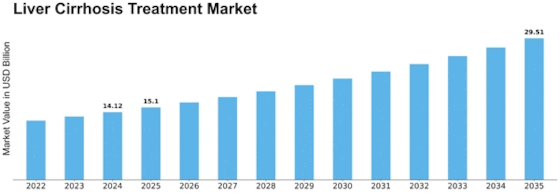

Liver Cirrhosis Treatment Size

Liver Cirrhosis Treatment Market Growth Projections and Opportunities

Different market factors influence the Liver Cirrhosis Treatment Market, which in turn affects its growth and dynamics. The rising prevalence of liver cirrhosis is one such driver globally. The rise in chronic liver diseases leads to a demand for effective treatment options attributed to alcohol consumption, viral hepatitis infection, and non-alcoholic fatty liver disease (NAFLD). The Liver Cirrhosis Treatment Market is influenced critically by advancements in medical research and technology. Ongoing efforts of pharmaceutical companies and healthcare researchers result in the creation of innovative therapies and drugs. These improvements not only enhance the effectiveness of existing treatments but also introduce novel approaches, thereby providing healthcare professionals with more tools for managing liver cirrhosis. This makes the market dynamic as the ever-changing field of medical science drives it. Demographics, like an aging population, are major considerations that determine how the liver cirrhosis treatment market behaves. As people get older, they start facing a higher risk of chronic liver conditions–cirrhosis inclusive-. The availability and accessibility of health infrastructure significantly determines the outcome on this front. Regions with advanced healthcare systems have better capacities to diagnose and treat patients who have cirrhosis effectively. In contrast, regions lacking adequate healthcare resources may face difficulties in giving timely or comprehensive services, something that influences market growth in such areas. Reimbursement policies/guidelines and government/insurance companies' expenditure on healthcare are key market characteristics influencing adoption rates for treating liver cirrhosis. With good reimbursement policies, patients may be encouraged to go for medical intervention at the right time, besides sticking to their prescriptions. Poor reimbursement mechanisms may prevent access to certain therapies, thus undermining overall market growth. The liver cirrhosis treatment market is affected by patient awareness, and education is a critical determinant of this, too. Enhancing knowledge about risk factors, symptoms, and available treatment alternatives may enable early diagnosis; hence, treatment can commence before the condition worsens further. Over time, partnerships between research institutions, pharmaceutical companies, and healthcare organizations have driven innovation in liver cirrhosis treatment. These collaborations facilitate the development of new therapies and other interventions by combining resources and expertise. By merging all stakeholders, an environment is created that enables progress in liver disease treatment to take place for the advantage of patients, thus causing market expansion. Thus, this section highlights critical areas that affect Liver Cirrhosis Treatment market competition among participants as well as the regulatory framework that governs their actions. In terms of stringent regulation, they help to guarantee safety and therapeutic utility while providing confidence to physicians or even patient populations who may be interested in such treatments. High competition forces firms to invest heavily in research and development, hence increasing the importance of innovation within a dynamic business community.

Leave a Comment