Joint Compound Size

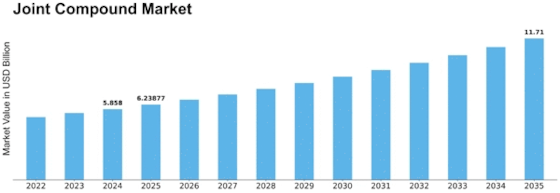

Joint Compound Market Growth Projections and Opportunities

The joint compound market is influenced by various factors that shape its growth, demand, and overall dynamics. One significant factor driving the market is the construction and renovation activities in residential, commercial, and industrial sectors. Joint compound, also known as drywall mud or plaster, is an essential material used in the finishing and smoothing of drywall seams and imperfections. As construction and renovation projects increase, so does the demand for joint compound to achieve smooth, seamless walls and ceilings. The growth of the construction industry, driven by factors such as population growth, urbanization, and infrastructure development, directly impacts the demand for joint compound in the market.

Technological advancements also play a crucial role in shaping the joint compound market. Innovations in manufacturing processes, formulations, and application methods contribute to improving the quality, performance, and ease of use of joint compound products. Advanced mixing equipment, drying technologies, and additives enhance the workability, adhesion, and drying time of joint compounds, making them more efficient and user-friendly for contractors and DIY enthusiasts. Additionally, advancements in packaging and delivery systems enable convenient storage, transportation, and application of joint compound products, driving market growth.

Market factors also include regulatory policies and quality standards governing the production, labeling, and safety of joint compound products. Regulatory agencies such as the Occupational Safety and Health Administration (OSHA) in the United States and the European Union Construction Products Regulation (CPR) in Europe impose regulations on the composition, labeling, and use of joint compound to ensure product safety, performance, and environmental protection. Compliance with these regulations is essential for manufacturers to obtain certifications, approvals, and market access for joint compound products. Moreover, adherence to industry standards and best practices enhances market credibility and consumer trust in joint compound products.

Economic factors such as GDP growth, consumer spending, and housing market trends influence the demand for joint compound products. During periods of economic expansion and increased construction activity, there is a higher demand for joint compound as new buildings are constructed and existing structures undergo renovation and remodeling. Conversely, economic downturns or declines in construction activity may lead to reduced demand for joint compound products, affecting market dynamics negatively. Moreover, fluctuations in raw material prices, such as gypsum and polymers, impact production costs and pricing strategies for joint compound manufacturers.

Raw material availability and pricing are critical market factors for the joint compound industry. Joint compound is primarily composed of gypsum powder, polymers, fillers, and additives that contribute to its adhesive and drying properties. Fluctuations in the prices and availability of these raw materials, as well as energy costs, can impact production costs and pricing strategies for joint compound manufacturers. Additionally, sourcing high-quality raw materials and ensuring a reliable supply chain are essential for maintaining product quality and meeting market demand.

Consumer preferences and trends also shape the joint compound market landscape. With increasing awareness of sustainability and indoor air quality, consumers are seeking joint compound products that are low in volatile organic compounds (VOCs) and environmentally friendly. Manufacturers are responding by developing low-VOC and eco-friendly formulations that meet regulatory requirements and consumer preferences. Moreover, the growing popularity of DIY home improvement projects and renovation shows has fueled demand for easy-to-use and beginner-friendly joint compound products, driving market growth.

Competition within the industry also influences the joint compound market dynamics. With numerous manufacturers and brands offering a wide range of joint compound products, competition can be intense, leading to price competition, product differentiation, and marketing efforts to gain market share. Companies may differentiate themselves through product quality, performance, packaging, branding, and customer service. Moreover, strategic partnerships, collaborations, and mergers and acquisitions may help companies strengthen their competitive position and expand their market presence in the joint compound industry.

Leave a Comment