Liquid Crystal Polymers Size

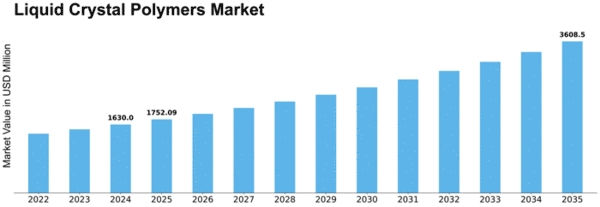

Liquid Crystal Polymers Market Growth Projections and Opportunities

The Global market for Liquid Crystal Polymers (LCP) is impacted by a group of aspects that altogether shape its conditions. These market aspects play a pivotal part in defining the development, demand, and overall trajectory of the LCP market. Understanding these aspects is important for shareholders to make informed decisions and navigate the ever-evolving platform of the LCP industry.

The electronics industry has emerged as a major propelling aspect of the LCP market. With the accelerating demand for high-performance, lightweight materials in electronic components, LCPs have found widespread applications in switches, connectors, and other electronic gadgets. Miniaturization tendencies in consumer electronics, such as wearables and smartphones, have further propelled the demand for LCPs because of their exceptional thermal and mechanical characteristics.

The automotive field is enduring and developing the advantage of Liquid Crystal Polymers, particularly in under-the-hood products. LCPs are assessed for their chemical inertness, heat resistance, and electrical insulation characteristics, making them appropriate for modules like sensors and connectors. The coherent prominence of lightweight substances in the automotive industry to enhance fuel efficacy has fueled the implementation of LCPs in countless vehicle components.

The launch of 5G technology across the globe has spurred demand for high-performance materials, including LCPs, in the telecommunications arrangement. LCPs are exploited in the fabrication of high-frequency components and connectors necessary for 5G networks. The spurring of the expansion of telecommunications infrastructure and employment of 5G networks are assumed to pound sustained demand for Liquid Crystal Polymers.

Rigorous environmental guidelines and a mounting emphasis on sustainability are inducing material choices across industry sectors. LCPs, with the potential for eco-friendly production and their recyclability and processes, are collecting traction as environmentally accountable substitutes in numerous applications. Manufacturers are gradually incorporating sustainability portions into their product offerings to relate with the developing environmental principles and meet the expectations of eco-aware consumers.

The global market for liquid crystal polymers is not without issues, including the high cost of processing and raw materials. The competitive platform is described by the existence of prime players struggling to gain a competitive advantage via tactics such as acquisitions, mergers, and cooperation. Permanent attempts by market participants to improve cost-effectiveness, increase their product ranges, and boost general product performance provide to the competitive circumstances of the LCP market.

Leave a Comment