Top Industry Leaders in the Lithium Ion Battery Cathode Material Market

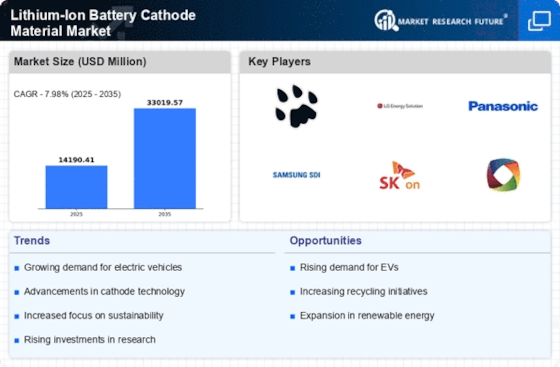

The lithium-ion battery cathode material market sits at the heart of the electric revolution. From powering smartphones to propelling electric vehicles, these critical materials determine battery performance, range, and cost. But within this seemingly static realm lies a dynamic and competitive landscape, driven by technological advancements, resource scarcity, and the ever-evolving needs of diverse industries. Let's delve into the intricacies of this market, exploring its key players, their strategies, and the factors shaping their success.

The lithium-ion battery cathode material market sits at the heart of the electric revolution. From powering smartphones to propelling electric vehicles, these critical materials determine battery performance, range, and cost. But within this seemingly static realm lies a dynamic and competitive landscape, driven by technological advancements, resource scarcity, and the ever-evolving needs of diverse industries. Let's delve into the intricacies of this market, exploring its key players, their strategies, and the factors shaping their success.

A Spectrum of Players Driving Innovation:

-

Global Giants: Leading the pack are established players like CATL (China), LG Chem (South Korea), BYD (China), Sumitomo Metal Mining (Japan), and Umicore (Belgium) with extensive production capacities, diverse product portfolios, and global reach. -

Regional Powerhouses: Companies like Tianqi Lithium (China), Ganfeng Lithium (China), and Posco (South Korea) cater to specific regional demands and offer competitive pricing. -

Niche Specialists: Smaller players like LFP Battery, Inc. (US) and Nano One Materials Corp. (Canada) focus on specialized materials like lithium iron phosphate (LFP) or novel cathode chemistries, pushing the boundaries of performance and sustainability.

Strategies for Charging Ahead:

-

Innovation: Developing new cathode materials with higher energy density, faster charging capabilities, and improved stability is crucial for staying ahead of the curve. -

Resource Security: Securing access to critical raw materials like lithium and cobalt through long-term contracts and strategic partnerships is essential in a market facing potential supply constraints. -

Sustainable Practices: Implementing environmentally friendly mining and processing methods, utilizing recycled materials, and minimizing waste generation are increasingly important differentiators. -

Vertical Integration: Integrating upstream mining and processing with downstream cathode production ensures control over quality, cost, and responsiveness. -

Strategic Partnerships: Collaborations with battery manufacturers, automotive companies, and research institutions drive innovation, market access, and resource optimization.

Factors Shaping Market Share:

-

Battery Demand and Trends: The growth of electric vehicle sales, consumer electronics, and energy storage applications directly impacts the demand for cathode materials. -

Material Performance: Energy density, charging speed, cycle life, and safety are key performance indicators influencing market share and pricing. -

Cost Competitiveness: Balancing advanced functionalities with affordability is crucial, especially for cost-sensitive applications like electric vehicles. -

Environmental Regulations: Stringent regulations on mining practices, waste disposal, and battery recycling influence material selection and production processes. -

Intellectual Property: Securing strong patent protection for innovative cathode materials is essential for maintaining a competitive edge.

Key Companies in the lithium-ion battery cathode material market include

BASF SE

FUJITSU

NICHIA CORPORATION

LONG POWER SYSTEMS (SUZHOU) CO., LTD

TARGRAY TECHNOLOGY INTERNATIONAL INC

HITACHI CHEMICAL CO., LTD

NEI CORPORATION

JFE CHEMICAL CORPORATION

MITSUBISHI CHEMICAL CORPORATION

SANTOKU CORPORATION

Recent Developments:

-

August 2023: CATL announces a new partnership with a mining company to develop a responsible and sustainable lithium supply chain. -

October 2023: BYD invests in a recycling facility for spent lithium-ion batteries, aiming to close the loop and reduce reliance on virgin materials. -

November 2023: Sumitomo Metal Mining successfully tests a new cobalt-free lithium cathode material, addressing concerns about resource scarcity and ethical sourcing. -

December 2023: Umicore partners with a battery manufacturer to develop a next-generation solid-state battery using innovative cathode materials.