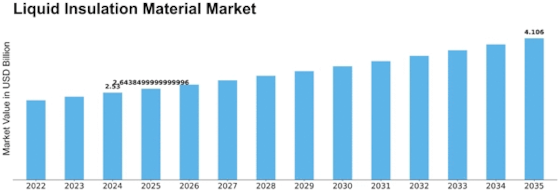

Liquid Insulation Material Size

Liquid Insulation Material Market Growth Projections and Opportunities

The market for liquid insulation materials is influenced by a variety of factors that contribute to its growth and dynamics within the construction and industrial sectors. Energy efficiency and sustainability are primary drivers impacting the market, as liquid insulation materials offer a versatile and effective solution for thermal insulation in buildings and industrial applications. These materials, often applied as liquid coatings or spray foams, provide an efficient barrier against heat transfer, reducing energy consumption and enhancing the overall insulation performance. The demand for environmentally friendly and energy-efficient construction solutions contributes to the growth of the liquid insulation material market, meeting the evolving needs of architects, builders, and industrial facility managers.

Economic factors play a crucial role in the liquid insulation material market. Construction activities, industrial projects, and infrastructure development impact the demand for insulation materials, subsequently influencing the market for liquid insulation. During periods of economic growth, there is often an increase in construction and retrofitting projects, leading to higher demand for effective and cost-efficient insulation solutions. Conversely, economic downturns may result in reduced investments in construction and building maintenance, affecting the market negatively. Monitoring economic trends is essential for stakeholders in the construction and insulation sectors to make informed business decisions and adapt to market fluctuations.

Technological advancements contribute to innovation in the liquid insulation material market. Continuous improvements in formulations, application methods, and performance characteristics enhance the versatility, efficiency, and durability of these materials. Advanced liquid insulation materials may feature improved thermal resistance, quicker curing times, and enhanced adhesion properties. Innovations in environmentally friendly formulations, such as low volatile organic compound (VOC) or water-based options, contribute to the development of sustainable and eco-friendly liquid insulation materials. Manufacturers that invest in cutting-edge technologies gain a competitive edge by offering high-performance and environmentally responsible solutions to meet the evolving needs of the construction and industrial sectors.

Environmental and energy efficiency considerations significantly influence the liquid insulation material market. As awareness of climate change and sustainability grows, there is an increasing demand for building materials that contribute to energy conservation. Liquid insulation materials, with their ability to provide seamless coverage and reduce thermal bridging, align with the market's focus on sustainable construction practices. Additionally, the versatility of liquid insulation materials in both new construction and retrofit applications makes them attractive for energy-efficient building upgrades. The market is further driven by government initiatives and regulations promoting energy efficiency and environmental responsibility in construction projects.

Market competition in the liquid insulation material industry is shaped by factors such as pricing, performance features, and brand reputation. Competitive pricing strategies that consider production costs, formulations, and market demand influence a company's market position. Building a strong reputation for providing reliable, efficient, and environmentally friendly liquid insulation materials is crucial for attracting and retaining customers. Effective marketing strategies, technical support, and after-sales service contribute to brand loyalty. Manufacturers and distributors must navigate these competitive factors strategically to establish a strong presence in the liquid insulation material market.

Regulatory compliance is also a significant factor in the liquid insulation material market. Adherence to safety standards, environmental regulations, and building codes is essential for manufacturers to ensure the reliability and safety of their products. Compliance with energy efficiency standards and certifications, such as those provided by organizations like LEED (Leadership in Energy and Environmental Design), contributes to the market dynamics. Government incentives for energy-efficient construction projects further influence the adoption of liquid insulation materials, encouraging businesses to invest in compliant and sustainable technologies for thermal insulation.

Leave a Comment