Lidar Size

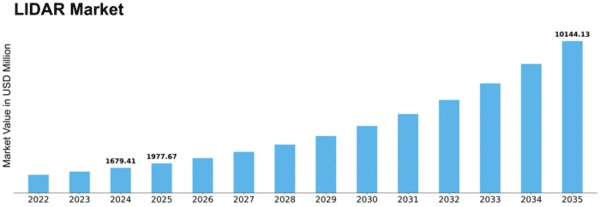

LIDAR Market Growth Projections and Opportunities

The LiDAR market is on track to achieve significant growth in the coming years. LiDAR, which stands for Light Detection and Ranging, utilizes laser techniques to provide various advantages to different industries, especially in areas like automotive, geographical survey, land mapping applications, and construction. The market is thriving due to its ability to offer continuous 360 degrees of visibility and provide accurate depth information. Key factors contributing to this growth include the rising demand for 3D imaging technology and the increased adoption of laser technology by government agencies.

Projections indicate that the global LiDAR market is poised to grow at a Compound Annual Growth Rate (CAGR) of 14.14% during the forecast period from 2018 to 2023. In 2017, the airborne LiDAR market dominated with the highest market share, followed closely by terrestrial LiDAR. This growth is spurred by a significant increase in investments in emerging economies, particularly aimed at developing public infrastructure and the real estate sector.

The global LiDAR market is categorized based on product type, component, technology, functional areas, and region. Looking at the regional aspect, Asia Pacific is expected to experience the fastest growth, starting with a market value of USD 451.3 million in 2017 and projected to reach USD 1154.2 million. This growth is estimated to have a CAGR of 17.06% during the forecast period. On the other hand, North America led the LiDAR market in 2017 and is anticipated to achieve a market value of approximately USD 1474.7 million by 2023.

The significance of LiDAR lies in its widespread applications across diverse sectors. In the automotive industry, LiDAR plays a crucial role in enhancing safety through its 360-degree visibility and accurate depth information. This technology is also extensively used in geographical surveys, providing valuable data for mapping and analysis. Moreover, in construction and land mapping applications, LiDAR's capabilities contribute to efficient planning and execution.

The driving forces behind the market's growth are the increasing demands for 3D imaging technology and the growing acceptance of laser technology by government agencies. As technology evolves, the LiDAR market is likely to witness further advancements, fueling its expansion into new sectors and applications. The continuous development and integration of LiDAR technology are expected to be pivotal in shaping the market's trajectory in the coming years.

Investors and stakeholders are keenly observing the market dynamics, particularly in emerging economies, where substantial investments are being made to boost public infrastructure and the real estate sector. This focus on development is propelling the demand for LiDAR technology, creating new opportunities and driving overall market growth.

Leave a Comment