Top Industry Leaders in the LCP Films Laminates Market

The future of the LCP films and laminates market is brimming with immense potential. The ongoing miniaturization trend and the quest for high-performance electronics will fuel the demand for these versatile materials. Continuous technological advancements, coupled with strategic collaborations and geographic expansion, will shape the competitive landscape. Sustainability initiatives and regulations will also play a significant role in driving responsible innovation and eco-friendly LCP solutions.

Strategies Shaping the Game:

-

Product Diversification: Leading players like Sumitomo Chemical and Toray Industries are expanding their portfolios, offering specialized LCP films and laminates for specific applications like flexible displays, high-frequency circuits, and medical devices. -

Technological Innovation: The focus is on developing high-performance LCPs with enhanced heat resistance, chemical stability, and low dielectric constant. Companies like Kolon Industries and Zhejiang Xinya are at the forefront of this innovation. -

Vertical Integration: Some players like Japan Electronic Materials are integrating upstream into LCP resin production to secure supply chains and optimize costs. -

Geographical Expansion: Emerging markets like China and India are witnessing high demand, prompting established players to set up production facilities or forge strategic partnerships in these regions.

Factors Dictating Market Share:

-

Product Quality and Performance: Superior thermal and electrical properties, coupled with lightweight and thinness, are crucial differentiators. -

Cost-Effectiveness: Balancing cutting-edge technology with competitive pricing is key to winning over price-sensitive customers. -

Customer Service and Technical Support: Extensive application knowledge and strong after-sales service are essential for long-term customer retention. -

Brand Reputation and Recognition: Well-established brands, like DuPont and Kaneka, hold an edge due to their proven track record and reliability.

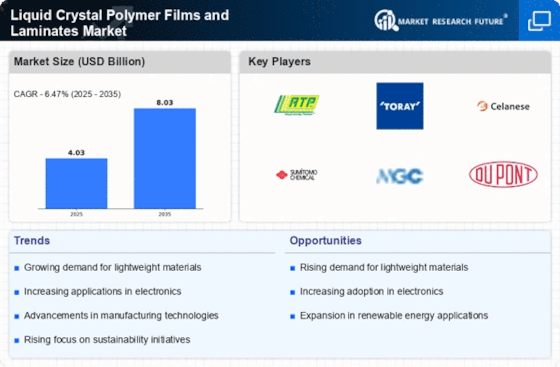

Key Companies in the Liquid Crystal Polymer Films and Laminates market include

- Solvay SA

- Poly plastics Co. Ltd.

- Celanese Corporation

- Rogers Corporation

- Asia International Enterprise (HK) Limited

- RTP Company

- Kuraray Co. Ltd

- Sumitomo Chemical Company

- Shanghai PRET Composites Co.Ltd

- PolyOne Corporation

Recent News

July 2020: Japan's Daicel acquired the stake of its affiliate Celanese Industries, a pioneer in polylactic acid, in the polylactic acid joint venture. The transaction has an approximate valuation of $1.5 billion. An engineering plastics joint venture in Japan will eventually go public and be purchased by a single owner.

January 2020: the Polyplastics Company, a leading developer of liquid crystal polymers (LCPs), announced new developmental grades of LCP, which give superior blister resistance for electronic connectors.

April 2019: Apple is expected to implement a liquid crystal polymer (LCP) board into its iPad Pros towards the end of the year to expand network performance while minimizing signal loss.

In 2021 Celanese Corporation announced that it had entered into a joint venture agreement with Mitsui & Co., Ltd for expanding their LCP offerings. This joint venture, known as Celanese Mitsui Chemicals Engineered Materials LLC, is expected to make available advanced LCP grades for use by different industries, including the vehicles manufacturing sector and aviation as well as electronics.

In 2020 Teijin DuPont Films Japan Limited launched a new LCP film called “Teonex QF.” High-temperature resistance and excellent dimensional stability make it suitable for various applications, such as electronic components or automobile parts.