- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

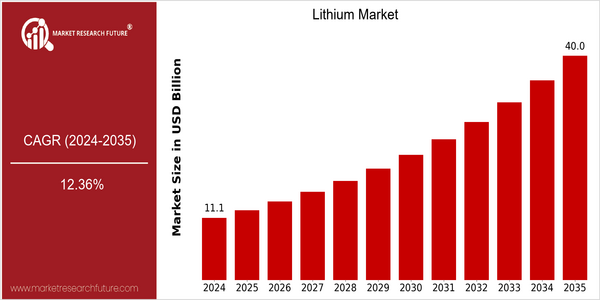

Lithium Market Size Snapshot

| Year | Value |

|---|---|

| 2024 | USD 11.1 Billion |

| 2035 | USD 40.0 Billion |

| CAGR (2025-2035) | 12.36 % |

Note – Market size depicts the revenue generated over the financial year

The lithium market is expected to grow to a size of $ 11.1 billion by 2024, and is forecast to grow to $ 40 billion by 2035. This remarkable growth rate, with a compound annual growth rate of 12.36% between 2025 and 2035, reflects the lithium market’s strong demand, as well as the increasing use of lithium in various sectors. The lithium-ion battery market is expected to be the largest application of lithium in the future. This is mainly due to the rapid development of the EV revolution and the rapid development of the electricity storage market. The lithium industry is expected to grow steadily. In addition, the shift to green energy will also lead to the lithium market growing further. The main lithium market players, such as Albemarle, SQM and Livent, are actively expanding production capacity and promoting technological innovation to meet the increasing demand. Strategic alliances and joint ventures are being established to enhance production capacity and secure supply chains. For example, the number of lithium-battery production contracts between lithium companies and automobile manufacturers is increasing. Strategic alliances and joint ventures are expected to play an important role in the future development of the lithium industry.

Regional Deep Dive

Lithium has been growing rapidly in various regions, driven by the increasing demand for electric vehicles (EVs), wind energy storage, and consumer electronics. The lithium market in North America is characterized by a robust supply chain and the increasing importance of domestic production, especially in the U.S. and Canada. Europe is focusing on promoting lithium-ion batteries through regulatory frameworks, while Asia-Pacific is the world's largest lithium-consuming and lithium-producing region, and China leads the world in both lithium production and lithium-battery technology. Middle East and Africa (MEA) are emerging lithium markets with significant extraction potential, and the lithium triangle in Latin America is rich in resources and is attracting worldwide investment.

North America

- In order to promote domestic lithium production and lithium-ion batteries, the United States has enacted the Inflation Reduction Act, which incentivizes lithium extraction and the manufacture of batteries, in order to reduce the country’s dependence on foreign suppliers.

- Albemarle and Livent are establishing themselves in North America, with lithium mining projects in Nevada and North Carolina, which are to give rise to a local supply chain.

- In the same way, the increasing demand for lithium batteries, as a result of the rapid development of the electric car industry, which is being driven by manufacturers such as Tesla and GM, is driving the development of lithium extraction and recovery techniques.

Europe

- The European Union has set itself the goal of reducing its carbon emissions. This has led to an increase in lithium-ion battery production, with Northvolt and BASF establishing gigafactories.

- The introduction of the European Battery Regulation is aimed at a more sustainable exploitation of lithium and is leading to a more sustainable extraction of lithium.

- A closer relationship between the battery producers and the automobile manufacturers, such as the one between the automobile manufacturer and the manufacturer of the batteries, such as the one between the automobile manufacturer and the manufacturer of the battery, such as the one between the automobile manufacturer and Umicore, is forming the lithium supply chain and securing the supply of lithium for the production of electric cars.

Asia-Pacific

- China's lithium industry has long been a world leader, with Ganfeng Lithium and Tianqi Lithium as its two leading enterprises.

- The Chinese government is now investing heavily in lithium-ion batteries and electric vehicles, and lithium demand is expected to rise sharply.

- In the meantime, new extraction methods are being developed, such as direct lithium extraction (DLE), which is expected to increase efficiency and reduce the environmental impact. Lithium Americas is working on such methods.

MEA

- In recent years, there has been an increasing interest in lithium as a potential source of lithium. Prospect Resources and Lepidico have been exploring and developing lithium deposits in the two countries.

- The African Continental Free Trade Agreement will facilitate trade and investment in lithium and will promote the sharing of resources across the continent.

- Governments are setting up regulations to attract foreign investment in lithium mining, and they recognize lithium's importance as a strategic mineral.

Latin America

- The lithium triangle is a triangular area between Argentina, Bolivia and Chile, rich in lithium-brine deposits, which have attracted the interest of major mining companies such as SQM and Livent.

- Recent regulatory changes in Argentina have made it easier for companies to start lithium extraction operations.

- Local communities and governments are beginning to demand that mining be done in a responsible way to protect water resources and the environment.

Did You Know?

“Lithium is the lightest of metals, and its reactivity is the highest of any metal, which makes it the most suitable substance for use in batteries, especially in electric cars.” — U.S. Geological Survey (USGS)

Segmental Market Size

The lithium market, especially the battery market, is undergoing strong growth, especially for electric cars and for storage of electricity from renewable sources. The lithium-ion batteries used for EVs and storage of electricity from renewable sources play a crucial role in the transition to sustainable energy. The demand for lithium-ion batteries is mainly based on the preference of consumers for a cleaner transport system and the support of governments, such as the Green Deal in the European Union and various subsidies in the United States and China.

Lithium batteries are now widely used, with Panasonic and Tesla leading the way in the manufacture of EV batteries. The most important applications are in the field of EVs, the grid and consumer goods. The decarbonization trend and the development of new battery technology such as solid-state batteries are accelerating the growth of lithium batteries. Furthermore, lithium batteries are being developed for the purpose of recyclability in response to the demand for a sustainable society. Artificial intelligence and the Internet of Things are contributing to the development of lithium batteries, enabling them to be used to optimize performance and life.

Future Outlook

From 2024 to 2035, the lithium market is expected to grow at a strong CAGR of 12.36%. This growth is largely driven by the rising demand for lithium-ion batteries, which are used in electric vehicles (EVs), in the storage of electricity from wind and solar sources and in consumer products. As global efforts to reduce CO2 emissions increase, the share of EVs is expected to rise considerably. By 2035, EVs are expected to account for more than 30% of new vehicle sales worldwide.

Market growth will be further supported by technological developments and supportive government policies. Among the technological developments, solid-state batteries and improved lithium-ion batteries are expected to increase the efficiency and viability of lithium-ion batteries, making them more attractive to manufacturers. Government policies in support of green energy and electric vehicles, particularly in Europe and North America, will also help to create a more favourable regulatory environment for lithium producers. Emerging trends, such as the increase in lithium extraction from geothermal brines and greater investment in domestic supply chains, will also play an important role in meeting the expected demand and ensuring market stability through to 2035.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 4.21 billion |

| Growth Rate | 8.10% (2024-2032) |

Lithium Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.