Top Industry Leaders in the Long Fiber Thermoplastics Market

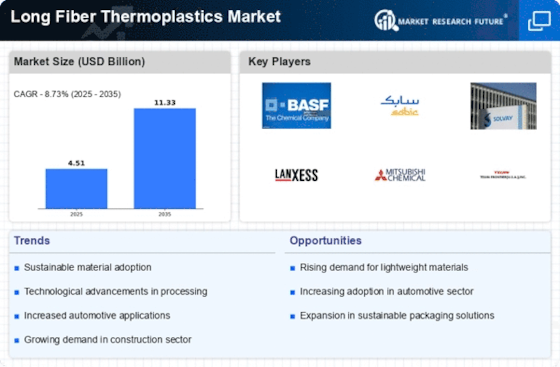

The long fiber thermoplastics (LFT) market is fueled by rising demand for lightweight, high-performance materials across diverse industries. This growth potential has ignited a fierce competitive landscape, with established players and innovative newcomers vying for market share. Let's delve into the strategies, factors influencing market share, and recent developments shaping this dynamic market.

The long fiber thermoplastics (LFT) market is fueled by rising demand for lightweight, high-performance materials across diverse industries. This growth potential has ignited a fierce competitive landscape, with established players and innovative newcomers vying for market share. Let's delve into the strategies, factors influencing market share, and recent developments shaping this dynamic market.

Strategies Adopted by Market Leaders:

-

Product Diversification: Major players like BASF, Lanxess, and Celanese are expanding their LFT portfolios, offering a wider range of resin types (PP, PA, PEEK), fiber reinforcements (glass, carbon), and processing technologies (injection molding, compression molding) to cater to specific end-use applications. -

Vertical Integration: Companies like PlastiComp and RTP Company are investing in upstream capabilities, acquiring fiber producers or establishing in-house compounding facilities, to gain control over raw materials and optimize production costs. -

Technological Innovation: Continuous research and development efforts are focused on improving LFT properties like strength-to-weight ratio, recyclability, and surface finish. Companies are also exploring bio-based fibers and advanced manufacturing techniques to enhance sustainability and competitiveness. -

Strategic Partnerships and Acquisitions: Collaborations between LFT manufacturers and end-users in industries like automotive and aerospace are accelerating product development and market adoption. Acquisitions of smaller players with niche expertise further strengthen market positions.

Factors Influencing Market Share:

-

Production Capacity and Geographic Reach: Companies with established production facilities and strong global distribution networks have an edge in meeting regional demands and securing larger contracts. -

Product Portfolio Breadth and Quality: Offering a diverse range of LFT materials with superior properties and consistent quality attracts a wider customer base and fosters brand loyalty. -

Technical Expertise and Customer Support: Providing comprehensive technical support and application-specific solutions helps LFT manufacturers build trust and long-term partnerships with customers. -

Pricing and Cost Competitiveness: Balancing competitive pricing with product quality and customer value proposition is crucial for market share retention and growth.

Key Companies in the Long Fiber Thermoplastics market include

- Celanese Corporation (US)

- SABIC (Saudi Arabia)

- Lanxess AG (Germany)

- BASF SE (Germany)

- Mitsubishi Chemical Holdings

- PlastiComp Inc. (US)

- Daicel Polymer Ltd. (Japan)

- Asahi Kasei Corporation

- RTP Company Inc.(US)

- Solvay (Belgium)

Recent News

October 2023 saw SABIC introduce their own low pressure compression molded automotive body panel based on a proprietary long fiber thermoplastic material.

May 2022 — Solvay (a well-known specialty chemical manufacturer) launched its carbon fibre products made from new composite material SolvaLite 714 Prepregs woven fabric items too were made available at this time too

November 2022 Celanese Corporation acquired majority stakes in DuPont Mobility & Materials businesses thereby improving upon its current range offer for thermoplastics & elastomers

Dow Chemical Company announced partnership agreement between itself and Shandong Weilian Chemical Co., Ltd which will see them jointly expand production capacity of acrylic acid esters within China so as meet ever-growing needs from Chinese market place for Long Fiber Thermoplastics (LFT) compounds.