Light Olefin Size

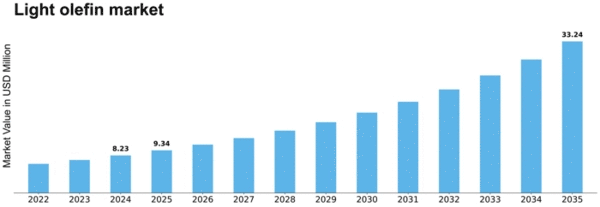

Light olefin market Growth Projections and Opportunities

Light olefins serve as the foundational elements in the petrochemical industry, serving as precursors for the production of major products like ethylene and propylene. In the context of ethylene polymerization, several processes, including chlorination, oxidation, acetoxylation, and oligomerization, are employed to generate ethylene derivatives. A significant portion of ethylene undergoes polymerization to yield various forms of polyethylene (PE) derivatives, encompassing High-Density Polyethylene (HDPE), Low-Density Polyethylene (LDPE), and Linear Low-Density Polyethylene (LLDPE) through high, medium, and low-pressure methods. The chlorination process contributes to the production of ethylene dichloride (EDC), Vinyl chloride monomers (VCM), and polyvinyl chloride (PVC) through dehydro-chlorination and polymerization. Oxidation involves extracting ethylene oxide and ethylene glycol through hydration treatment, while acetylation is employed to derive vinyl acetate monomers from ethylene. Oligomerization is yet another process, creating alpha olefin derivatives.

Similarly, in the case of propylene polymerization, processes such as ammoxidation, chlorohydrnation, epoxidation, and oxo reaction are executed to yield diverse propylene derivatives, including polypropylene (PP), propylene oxide (PO), acrylonitrile, acrylic acid, among others.

Various techniques such as steam cracking, fluid catalytic cracking (FCC), propane dehydrogenation (PDH), methanol to olefins (MTO), and other methodologies are employed for olefin production. Presently, the MTO process stands out as a widely utilized method for light olefin production, extracting these compounds from diverse sources such as coal, natural gas, and biomass. The applications of light olefins span across refineries and various chemical commodities, with the increasing demand for polymers serving as a primary driver for market growth. Plastics are progressively replacing conventional materials like steel, wood, metal, and concrete, providing end-users with enhanced ease and convenience. However, the direct exposure of ethylene to the atmosphere poses environmental challenges, contributing to air pollution. To address this issue, the industry is actively exploring biomass feedstock as an alternative, with countries like Brazil, China, and India garnering attention due to the availability of cost-effective materials.

Leave a Comment