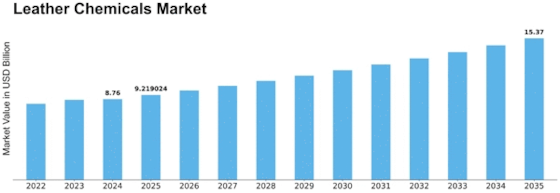

Leather Chemicals Size

Leather Chemicals Market Growth Projections and Opportunities

The Leather Chemicals Market Size was valued at USD 7.8 Billion in 2022. The Leather Chemicals market industry is projected to grow from USD 8.26 Billion in 2023 to USD 13.17 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 6.00%

Global Leather Industry Demand: The demand for leather chemicals is intricately linked to the global leather industry, which serves diverse sectors including fashion, automotive, furniture, and footwear. The leather industry's growth directly impacts the demand for chemicals used in various stages of leather processing.

Economic Trends and Consumer Behavior: Economic factors such as disposable income levels, consumer preferences, and spending patterns play a crucial role in driving demand for leather products. Shifts in consumer behavior towards premium and sustainable leather goods can influence the demand for higher quality leather chemicals.

Environmental Regulations and Sustainability Initiatives: Increasing environmental regulations regarding chemical usage and wastewater management in leather processing plants have compelled manufacturers to adopt eco-friendly and sustainable chemical solutions. The market for environmentally friendly leather chemicals is driven by regulatory compliance and consumer demand for sustainable products.

Raw Material Availability and Prices: Leather chemicals are derived from a variety of raw materials, including synthetic and natural sources. Fluctuations in the prices and availability of raw materials, such as tanning agents, dyestuffs, and finishing chemicals, can impact the overall production costs and pricing strategies of leather chemical manufacturers.

Technological Advancements and Innovation: Technological innovations in leather processing techniques and chemical formulations have led to the development of advanced leather chemicals that offer improved performance, durability, and environmental sustainability. Market players investing in research and development to innovate new products gain a competitive edge in the industry.

Regional Market Dynamics: The Leather Chemicals Market exhibits varying dynamics across different regions due to factors such as regional economic growth, industrialization, and cultural preferences for leather products. Emerging economies with growing leather industries present lucrative opportunities for market expansion, while mature markets may experience slower growth rates.

Trade Policies and Tariffs: Global trade policies, tariffs, and trade agreements impact the import and export of leather chemicals, influencing market competition and pricing dynamics. Changes in trade regulations can affect the accessibility of raw materials and finished products, shaping market trends and strategies for market players.

Consumer Trends and Fashion Preferences: Fashion trends, consumer preferences, and lifestyle choices influence the demand for leather products and, consequently, the demand for leather chemicals. Market players need to stay abreast of evolving fashion trends and consumer preferences to align their product offerings with market demands.

Supply Chain and Distribution Channels: The efficiency of the supply chain and distribution channels significantly impacts the availability and accessibility of leather chemicals to manufacturers and end-users. Market players optimizing their supply chain networks and distribution channels can enhance market penetration and customer reach.

Competitive Landscape and Market Dynamics: The Leather Chemicals Market is characterized by intense competition among key players, driving continuous innovation, pricing strategies, and market expansion efforts. Understanding the competitive landscape and market dynamics is crucial for market players to devise effective business strategies and stay ahead in the market.

Leave a Comment