Rising Healthcare Costs

The Long Term Care Insurance Market is experiencing a surge in demand due to escalating healthcare costs. As individuals face increasing expenses related to medical care, the need for financial protection against long-term care becomes more pronounced. According to recent data, the average annual cost of nursing home care has reached approximately 100,000 USD, which is a substantial financial burden for many families. This trend indicates that consumers are increasingly recognizing the necessity of long-term care insurance as a means to safeguard their assets and ensure access to quality care. Consequently, the rising healthcare costs are likely to drive growth in the Long Term Care Insurance Market, as more individuals seek to mitigate the financial risks associated with aging and chronic illnesses.

Regulatory Changes and Incentives

Regulatory changes and incentives are playing a pivotal role in shaping the Long Term Care Insurance Market. Governments are increasingly recognizing the financial strain that long-term care can impose on public resources and are implementing policies to encourage private insurance uptake. For instance, tax incentives for long-term care insurance premiums are being introduced in various regions, making it more financially attractive for consumers. Additionally, some jurisdictions are mandating that insurance providers offer certain benefits, which can enhance the appeal of long-term care policies. These regulatory shifts are likely to stimulate growth in the Long Term Care Insurance Market, as they create a more favorable environment for both consumers and insurers.

Increased Awareness of Long-Term Care Needs

There is a growing awareness among the population regarding the importance of planning for long-term care needs, which is significantly influencing the Long Term Care Insurance Market. Educational campaigns and resources have highlighted the potential costs associated with long-term care, prompting individuals to consider insurance options earlier in life. Data suggests that nearly 70% of individuals over the age of 65 will require some form of long-term care, which underscores the necessity for proactive planning. This heightened awareness is likely to lead to an increase in policy purchases, as consumers become more informed about their options and the benefits of long-term care insurance. As a result, the Long Term Care Insurance Market is poised for expansion as more individuals recognize the value of securing their future.

Changing Family Dynamics and Caregiving Trends

Changing family dynamics and caregiving trends are significantly impacting the Long Term Care Insurance Market. With more families becoming geographically dispersed and traditional caregiving roles evolving, individuals are increasingly seeking professional long-term care solutions. The rise of dual-income households and the growing number of women in the workforce have contributed to this shift, as family members may not be available to provide care. Consequently, the demand for long-term care insurance is likely to rise, as individuals look to secure professional care services for themselves or their loved ones. This trend indicates a potential growth trajectory for the Long Term Care Insurance Market, as consumers seek to ensure that they have the necessary resources to access quality care in the future.

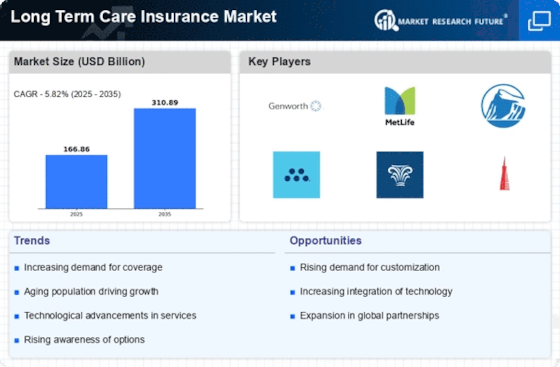

Technological Advancements in Insurance Products

Technological advancements are revolutionizing the Long Term Care Insurance Market by enabling the development of innovative insurance products. Insurers are increasingly leveraging technology to create personalized policies that cater to the unique needs of individuals. For example, the integration of telehealth services and digital health monitoring can enhance the value of long-term care insurance by providing policyholders with access to remote care options. Furthermore, data analytics allows insurers to better assess risk and tailor premiums accordingly. This technological evolution not only improves the customer experience but also encourages more individuals to consider long-term care insurance as a viable option. As a result, the Long Term Care Insurance Market is likely to benefit from these advancements, leading to increased policy adoption.