Rising Air Pollution Levels

The respiratory drugs market in Japan is experiencing growth due to increasing air pollution levels. Urbanization and industrial activities have led to a rise in particulate matter and other pollutants, which exacerbate respiratory conditions such as asthma and chronic obstructive pulmonary disease (COPD). According to the Ministry of the Environment, air quality in major cities often exceeds safe limits, prompting a higher demand for effective respiratory medications. This trend is likely to continue, as the population becomes more aware of the health impacts of pollution. Consequently, pharmaceutical companies are focusing on developing innovative treatments to address these challenges, thereby driving the respiratory drugs market.

Advancements in Telemedicine

The rise of telemedicine in Japan is transforming the respiratory drugs market by improving patient access to healthcare services. With the increasing adoption of digital health technologies, patients can now consult healthcare professionals remotely, facilitating timely diagnosis and treatment of respiratory conditions. This trend is particularly beneficial for individuals living in rural areas, where access to specialized care may be limited. As telemedicine continues to evolve, it is likely to enhance the distribution and prescription of respiratory medications, thereby contributing to market growth. The integration of technology in healthcare is expected to streamline patient management and improve treatment outcomes.

Focus on Personalized Medicine

The respiratory drugs market is witnessing a shift towards personalized medicine, which tailors treatments to individual patient needs. This approach is gaining traction in Japan, where advancements in genomics and biotechnology are enabling the development of targeted therapies for respiratory diseases. By understanding the genetic and environmental factors that contribute to these conditions, pharmaceutical companies are creating more effective and safer medications. This trend is likely to enhance patient adherence to treatment regimens and improve overall health outcomes, thereby driving growth in the respiratory drugs market. The emphasis on personalized approaches may also lead to increased investment in research and development.

Increased Healthcare Expenditure

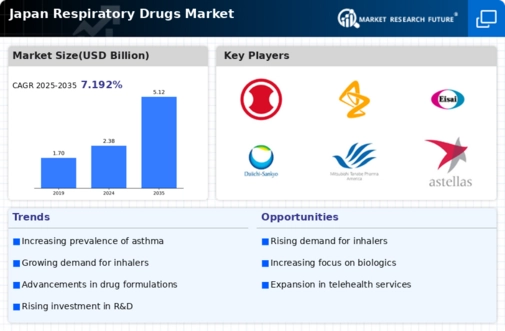

Japan's healthcare expenditure has been on the rise, which positively influences the respiratory drugs market. The government has been investing heavily in healthcare infrastructure and services, with total healthcare spending reaching approximately $500 billion in recent years. This increase in funding allows for better access to medications and treatments for respiratory diseases. Furthermore, as the population ages, the demand for respiratory drugs is expected to grow, leading to a projected market expansion of around 6% annually. This financial commitment from both the government and private sectors is likely to enhance the availability of advanced respiratory therapies.

Growing Awareness of Respiratory Health

There is a notable increase in public awareness regarding respiratory health in Japan, which is significantly impacting the respiratory drugs market. Campaigns aimed at educating the population about the risks associated with respiratory diseases have led to a higher rate of diagnosis and treatment. As individuals become more informed about conditions like asthma and COPD, they are more likely to seek medical advice and appropriate medications. This shift in consumer behavior is expected to drive market growth, as healthcare providers respond to the rising demand for effective respiratory treatments.