Top Industry Leaders in the Large Format Display Market

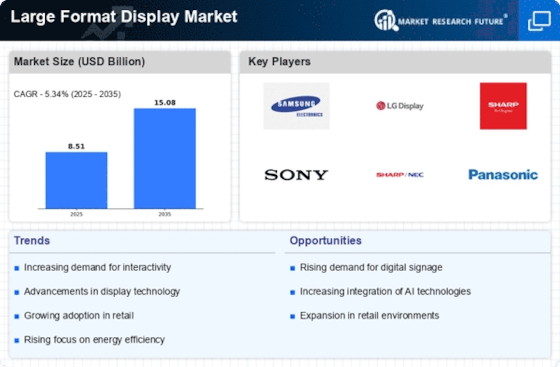

Competitive Landscape of the Large Format Display (LFD) Market:

The large format display (LFD) market, encompassing digital signage, video walls, and projection systems, is a bustling arena witnessing steady growth fueled by digitalization and immersive experiences. This dynamic landscape harbors established giants and nimble emerging players, each vying for their slice of the pie. Understanding the competitive landscape is crucial for any player navigating this terrain, and this analysis delves into the key aspects shaping the battleground.

Some of the Large Format Display companies listed below:

- Samsung Electronics Co., Ltd.

- Leyard Optoelectronic Co., Ltd.

- LG Display Co., Ltd.

- Sony Corporation

- Barco NV

- NEC Corp.

- TPV Technology Ltd. (

- View Sonic Corporation

- Sony Corporation.

Strategies Adopted by Key Players:

- Samsung and LG Electronics: These Korean behemoths hold the top two spots, leveraging their brand recognition, extensive product portfolios spanning LCD, LED, and MicroLED technologies, and aggressive marketing campaigns. Samsung leads the charge with its "The Wall" microLED technology, while LG focuses on OLED displays and curved signage solutions.

- NEC and Barco: These European brands cater to niche markets like corporate and government applications. NEC excels in high-brightness displays and video wall solutions, while Barco specializes in professional-grade projection systems and control room applications.

Factors for Market Share Analysis:

- Technology: Innovation holds the key, with players vying for dominance in next-generation technologies like MicroLED, transparent displays, and flexible displays. Companies like Absen, Leyard, and Hypervsn are making waves in these areas.

- Application Focus: Targeting specific end-user segments is vital. For example, Christie Digital thrives in entertainment and cinema, while Sharp Corporation caters heavily to the retail sector.

- Regional Dynamics: Asia Pacific, particularly China, is the growth engine, while North America and Europe remain mature markets. Companies like BOE and Hisense are capitalizing on the Asian boom.

- Pricing and Value Proposition: Balancing affordability with features and performance is crucial. While budget-conscious buyers look towards Chinese players, those seeking premium experiences rely on established brands.

Emerging Players and Disruptive Forces:

- Start-ups: Agile start-ups like NanoLumens and Prysm are challenging incumbents with innovative modular LED solutions and cloud-based content management systems.

- Software and Content Providers: Companies like Intuiface and Yodeck are blurring the lines by offering end-to-end LFD solutions, bundling hardware with content creation and management tools.

- Vertical Integration: Some players, like Leyard, are vertically integrating, controlling the entire value chain from chipsets to finished displays, gaining cost and quality advantages.

Latest Company Updates:

Samsung Electronics Co., Ltd.

- December 2023: Unveiled the industry's first UHD 65-inch video wall panels, offering seamless viewing and high brightness.

- October 2023: Partnered with Google to develop and launch smart display solutions for the retail and healthcare sectors.

Leyard Optoelectronic Co., Ltd.

- September 2023: Launched a new series of ultra-thin and lightweight LED video wall panels for rental and staging applications.

- August 2023: Secured a major contract to supply LED displays for a large sports stadium in the Middle East.

LG Display Co., Ltd.

- November 2023: Announced plans to invest $3 billion in OLED display manufacturing in China to meet the growing demand for LFDs.

- October 2023: Showcased a prototype of a transparent OLED display at a trade show, generating significant industry buzz.