Load Break Switch Size

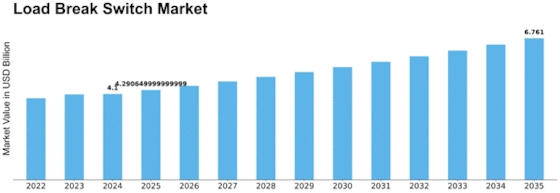

Load Break Switch Market Growth Projections and Opportunities

Several variables drive the Load Break Switch (LBS) industry's growth and trends. LBS, a vital component of power distribution networks, is in high demand worldwide due to electrical infrastructure growth, modernization, and renewable energy focus. Demand for dependable and efficient power distribution in residential, commercial, and industrial sectors has driven market expansion. Urbanization, especially in emerging nations, increases electricity demand, strengthening the LBS market.

Technology drives LBS market dynamics. Innovations that improve load break switch performance, durability, and safety promote market competition. Manufacturers consistently create new LBS solutions that increase operating efficiency, remote monitoring, and reliability to meet end-user demands. The market for intelligent load break switches that enable remote operations and real-time monitoring is also driven by smart technologies and IoT in power distribution systems.

Additionally, government regulations and policies greatly affect LBS market dynamics. Safety, environmental, and energy efficiency restrictions force manufacturers to provide LBS solutions that meet these criteria. Government investments in power infrastructure upgrades and rural energy access boost market growth. Renewable energy sources need dependable switching solutions to integrate into the grid, hence subsidies, incentives, and mandates indirectly boost the LBS industry.

Market competition and prominent players also affect LBS dynamics. Established firms and newcomers compete through product innovation, strategic cooperation, mergers, and acquisitions. This competitive landscape encourages technology breakthroughs and pricing competition, giving clients more alternatives and growing the industry.

Geographical dispersion also affects market dynamics. Asia Pacific, Latin America, and Africa have high LBS demand because to growing industrialization and infrastructural expansion. Infrastructure renovations and modernization boost growth in North America and Europe. The worldwide LBS market is dynamic because to regional differences in urbanization, industrial expansion, and energy change.

Technological innovation, regulatory frameworks, market rivalry, and geographical trends affect Load Break Switch market dynamics. These characteristics drive LBS market expansion by forcing manufacturers to innovate and meet global power distribution sector demands.

Leave a Comment