Linear Motor Size

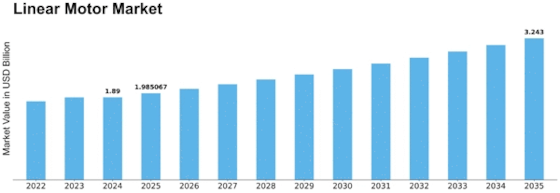

Linear Motor Market Growth Projections and Opportunities

The linear motor market is impacted by a bunch of variables that all in all shape its elements and development direction. One huge market factor is mechanical progressions. As developments in motor innovation keep on unfurling, linear motors experience upgrades in proficiency, accuracy, and by and large execution. These progressions drive the market forward by drawing in ventures looking for state of the art answers for their computerization and movement control needs. Another key element is the rising interest for computerization across different businesses. As organizations endeavor to improve efficiency and productivity, the reception of mechanized frameworks becomes basic. Linear motors assume a significant part in this situation, offering quick and exact linear movement for applications like mechanical technology, transport frameworks, and assembling processes. The rising pattern of modern computerization contributes essentially to the development of the linear motor market. As maintainability turns into a focal worry for businesses around the world, the interest for energy-effective arrangements drives the reception of linear motors. This variable meets natural objectives as well as assists organizations with decreasing functional costs over the long haul. Worldwide monetary circumstances are vital in molding the linear motor market. Monetary reliability and development straightforwardly influence the ventures made by enterprises in mechanization advances. During times of financial flourishing, organizations are more disposed to put resources into cutting edge computerization arrangements, in this way helping the interest for linear motors. Linear motors are also being used extensively in the power and aviation sectors. Linear motors are used in ecologically friendly power frameworks in the energy industry, such as wind turbine controllers and sun-oriented trackers. Linear motors find use in a variety of aviation applications, such as satellite positioning systems and aircraft controls. The needs of the aviation industry for lightweight and high-performance systems align with the characteristics of linear motors, making them a preferred choice in this field. Additionally, consumer preferences and behavior have a significant impact on the linear motor industry. Superior performance linear motors are becoming more and more in demand as end users place an increasing emphasis on speed, accuracy, and consistent quality in their applications. Market participants are aware of these tendencies and modify their offerings to satisfy customers' evolving needs, ensuring sustained relevance and growth in the professional scene.

Leave a Comment