Health and Wellness Trends

The Kitchen Appliances Products Market is significantly influenced by the rising health and wellness trends among consumers. As individuals become more health-conscious, there is an increasing preference for appliances that facilitate healthier cooking methods, such as air fryers and steamers. This trend is supported by market data showing that sales of health-oriented kitchen appliances have risen by nearly 15% in the past year alone. Consumers are actively seeking products that enable them to prepare nutritious meals at home, which in turn drives manufacturers to develop innovative solutions that align with these health-focused preferences. Consequently, the Kitchen Appliances Products Market is adapting to meet the evolving demands of health-conscious consumers.

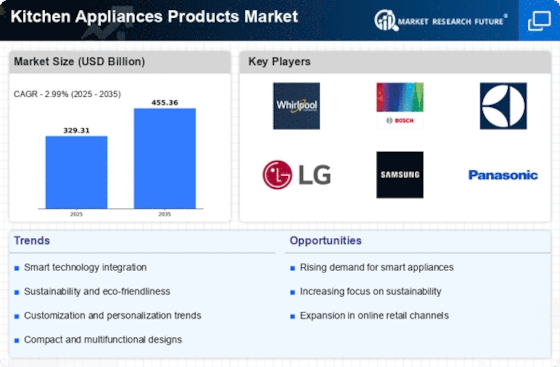

Rising Consumer Demand for Convenience

The Kitchen Appliances Products Market experiences a notable surge in consumer demand for convenience-driven products. As lifestyles become increasingly fast-paced, consumers seek appliances that simplify meal preparation and cooking processes. This trend is reflected in the growing popularity of multifunctional devices, such as food processors and smart ovens, which cater to the need for efficiency. Market data indicates that the demand for such appliances has led to a projected growth rate of approximately 6% annually over the next five years. This shift towards convenience not only influences purchasing decisions but also drives manufacturers to innovate and enhance product features, thereby shaping the competitive landscape of the Kitchen Appliances Products Market.

Sustainability and Eco-Friendly Products

Sustainability has emerged as a critical driver in the Kitchen Appliances Products Market, as consumers become more environmentally conscious. There is a growing demand for eco-friendly appliances that minimize energy consumption and reduce waste. Market data indicates that sales of energy-efficient kitchen appliances have increased by approximately 10% annually, reflecting a shift in consumer preferences towards sustainable options. Manufacturers are responding by developing products that meet these eco-friendly standards, such as energy-efficient dishwashers and refrigerators. This focus on sustainability not only appeals to environmentally aware consumers but also positions companies favorably in a competitive market, thereby influencing the overall dynamics of the Kitchen Appliances Products Market.

Diverse Consumer Preferences and Customization

The Kitchen Appliances Products Market is characterized by diverse consumer preferences, which drive the demand for customized kitchen solutions. As households vary in size and cooking habits, consumers seek appliances that cater to their specific needs. This trend is evident in the increasing popularity of modular kitchen systems and customizable appliances that allow users to select features according to their preferences. Market data suggests that the customization segment is expected to grow by 8% over the next few years, as consumers prioritize personalization in their kitchen experiences. This shift compels manufacturers to offer a wider range of options, thereby enhancing their appeal in the competitive landscape of the Kitchen Appliances Products Market.

Technological Advancements in Kitchen Appliances

Technological advancements play a pivotal role in shaping the Kitchen Appliances Products Market. The integration of smart technology, such as IoT-enabled devices, has transformed traditional kitchen appliances into sophisticated tools that enhance user experience. For instance, smart refrigerators can monitor food inventory and suggest recipes based on available ingredients. Market data suggests that the adoption of smart appliances is expected to grow by over 20% in the coming years, as consumers increasingly value connectivity and automation. This technological evolution not only improves functionality but also influences consumer purchasing behavior, compelling manufacturers to invest in research and development to remain competitive in the Kitchen Appliances Products Market.