Rising Focus on Personalized Medicine

The Live Cell Encapsulation Market is increasingly influenced by the rising focus on personalized medicine, which aims to tailor treatments to individual patient needs. This approach necessitates the use of live cell therapies that can be customized based on genetic and phenotypic characteristics. The market for personalized medicine is projected to exceed USD 2 trillion by 2025, highlighting the growing importance of this sector. Live cell encapsulation technologies are essential for ensuring the stability and efficacy of these personalized therapies. By protecting live cells from degradation and enhancing their delivery, encapsulation methods are likely to play a critical role in the success of personalized treatments. As healthcare systems shift towards more individualized care, the demand for innovative encapsulation solutions is expected to rise, further propelling the market forward.

Expanding Applications in Biotechnology

The Live Cell Encapsulation Market is benefiting from expanding applications in biotechnology, particularly in areas such as vaccine development and biopharmaceutical production. Encapsulated live cells are increasingly utilized in the production of biologics, where they can enhance yield and stability. The biopharmaceutical market is anticipated to reach USD 500 billion by 2025, creating substantial opportunities for live cell encapsulation technologies. Moreover, the use of encapsulated cells in vaccine formulations can improve immune responses and prolong shelf life, making them more effective. As biotechnology continues to evolve, the demand for innovative encapsulation solutions is likely to grow, driving market expansion. This trend indicates a promising future for companies that specialize in live cell encapsulation technologies tailored for biotechnological applications.

Increasing Demand for Regenerative Medicine

The Live Cell Encapsulation Market is witnessing a notable increase in demand for regenerative medicine, which relies heavily on the use of encapsulated live cells. This sector is expanding as more healthcare providers recognize the potential of cell-based therapies to treat chronic diseases and injuries. The market for regenerative medicine is expected to reach USD 50 billion by 2026, indicating a robust growth trajectory. Encapsulation technologies play a vital role in protecting cells from the immune system and enhancing their therapeutic efficacy. As the healthcare landscape evolves, the integration of live cell encapsulation into regenerative medicine applications is likely to become more prevalent, thereby driving market growth. This trend suggests a promising future for companies involved in the development of encapsulation technologies tailored for regenerative applications.

Increased Funding for Research and Development

The Live Cell Encapsulation Market is experiencing increased funding for research and development, which is crucial for advancing encapsulation technologies. Governments and private investors are recognizing the potential of live cell therapies and are allocating resources to support innovative research. In recent years, funding for biotechnology research has surged, with investments reaching over USD 30 billion annually. This influx of capital is likely to accelerate the development of new encapsulation methods and applications, thereby enhancing market growth. Furthermore, collaborations between academic institutions and industry players are becoming more common, fostering innovation in live cell encapsulation. As research continues to advance, the market is expected to benefit from novel technologies that improve the efficacy and safety of live cell therapies.

Technological Innovations in Live Cell Encapsulation

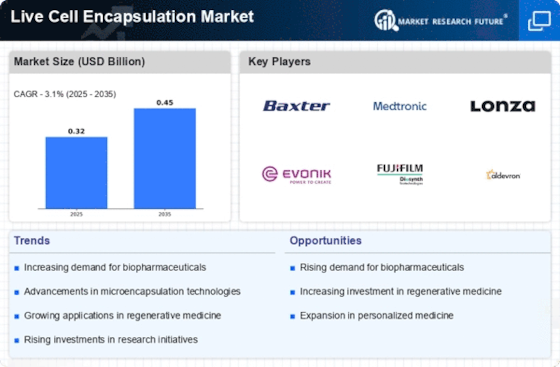

The Live Cell Encapsulation Market is experiencing a surge in technological innovations that enhance encapsulation techniques. Advances in materials science, such as the development of biocompatible polymers, are enabling more effective cell protection and viability. These innovations are crucial for applications in drug delivery and tissue engineering, where maintaining cell functionality is paramount. The market is projected to grow at a compound annual growth rate of approximately 10% over the next five years, driven by these advancements. Furthermore, the integration of microfluidics and nanotechnology into encapsulation processes is likely to improve precision and efficiency, thereby expanding the potential applications of live cell encapsulation. As a result, companies are increasingly investing in research to develop novel encapsulation methods that could redefine therapeutic strategies.