Share Analysis:

- Network Coverage: Extent and quality of network deployments, especially in rural areas.

- Product Portfolio Breadth: Offering diverse hardware and software options for various use cases.

- Pricing and Service Tiering: Catering to different budget constraints and application requirements.

- Partnerships and Alliances: Collaborations with industry players to expand reach and offer complete solutions.

- Technical Innovation: Commitment to advancing LoRa technology and addressing evolving market needs.

New and Emerging Companies:

- Loriot: Cloud-based IoT platform providing network connectivity management and application enablement.

- Mylesight: Offers a wide range of LoRaWAN gateways, sensors, and industrial IoT solutions.

- Machine LPWAN: Specializes in low-power, wide-area networks for asset tracking and environmental monitoring.

- Thingsboard: Open-source IoT platform supporting LoRaWAN integration and application development.

Current Company Investment Trends:

- Increased R&D Spending: Leading players are pouring resources into chip development, network optimization, and security enhancements.

- Partnership Focus: Building strong alliances with network operators, application developers, and system integrators.

- Go-to-Market Expansion: Entering new geographical markets and addressing underserved application segments.

- Acquisition Strategies: Mergers and acquisitions to gain market share and expertise in complementary areas.

Latest Company Updates:

October 31, 2023, The Indian government announces plans to deploy a nationwide LoRaWAN network for smart city initiatives.

November 22, 2023, SK Telecom launches a commercial LoRaWAN network in South Korea, targeting smart agriculture and logistics.

December 19, 2023, The European Commission allocates €12 billion for research and development of next-generation low-power wide-area networks, potentially benefiting LoRaWAN.