Top Industry Leaders in the Laser Welding Machine Market

*Disclaimer: List of key companies in no particular order

Latest Laser Welding Machine Market Company Updates:

Competitive Landscape of the Laser Welding Machine Market: A 600-word Analysis

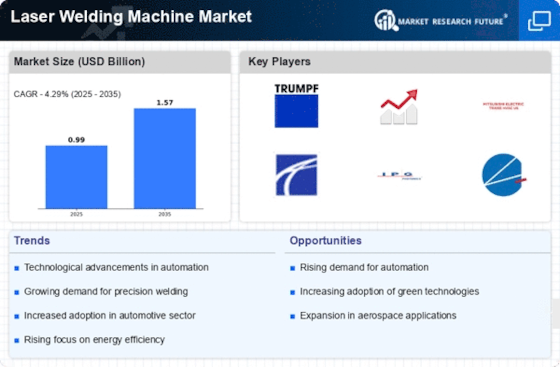

The laser welding machine market is a dynamic and rapidly evolving landscape, fueled by surging demand for precision, efficiency, and automation in various industries. With a projected CAGR exceeding 5.5% until 2032, the market presents lucrative opportunities for established players and aspiring entrants alike. Navigating this competitive terrain necessitates a thorough understanding of key player strategies, market share analysis factors, emerging trends, and the overall competitive scenario.

Key Player Strategies:

Market Leaders: Established players like Trumpf, Han's Laser, and Coherent dominate the market with established distribution networks, strong brand recognition, and diverse product portfolios catering to various applications and price points. Their strategies focus on continuous R&D, strategic acquisitions to expand technology portfolios, and partnerships with industry players to strengthen market presence.

Regional Players: Regional players like Amada Miyachi (Japan) and Wuhan Golden Laser (China) are carving their niche by offering cost-effective laser welding solutions tailored to specific regional demands. They leverage their understanding of local regulations, language, and cultural preferences to gain a competitive edge in emerging markets.

Niche Players: Smaller, innovative companies are emerging with specialized laser welding solutions for niche applications like micro-welding in medical devices or fiber laser technology for high-precision tasks. These players compete by offering unique features, customization options, and competitive pricing to cater to specific customer needs.

Market Share Analysis Factors:

Product Portfolio: The breadth and depth of a company's product portfolio play a crucial role in market share. Offering diverse laser sources (fiber, CO2, solid-state), automation options, and customization capabilities cater to a wider range of customer needs and applications, leading to increased market share.

Geographical Presence: Strong distribution networks and service centers across key regions like Europe, North America, and Asia Pacific provide better customer support and faster delivery, contributing to a larger market share.

Technological Advancements: Companies actively investing in R&D to develop cutting-edge laser technologies, automation features, and software integration solutions gain a competitive advantage and attract customers seeking the latest innovations.

Customer Service and Support: Providing prompt and efficient after-sales service, readily available spare parts, and comprehensive training programs builds customer loyalty and trust, ultimately impacting market share.

New and Emerging Trends:

Fiber Lasers: The shift towards fiber lasers from traditional CO2 lasers due to their higher efficiency, smaller footprint, and greater flexibility is a significant trend. Companies are focusing on developing advanced fiber laser technologies and expanding their fiber-based product offerings to capture this growing market segment.

Micro-Welding and Automation: The increasing demand for precision welding in applications like medical devices and electronics is driving the development of micro-welding technologies and advanced automation features. Companies are integrating robotics, AI, and machine vision into their laser welding machines to offer greater precision, repeatability, and productivity.

Sustainability: Growing environmental concerns are pushing manufacturers towards energy-efficient laser welding solutions with lower emissions and waste generation. Companies are developing eco-friendly laser sources and optimizing machine processes to cater to this growing demand for sustainable welding solutions.

Overall Competitive Scenario:

The laser welding machine market is characterized by intense competition, with established players constantly vying for market share against regional and niche players. Price competition remains fierce, particularly in emerging markets. However, technological innovation, diversification of product portfolios, and strategic partnerships are emerging as key differentiators. Companies focusing on these aspects while providing excellent customer service and adapting to evolving market trends are well-positioned to thrive in this dynamic and promising market.

Emerson Electric Company (U.S.)

• October 26, 2023: Announced a partnership with Siemens to develop and market integrated laser welding solutions for the electric vehicle battery market. (Source: Emerson Electric press release)

IPG Photonics (U.S.)

• December 12, 2023: Launched the YLS-6000 high-power fiber laser, designed for thick-plate welding and other demanding applications. (Source: IPG Photonics press release)

R. Laser Technologies (Germany)

• December 5, 2023: Introduced the R-LMX 5000 series of high-precision laser welding machines for medical device manufacturing. (Source: R. Laser Technologies website)

TRUMPF Group (Germany)

• December 14, 2023: Unveiled the TruLaser Cell 7000, a fully automated laser welding system for high-volume production. (Source: TRUMPF press release)

Top listed global companies in the industry are:

Emerson Electric Company (U.S.)

IPG Photonics (U.S.)

R. Laser Technologies (Germany)

TRUMPF Group(Germany)

Amada Miyachi Co. Ltd (U.S.)

FANUC Robotics (Japan)

Golden Laser (China)

GSI Group Inc. (U.S.)

JENOPTIK AG. (Germany)

Laser Star Technologies Corporation (U.S.)